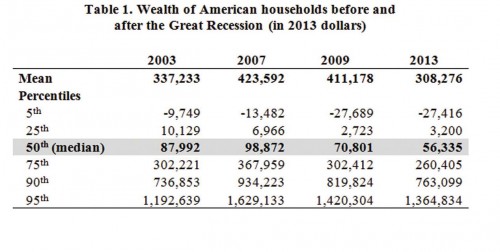

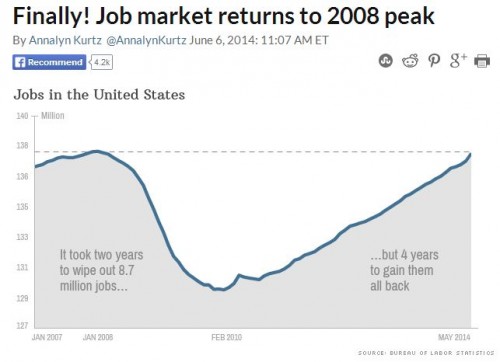

According to a June 2014 Russell Sage Foundation report, the average U.S. household experienced a real wealth decline of more than one-third over the 10 years ending in 2013.

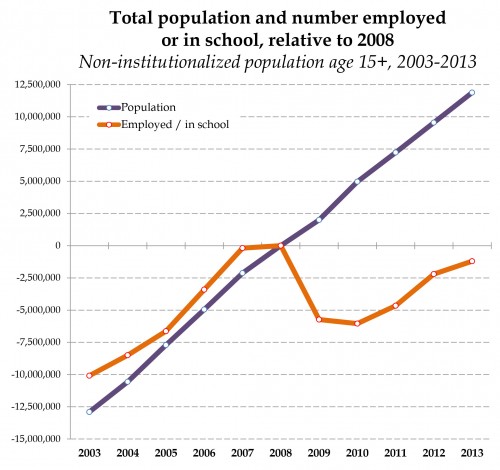

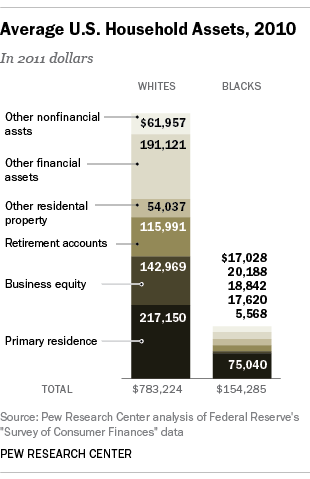

Table 1 shows that the net worth of the median household fell from $87,992 in 2003 to $56,335 in 2013, for a decline of 36%. In fact, the last ten years were hard on the overwhelming majority of American households. Only the top 2 groups enjoyed wealth gains over the period. Also noteworthy is the tiny net worth of households below the median.

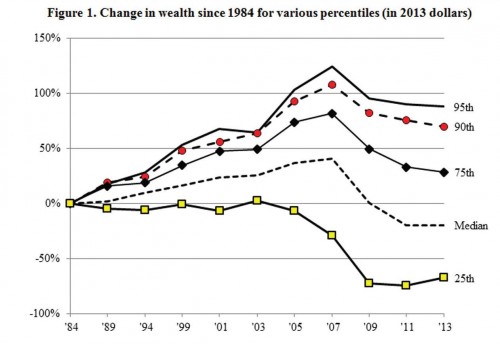

Figure 1 provides a longer term perspective on wealth movements. We can see that most households enjoyed growing wealth from 1984 to the 2007 crisis, with wealth falling across the board since. However, the median household is now significantly poorer than it was in 1984. Only the richer households managed to maintain most of their earlier gains in wealth.

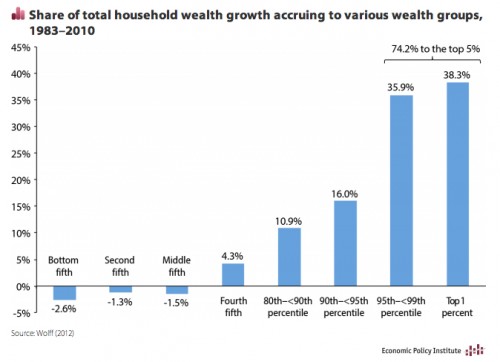

These trends highlight the fact that we have a growing inequality of wealth, as well as of income, and they are not likely to reverse on their own.

Martin Hart-Landsberg is a professor of economics at Lewis and Clark College. You can follow him at Reports from the Economic Front.