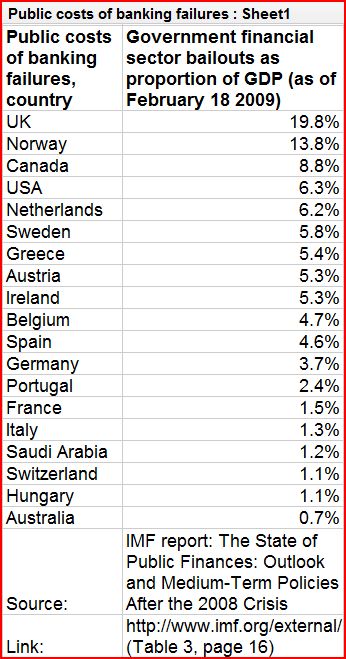

The Guardian is now making all of the data it uses in its stories available for free online. You can browse their data on subjects as wide ranging as imports and exports of plastic bags, reported amounts of exercise, and the best selling singles of 2008 at their Data Store. As one example, I’ve pasted in 20 government financial bail outs as a percentage of their GDP: