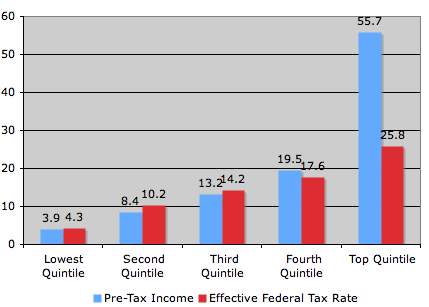

This image, found at International Networks, depicts the globe at night. The areas bathed in electricity reveal “the global spread of industrialization, as evidenced by the lights of human civilization”:

I think it’s interesting to compare this image with a world population map (link):

At first the two maps seem to overlap pretty nicely, but if you look closely there are plenty of interesting discrepancies, especially in Africa.

Thanks to Toban B. for the link that got me to the graphic that inspired this post.

NEW (Apr. ’10)! In the comments, Brendon linked to this great image of the Korean peninsula at night that reveals an amazing difference between North and South Korea:

—————————

Lisa Wade is a professor of sociology at Occidental College. You can follow her on Twitter and Facebook.

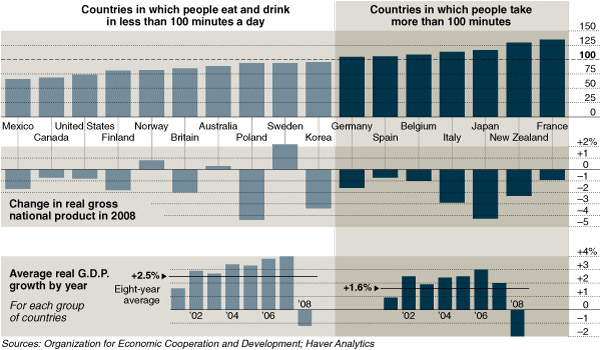

As before, the statistics are far from conclusive, but the data continues to invite a discussion about food and culture.

As before, the statistics are far from conclusive, but the data continues to invite a discussion about food and culture.