Worldmapper offers maps in which the actual land area is morphed to represent various disproportionalities across the globe. The website has over 300 maps! Thanks 73man for the tip!

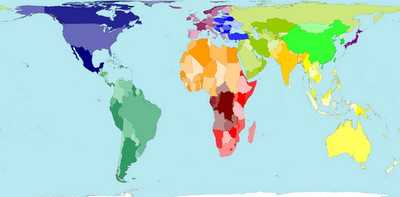

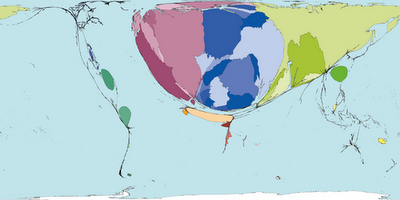

I borrowed a few examples and pasted them in below. The first map is an actual land area map for reference.

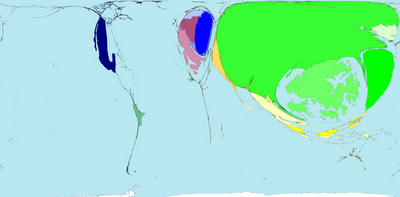

Territory size shows the proportion of worldwide net exports of toys (in US$) that come from there. Net exports are exports minus imports. When imports are larger than exports the territory is not shown.

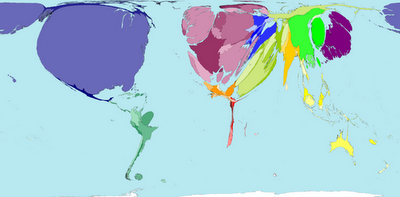

Territory size shows the proportion of worldwide net imports of toys (in US$) that are received there. Net imports are imports minus exports. When exports are larger than imports the territory is not shown.

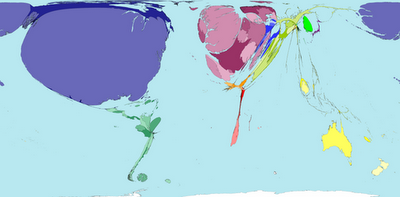

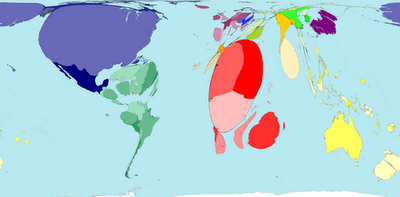

Territory size shows the proportion of carbon dioxide emissions in 1980 that were directly from there.

Territory size shows the proportion of all territory level decreases in carbon dioxide emissions between 1980 and 2000, that occurred there.

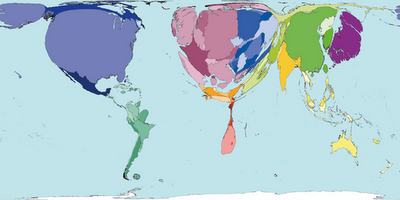

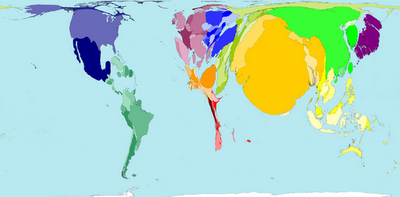

Territory size shows the proportion of state military spending worldwide that was spent by that territory in 2002.

Territory size shows the proportion of species worldwide that became extinct between 1500 current era and 2004, that became extinct there.

Territory size shows the proportion of all people over 15 in the world living with diabetes who live there.

Territory size shows the proportion of all people aged 15-49 with HIV (Human Immunodeficiency Virus) worldwide, living there.

See more alternative maps here.

.