The Federal Reserve Bank recently released 1,197 pages of transcripts of its 2006 closed door meetings. As the Wall Street Journal comments: “The transcripts paint the most detailed picture yet of how top officials at the central bank didn’t anticipate the storm about to hit the U.S. economy and the global financial system.”

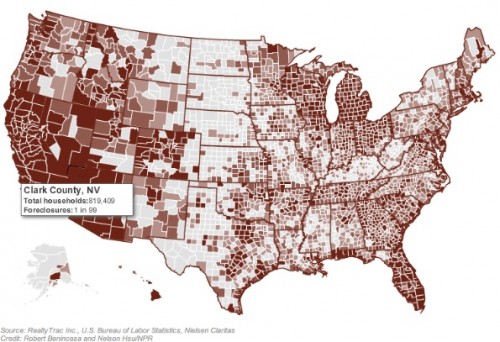

Federal Reserve officials suspected that housing prices were peaking (see chart below). But since they didn’t believe that prices had been driven up by a well entrenched bubble, they were not very concerned that they were coming down.

The Financial Times described the general Federal Reserve stance as follows:

Almost every Fed policymaker concluded that weaker housing would cause a slowdown in consumption and investment but expected that to offset strength elsewhere in the economy, leading to continued growth overall.

“Housing is the crucial issue. To get a soft landing, we need some cooling in housing,” said Ben Bernanke, Fed chairman, in his summing up of the economic situation in March 2006. “I think we are unlikely to see growth being derailed by the housing market.”

…

Indeed, a number of Fed officials saw the housing slowdown as welcome news that would help resolve a potential threat to the economy. “As to housing, we are in fact, as all have noted, squeezing out of that sector the speculative excesses that developed with the low interest rates of recent years — and doing so is unavoidable if we want to correct the sector,” said Thomas Hoenig, then president of the Kansas City Fed, at the September 2006 meeting of the FOMC.

The transcripts show that the Federal Reserve was so confident that the economy was on solid footing that many officials were, according to the Wall Street Journal:

…offering praise for outgoing Fed Chairman Alan Greenspan, who attended his final Fed meeting in January 2006. Timothy Geithner, then president of the Federal Reserve Bank of New York and now Treasury Secretary, playfully offered this forecast about Mr. Greenspan’s legacy: “I think the risk that we decide in the future that you’re even better than we think is higher than the alternative.”

…

The transcripts also suggest that Fed officials misgauged the potential for housing problems to spill over into the broader economy.

“Our recent financial-market data don’t, in my view, provide a convincing case for a substantial increase in the probability of a much weaker path for growth going forward,” Mr. Geithner said at a meeting in December 2006.

So how did the best and the brightest get it so wrong?

Perhaps the major reason is because it served their interests to pretend there was no housing bubble. The recovery from our 2001 recession was driven by consumption and that consumption was supported directly and indirectly by the housing bubble. In other words stopping the bubble would have revealed the weakness in our economy and the need for serious structural change. It was far easier and more lucrative for those at the top to just let the bubble go on expanding and pretend that it didn’t exist.

The following chart from the New York Times puts the movement in housing prices highlighted above into a longer term perspective, revealing just how strong speculative pressures were in the housing market.

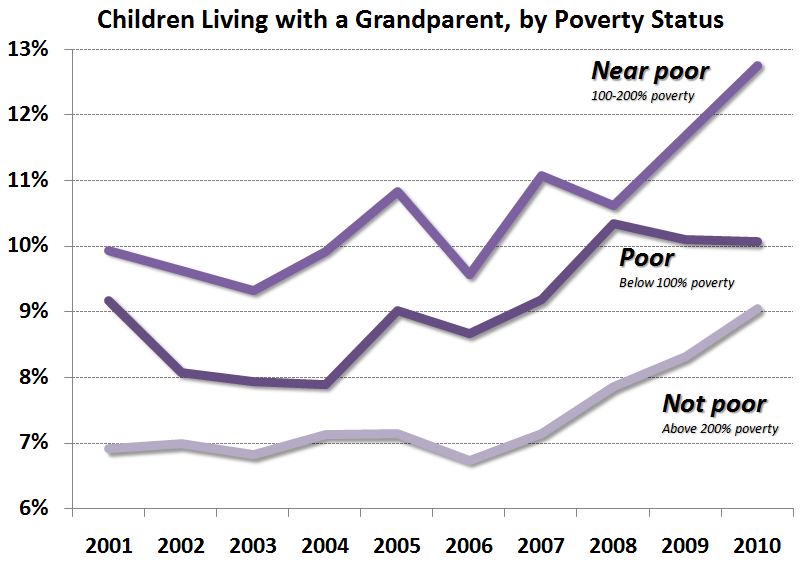

As Dean Baker, one of the very few economists to warn about the dangers of the bubble, explains:

First, what happened is very straightforward: we had a huge run-up in house prices that had no basis in the fundamentals of the housing market. After 100 years in which nationwide house prices just kept even with the overall rate of inflation, house prices began to sharply outpace inflation, beginning in the late 1990s.

By 2002, when some of us first noticed the bubble, house prices had already risen by more than 30 per cent in excess of inflation. By the peak of the bubble in 2006, the increase in house prices was more than 70 per cent above the rate of inflation.

This was a huge problem because this bubble was driving the economy. It drove the economy directly by creating a boom in residential housing construction. We were building housing at a near record pace in the years 2002-2006. This was in spite of the fact that we had an ageing population and record levels of vacancies at the start of that period.

The other way in which the bubble was driving the economy was through its effect on consumption. The bubble created more than US $8tn [trillion] in ephemeral wealth in housing. Homeowners thought this wealth was real and spent accordingly. The result was a massive consumption boom that sent the saving rate down to zero in the years from 2004-2006.

In reality, a lot of the consumer spending driving growth was financed by home refinancing, which helped many housholds compensate for stagnant wages and weak job creation at the cost of a sharp rise in debt. As a Wall Street Journal blog post pointed out, “From 2000 to 2007, household debt doubled from $7 trillion to $14 trillion, with debt related to housing responsible for 80% of the increase. By 2007, the household debt to GDP ratio reached its highest level since 1929.”

As we now know only too well, the collapse of the housing bubble reverberated through the economy, including the financial sector, triggering the Great Recession. Tragically, many of the “best and brightest” remain in leadership positions today, still arguing for the soundness of economic fundamentals.