Nate Silver at FiveThirtyEight discusses the “Cash for Clunkers” program. There has been a fair amount of criticism of the fact that the program, which is supposed to stimulate the economy partly by providing a boost to the auto industry, has been used by consumers to buy a large number of non-U.S.-made cars (which, of course, is a slippy definition–there are Toyota and Honda plants in the U.S. and Ford plants in Mexico, but by “U.S.-made,” people generally refer to Ford, GM, and I guess Chrysler).

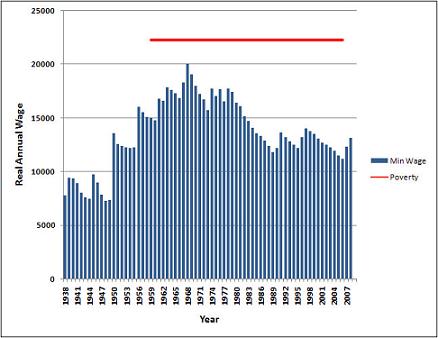

But the other point of the Cash for Clunkers program was to increase the gas mileage of the U.S. auto fleet overall. The new car you can apply the federal aid to has to get at least 22 mpg. And because of choices the U.S. auto companies have made in the past about what kinds of cars and trucks to emphasize, a smaller proportion of the models Ford, GM, and Chrysler offer qualify for the program:

Of course, this graph doesn’t tell us how popular each of the models are–if GM only had one model that got more than 22 mpg, but that one model was incredibly popular, the company might have an average fleet fuel efficiency that was relatively good. And if Chrysler had a lot more models available than Honda, it might have more 22+ mpg models total even though they’re a lower percentage of all Chrysler cars.

Still, I found the graph shocking; 22 mpg seems like such a low benchmark, I never would have guess than less than 1 in 5 U.S. models manages to meet it. Hopefully the Cash for Clunkers will have a longer-term effect of encouraging the U.S. automakers to emphasize fuel efficiency to a much greater degree than they’ve been doing (and U.S. consumers to buy their fuel efficient models).