Cross-posted at Reports from the Economic Front.

Social Security is in Danger

The recently approved deficit reduction plan includes the establishment of a Congressional super committee that is supposed to propose ways to achieve $1.2-1.5 trillion in deficit reduction over the next ten years. Everything is on the table, including Social Security. It must complete its work by November 23, 2011.

While the committee could decide to spare Social Security, the odds are great that its final proposal will include significant benefit cuts. Most Republicans have long sought to dismantle the program and President Obama is willing to accept a reduction in Social Security benefits for the sake of deficit reduction. Standard and Poor’s downgrade of the federal government’s credit rating only adds to the pressure. The rating agency explained its decision as follows:

We lowered our long-term rating on the U.S. because we believe that the prolonged controversy over raising the statutory debt ceiling and the related fiscal policy debate indicate that further near-term progress containing the growth in public spending, especially on entitlements, or on reaching an agreement on raising revenues is less likely than we previously assumed and will remain a contentious and fitful process.

Why Social Security is Important

There has been little media discussion of the importance of Social Security to those over 65. According to the Economic Policy Institute:

The average annual Social Security retirement benefit in 2009 was $13,406.40, slightly above the $10,289 federal poverty line for individuals age 65 and older, but less than the minimum wage. While modest in size, Social Security benefits comprise a substantial share of household income for most elderly recipients.

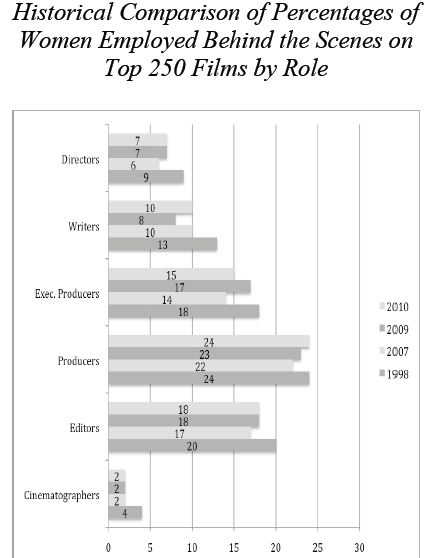

The chart below shows that the poorest 40% of households with a head 65 years or older rely on social security for more than 80% of their income. Even the middle 20% depend on social security for more than 60% of their income. In sum, cutting social security benefits will hit hard at the great majority of seniors.

How the Change Will Undermine Benefits

If the super committee does decide to go after social security, it will likely do so by proposing that social security benefits be adjusted using a new measure of inflation. Right now benefits are adjusted using the CPI-W, which measures the change in prices of goods and services commonly consumed by urban wage earners and clerical workers. The new measure is called the Chained Consumer Price Index for all Urban Consumers.

This all sounds very technical, but the basic idea is simple. The CPI-W measures the increase in the cost of a relatively fixed bundle of goods and services. The Chained Consumer Price Index assumes that consumers continually adjust their purchases, giving up those goods and services that are expensive in favor of cheaper substitutes. The chained index would produce a lower rate of inflation because the goods and services whose prices are rising the fastest would be dropped from the index or given lower weight. The result would be a smaller annual cost of living adjustment for those receiving Social Security, thereby cutting Social Security outlays.

Those who support using a chained index argue that it is a more accurate measure of inflation than the CPI-W. In reality, it just masks the fact that people are unable to buy the goods and services they once enjoyed. If we are really concerned about accuracy, we could use the CPI-E, which measures the change in prices of those goods and services commonly consumed by seniors. The CPI-E has risen much faster than the CPI-W, demonstrating that current cost of living adjustments are actually too low, not too high.

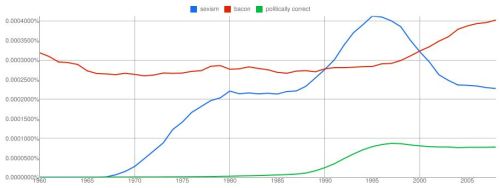

The following chart should leave no doubt as to what is at stake in this “technical” adjustment. A medium earner retiring this year at age 65 would receive $15,132. The retiree’s real (inflation adjusted) earnings would remain constant over time assuming that Social Security benefits were adjusted using the existing CPI-W. If benefits were adjusted using the proposed Chained CPI, the retiree’s real earnings would steadily decline, falling to $13,740 at age 95. By comparison, benefits would grow to $16,131 if the CPI-E were used.

Why Social Security is the Wrong Target

Social Security shouldn’t be on the cutting board at all. It is a self-financing system, one with a large surplus. Some analysts say that the system will not have sufficient funds to meet its obligations by 2037. In fact, this claim is based on very extreme and unlikely assumptions about future economic activity. But, even if we accept these assumptions, we can easily escape the predicted crisis by applying the Social Security tax to labor income above $106,800. Currently, earnings above that amount are exempt from the tax. Removing the tax ceiling would ensure the solvency of Social Security through the next 75 years.