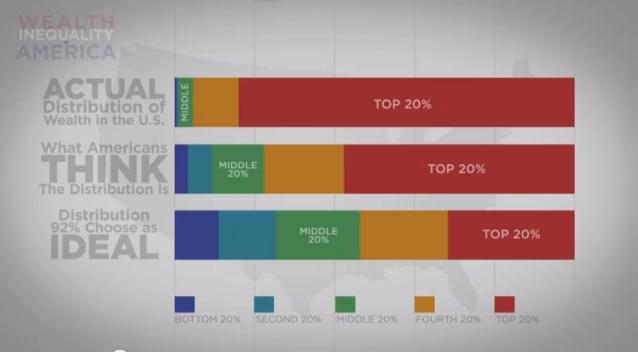

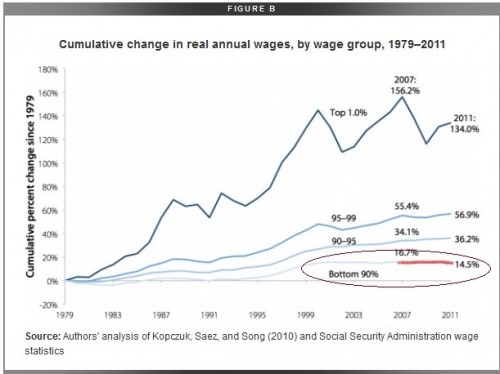

Emma K. submitted a sobering illustration of wealth inequality in the U.S. It compares American ideal distributions of wealth, with what they think it is and what it really is. Suffice to say, Americans wish for more equal distributions, but the reality far outpaces their worst nightmare.

Here’s a snapshot:

A worthwhile 6 minutes:

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.