Cross-posted at Montclair SocioBlog.

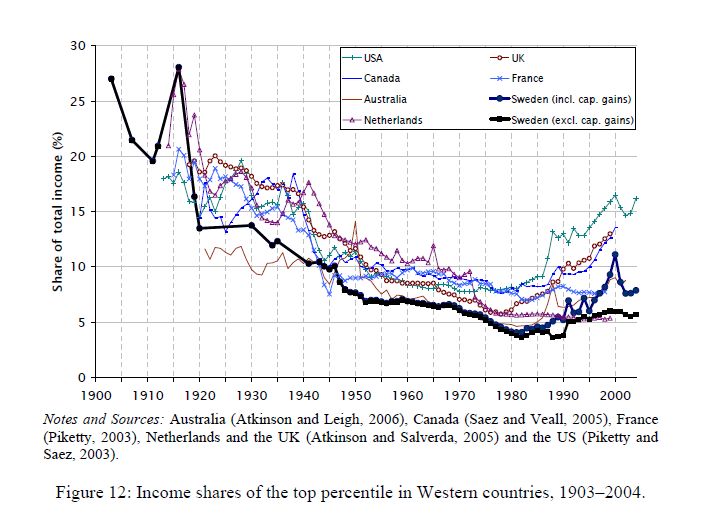

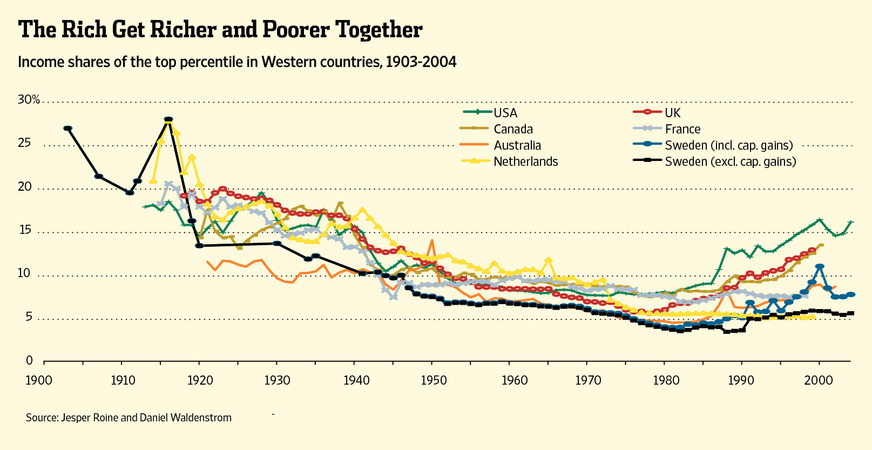

This graph tracks the share of income going to the top 1% in seven countries. It’s from a paper by two Swedish economists, Jesper Roine and Daniel Waldenström (pdf).”’

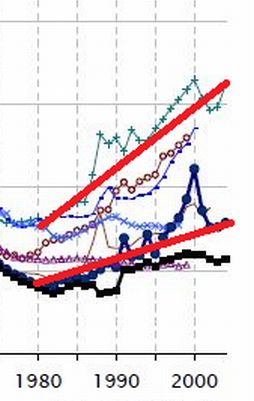

As the . . . chart . . . shows, the share of income for the top 1% in these seven countries generally follows the same trend line. That means domestic policy can’t be the principal reason for the current spread between high earners and others. Since the 1980s, that spread has increased in nearly all seven countries. The U.S. and Sweden, countries with very different systems of redistribution, along with the U.K. and Canada show the largest increase in the share of income for the top 1%. [emphasis added]

So who are you going to believe – the Wall Street Journal or your lying eyes?