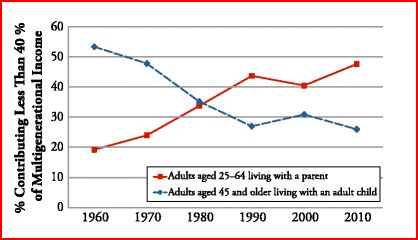

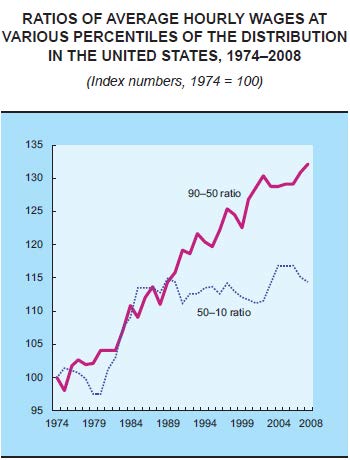

Repeatedly at SocImages, we’ve offered data showing that the middle class is shrinking. The rich are getting richer, while a rising percentage of Americans are having trouble making ends meet. One measure of this is the number of households that include both adults and their adult children. About 12% of 25 to 44-year-olds lived with their parents in 1960, that dropped to 9% by 1980 and, in 2010, topped out at 17%. Almost one-in-five adults were living with their parents at the turn of this decade.

There are two scenarios, here, however. One indicates the decreasing financial well-being of the elderly: parents move in with their children because they can’t afford to live alone, perhaps after retirement. The other indicates the decreasing financial well-being of young and mid-life adults: children are moving in with their parents because they can’t get a good start to life.

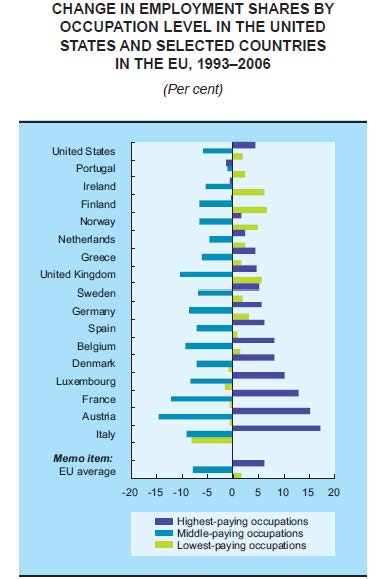

It turns out that the first scenario is actually on the decrease, while the latter is on the increase. The rise in co-residence is a consequence of the failure of our economy to integrate young people into jobs that pay a living wage. Literally, a growing number of Americans — both young people and those in mid-life — can’t afford to leave the nest. And, no, this didn’t start with the recession, it started in the ’80s.

We’ve done a decent job trying to ensure that the elderly don’t live in poverty, it’s time to start working on making sure the rest of America doesn’t either.

Thanks to @toddgorman for the link! Cross-posted at Pacific Standard and The Huffington Post.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.