AGM, while perusing the U.S. Bureau of Labor Statistics website and discovered that the U.S. government has seen fit to illustrate various jobs with photographs. The photographs reveal quite dramatic assumptions about who does what jobs. I’ll let you be the judge as to what they are, in alphabetical order.

Authors:

Cooks and Food Preparation Workers:

Dentists:

Dental Assistants:

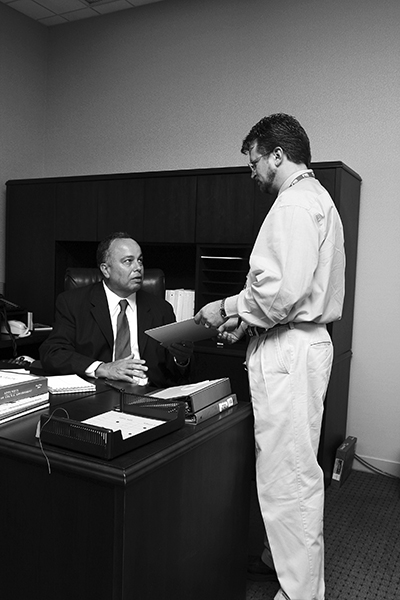

Executives:

Personal Appearance Workers:

Physicians:

Physician and Medical Assistants (fixed):

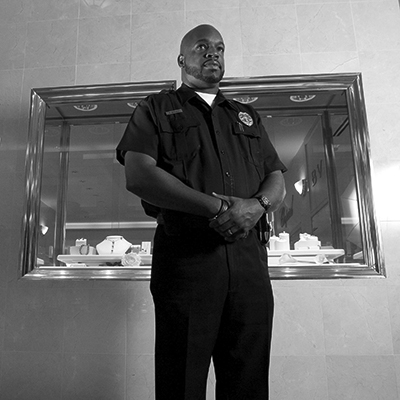

Security Guards:

AGM thought the picture of sociologists deserved the caption, “Sociologists have nothing but contempt for one other, both as scholars and as human beings.”

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.