To commemorate the last weekend before Christmas, when many will be out trying desperately to complete holiday shopping, I thought I’d post this image, designed and sent in by Joseph Moriarty in response to the craziness of all the holiday-season shopping frenzies (including the now-predictable tramplings):

economics: capitalism

In this six-minute video from the New York Times, past residents and developers describe how Times Square was transformed from “the sleaziest block in America” to the corporate palace that it is today. Thanks to Dmitriy T.M. for the submission!

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Annie Leonard tackles e-waste (what happens after we’re done with our computers, cell phones, etc) in the latest 7-minute edition in her Story of Stuff series (see also her first story of stuff and her analysis of bottled water and cap and trade).

Via Reports from the Economic Front.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

After Gwen posted her fascinating discussion of the way that people who are reliant on public transportation are inconvenienced or isolated (based on photos sent in by Lynne Shapiro), David F. sent a link to an article in The Columbus Dispatch about the public transportation in downtown Columbus. Downtown developers, it reports, oppose a plan by the Central Ohio Transit Authority (COTA) to build a transfer station. The reporter writes:

Downtown developers have complained that COTA passengers waiting for transfers near Broad and High streets, and buses lining the curbs make the area less attractive for retail stores and their customers.

Translation: no one wants to see buses and the people who ride them.

Because, you see, when the buses stop there, those kind of people are there waiting for the bus:

(Image at Google)

One of these developers, Cleve Ricksecker, explains:

Transit-dependent riders who are going through Downtown, for whatever reason, don’t shop… Large numbers of people waiting for a transfer can be intimidating for someone walking down the sidewalk.

Translation: People who buy things want to be protected from knowing about and interacting with people who are too poor to buy things.

Much better to make life more difficult for people who ride the bus.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

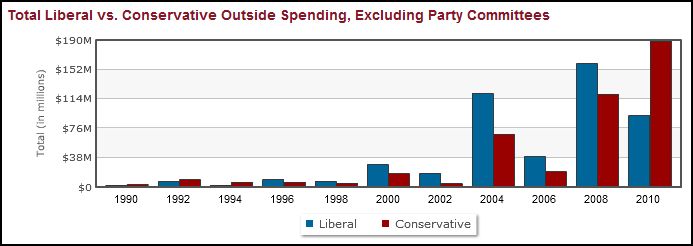

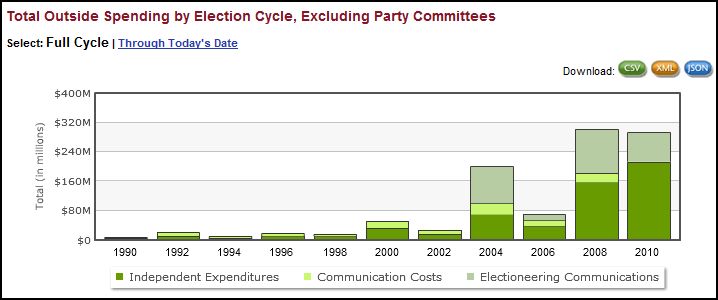

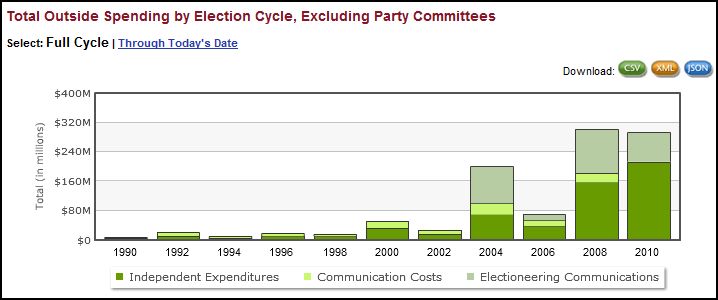

In 2010, as a matter of free speech, the United States Supreme Court decided that there can be no limits on corporate spending on advertisements in favor of a political candidate (Citizens United v. Federal Election Commission). Open Secrets produced two figures revealing the rise in “outside spending” (i.e., non-party spending) showing the rise.

Total outside spending:

Outside spending for liberals and conservatives:

Open Secrets explains:

…the 2004 election marked a watershed moment in the use of independent expenditures to try to sway voters, with most of that new spending coming from the national party committees. The 2010 election marks the rise of a new political committee, dubbed “super PACs,” and officially known as “independent-expenditure only committees,” which can raise unlimited sums from corporations, unions and other groups, as well as wealthy individuals.

Hermes’ Journeys editorializes:

You can see that liberals slightly outspent conservatives every election since 1996. Except for this year, when quite suddenly a mysterious flood of funding caused conservative campaign coffers to skyrocket, DOUBLING what liberals could muster. Was this the result of concerned right-leaning citizens becoming active in politics and making individual donations? Of course not, it was profit-minded corporations…

…enabled, if I may finished HJ’s sentence, by the recent court decision.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

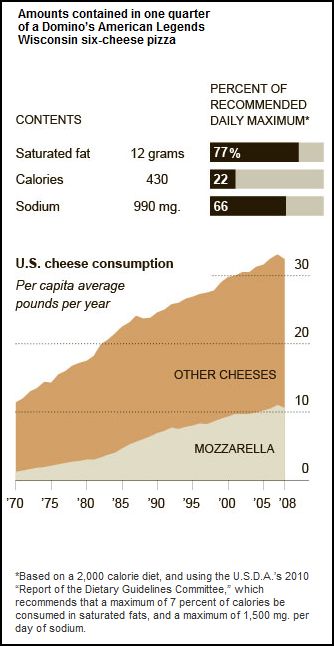

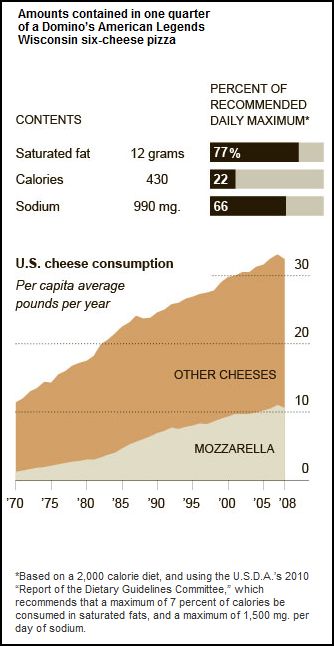

A recent New York Times article on cheese, brought to my attention by Jordan G., beautifully illustrates the fact that the U.S. government is not a coherent bloc, but a collection of competing interests.

Last month Domino’s Pizza released a new pizza named “The Wisconsin.” Named after a superbly cheesy state (one close to our hearts here at SocImages), the pizza has six cheeses on top and two in the crust. The New York Times reports that one quarter of a pie (an amount I could certainly put away without effort), had more than 3/4ths of the recommended maximum in a day and double the calories of some of its other pizzas.

The Wisconsin:

Cheese, it turns out, is the main source of saturated fats in American diets and saturated fats contribute to significant morbidity and mortality in the U.S. The government, accordingly, recommends that we eat less of it.

Document from the Department of Agriculture:

And here’s where the story gets interesting. The Department of Agriculture is not only responsible for the health of Americans, it’s responsible for the health of the American food industry. As consumption of cheese and non-low-fat milks declines in the U.S., the dairy industry suffers. According to the New York Times:

Every day, the nation’s cows produce an average of about 60 million gallons of raw milk, yet less than a third goes toward making milk that people drink. And the majority of that milk has fat removed to make the low-fat or nonfat milk that Americans prefer. A vast amount of leftover whole milk and extracted milk fat results.

The government used to buy cheese and butter from its dairy farmers, leading to a vast collection of dairy products stored in underground caves in Missouri (totally not kidding). It’s switched strategies — after all, how much cheese and butter can one country hoard? — and while one arm of the Department of Agriculture tells us to eat less cheese, another is telling us to eat more.

In fact, the government spent $12 million American tax dollars marketing The Wisconsin pictured above. Dairy Management is the dairy marketing arm of the U.S. Department of Agriculture. It has a budget of nearly $140 million per year… and it is in cahoots with pizza chains.

“This is one way that we can support dairy farms across the country: by selling a pizza featuring an abundance of their products,” a Domino’s spokesman said in a news release. “We think that’s a good thing.”

…

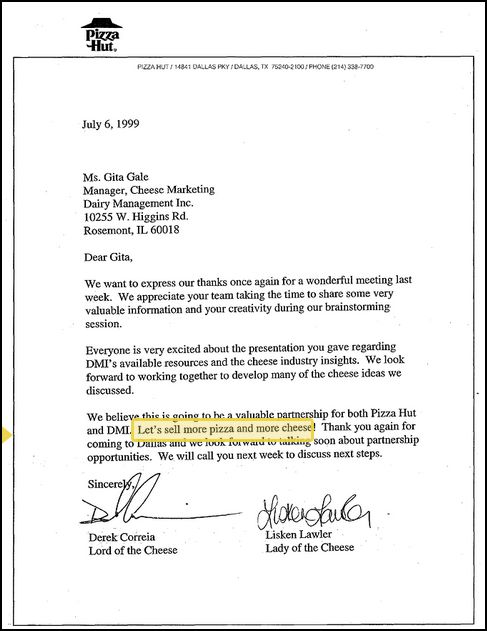

“Let’s sell more pizza and more cheese!” said two officials with Pizza Hut, which began putting cheese inside its crust after holding development meetings with Dairy Management, according to a memorandum released by the Agriculture Department.

Random suspicious documents:

Dairy Management’s Pizza Hut promotion in 2002 (the “Summer of Cheese”) reportedly pushed an additional 102 million pounds of cheese into American bellies. And consumers are eating up Domino’s new pie. The Times reports that sales have “soared by double digits.”

My co-blogger, Gwen, specializes in rural sociology and agriculture. Discussing this post, she confirms:

It is a deeply, deeply divided government entity, with the “let’s sell more!” side almost always better funded… [than] the “but it kills people!” side.

Next up: Tobacco.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Cross-posted at Reports from the Economic Front.

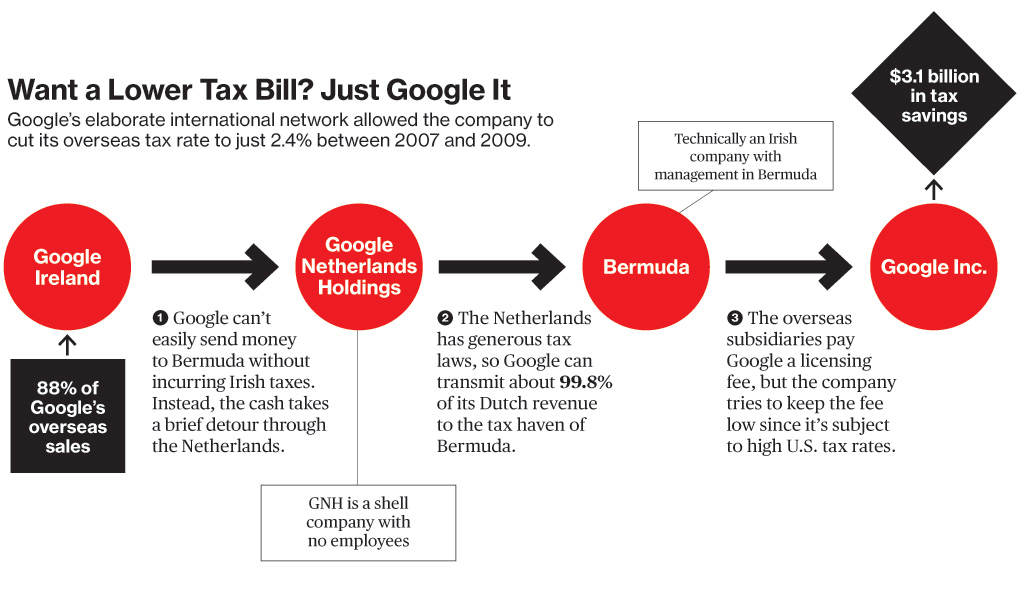

How do corporations escape paying taxes? Businessweek recently ran a story on Google that helps to explain how they do it.

The story begins by noting that: “Google has made $11.1 billion overseas since 2007. It paid just 2.4 percent in taxes. And that’s legal.” This is pretty incredible because Google does business in many advanced capitalist countries with high tax rates. For example, “The corporate tax rate in the U.K., Google’s second-largest market after the U.S., is 28 percent.”

While the article focuses on Google, and how it avoids paying taxes, it made clear that most of the leading high-technology companies use remarkably similar techniques to achieve similar results.

Ok, so how does Google do it? Google’s office in Ireland is the center of the company’s international operations. In 2009 it “was credited with 88 percent of the search juggernaut’s $12.5 billion in sales outside the U.S.” But Google doesn’t pay taxes on that amount, because most of the profits went to Bermuda, where there is no corporate income tax.

So, how did Google get its profits to Bermuda? Businessweek explains:

Google’s profits travel to the island’s white sands via a convoluted route known to tax lawyers as the “Double Irish” and the “Dutch Sandwich.” In Google’s case, it generally works like this: When a company in Europe, the Middle East, or Africa purchases a search ad through Google, it sends the money to Google Ireland. The Irish government taxes corporate profits at 12.5 percent, but Google mostly escapes that tax because its earnings don’t stay in the Dublin office, which reported a pretax profit of less than 1 percent of revenues in 2008.

Irish law makes it difficult for Google to send the money directly to Bermuda without incurring a large tax hit, so the payment makes a brief detour through the Netherlands, since Ireland doesn’t tax certain payments to companies in other European Union states. Once the money is in the Netherlands, Google can take advantage of generous Dutch tax laws. Its subsidiary there, Google Netherlands Holdings, is just a shell (it has no employees) and passes on about 99.8 percent of what it collects to Bermuda. (The subsidiary managed in Bermuda is technically an Irish company, hence the “Double Irish” nickname.)

This set-up (as Businessweek describes it) also helps Google lower its tax bill in the U.S. Google Ireland licenses its search and advertizing technology from Google’s headquarters in Mountain View, California. Obviously this technology is worth a lot—but Google headquarters keeps the licensing fee to Google Ireland low. Doing so means that Google headquarters can minimize its U.S. earnings and thus its tax obligations to the U.S. government. And of course, Google Ireland knows how to move its profits around to minimize its tax liabilities.

Not surprisingly, corporations are always eager to learn from each other. Thus, “Facebook is preparing a structure similar to Google’s that will send earnings from Ireland to the Cayman Islands, according to company filings and a person familiar with the arrangement.” Microsoft already has one in place.

According to one study cited by Businessweek (done by Kimberly A Clausing, an economics professor at Reed College), these kinds of profit shifting arrangements cost the U.S. government as much as $60 billion a year. And of course Ireland also loses plenty. Too bad that the governments of Ireland and the U.S. are suffering from large federal deficits and under immense pressure to slash spending. Collateral damage I guess to the profit-making drive.

What is being done to change this apparently legal racket? According to Businessweek:

The government has made halting steps to change the rules that let multinationals shift income overseas. In 2009 the Treasury Dept. proposed levying taxes on certain payments between U.S. companies’ foreign subsidiaries, potentially including Google’s transfers from Ireland to Bermuda. The idea was dropped after Congress and Treasury officials were lobbied by companies including General Electric, Hewlett-Packard, and Starbucks, according to federal disclosures compiled by the nonprofit Center for Responsive Politics. In February the Obama Administration proposed measures to curb companies’ ability to shift profits offshore, but they’ve largely stalled.

A nice cozy system, isn’t it.

In consumer society, products sell an image of the consumer to others. Chocolate, for example, can bring prestige if it comes from a particular manufacturer and falls within a certain price range. The design and ideology behind Godiva for example, promotes a sophisticated chocolate and uses powerful imagery to convince consumers that they may attain an unparalleled experience of high-class luxury.

Godiva promotes the idea that consumers of their chocolates are somehow “higher class” and more “tasteful” than people who do not consume them. As a result, their chocolates have a higher exchange value than the everyday, $1 chocolates meant for middle and lower-class consumers.

Many chocolate connoisseurs argue that Godiva chocolates taste like sugar and candle wax, failing to satisfy the European taste criteria for elite chocolate. Nevertheless, the reputation of Godiva as luxurious is enough to satisfy many non-connoisseurs and it, accordingly, maintains a high exchange-value. Hoping to capitalize on the trend, many popular brands have released their own line of “premium” chocolates hoping to reap profits far out of proportion to the cost of production.

From a Marxist viewpoint, status-symbol chocolate advertising exemplifies how fetishization helps maintain capitalism. Such advertising tacitly legitimizes the elite class by reinforcing the image of upper-class superiority and by presenting the luxurious lifestyle as something to aspire to. It also helps foster false consciousness, which lulls the oppressed working class into complicity, even or especially when prices for “premium” chocolates fall suspiciously low.

Is fair trade a resolution to chocolate’s fetishism?

Chocolate’s fetishism is partially resolved through Fair Trade, which redistributes some of those profits back to the working class and makes the consumer conscious of the worker.

The fetishism of chocolate is only partly resolved, however, since the owning class continues to profit from the fetishism of the commodity and from the enhancing status of the “Fair Trade” label. The purchasing of Fair Trade chocolate, you see, provides the consumer with some emotional comfort; it flatters them just as a high end chocolate product flatters buyers who identify themselves as elite. Therefore, there is an increase in the consumer’s cultural capital with the purchase of Fair Trade chocolate. It is still fetishism to the extent that the consumer is purchasing a comforting emotion or an image of themselves saving the world, which is encouraged by advertising campaigns and wrapper designs. However, in an interesting twist, fetishism is used to reverse the effects that it is traditionally guilty of: benefiting the upper-class at the expense of the lower-class.

————————-

Jamal Fahim graduated from Occidental College in 2010 with a major in Sociology and a minor in Film and Media Studies. He was a member and captain of the Occidental Men’s Tennis team. Jamal currently lives in Los Angeles with the intention of working in the film industry as a producer. His interests include film, music, digital design, anime, Japanese culture, improvising, acting, and of course, chocolate!

If you would like to write a post for Sociological Images, please see our Guidelines for Guest Bloggers.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

In this six-minute video from the New York Times, past residents and developers describe how Times Square was transformed from “the sleaziest block in America” to the corporate palace that it is today. Thanks to Dmitriy T.M. for the submission!

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Annie Leonard tackles e-waste (what happens after we’re done with our computers, cell phones, etc) in the latest 7-minute edition in her Story of Stuff series (see also her first story of stuff and her analysis of bottled water and cap and trade).

Via Reports from the Economic Front.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

After Gwen posted her fascinating discussion of the way that people who are reliant on public transportation are inconvenienced or isolated (based on photos sent in by Lynne Shapiro), David F. sent a link to an article in The Columbus Dispatch about the public transportation in downtown Columbus. Downtown developers, it reports, oppose a plan by the Central Ohio Transit Authority (COTA) to build a transfer station. The reporter writes:

Downtown developers have complained that COTA passengers waiting for transfers near Broad and High streets, and buses lining the curbs make the area less attractive for retail stores and their customers.

Translation: no one wants to see buses and the people who ride them.

Because, you see, when the buses stop there, those kind of people are there waiting for the bus:

(Image at Google)

One of these developers, Cleve Ricksecker, explains:

Transit-dependent riders who are going through Downtown, for whatever reason, don’t shop… Large numbers of people waiting for a transfer can be intimidating for someone walking down the sidewalk.

Translation: People who buy things want to be protected from knowing about and interacting with people who are too poor to buy things.

Much better to make life more difficult for people who ride the bus.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

In 2010, as a matter of free speech, the United States Supreme Court decided that there can be no limits on corporate spending on advertisements in favor of a political candidate (Citizens United v. Federal Election Commission). Open Secrets produced two figures revealing the rise in “outside spending” (i.e., non-party spending) showing the rise.

Total outside spending:

Outside spending for liberals and conservatives:

Open Secrets explains:

…the 2004 election marked a watershed moment in the use of independent expenditures to try to sway voters, with most of that new spending coming from the national party committees. The 2010 election marks the rise of a new political committee, dubbed “super PACs,” and officially known as “independent-expenditure only committees,” which can raise unlimited sums from corporations, unions and other groups, as well as wealthy individuals.

Hermes’ Journeys editorializes:

You can see that liberals slightly outspent conservatives every election since 1996. Except for this year, when quite suddenly a mysterious flood of funding caused conservative campaign coffers to skyrocket, DOUBLING what liberals could muster. Was this the result of concerned right-leaning citizens becoming active in politics and making individual donations? Of course not, it was profit-minded corporations…

…enabled, if I may finished HJ’s sentence, by the recent court decision.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

A recent New York Times article on cheese, brought to my attention by Jordan G., beautifully illustrates the fact that the U.S. government is not a coherent bloc, but a collection of competing interests.

Last month Domino’s Pizza released a new pizza named “The Wisconsin.” Named after a superbly cheesy state (one close to our hearts here at SocImages), the pizza has six cheeses on top and two in the crust. The New York Times reports that one quarter of a pie (an amount I could certainly put away without effort), had more than 3/4ths of the recommended maximum in a day and double the calories of some of its other pizzas.

The Wisconsin:

Cheese, it turns out, is the main source of saturated fats in American diets and saturated fats contribute to significant morbidity and mortality in the U.S. The government, accordingly, recommends that we eat less of it.

Document from the Department of Agriculture:

And here’s where the story gets interesting. The Department of Agriculture is not only responsible for the health of Americans, it’s responsible for the health of the American food industry. As consumption of cheese and non-low-fat milks declines in the U.S., the dairy industry suffers. According to the New York Times:

Every day, the nation’s cows produce an average of about 60 million gallons of raw milk, yet less than a third goes toward making milk that people drink. And the majority of that milk has fat removed to make the low-fat or nonfat milk that Americans prefer. A vast amount of leftover whole milk and extracted milk fat results.

The government used to buy cheese and butter from its dairy farmers, leading to a vast collection of dairy products stored in underground caves in Missouri (totally not kidding). It’s switched strategies — after all, how much cheese and butter can one country hoard? — and while one arm of the Department of Agriculture tells us to eat less cheese, another is telling us to eat more.

In fact, the government spent $12 million American tax dollars marketing The Wisconsin pictured above. Dairy Management is the dairy marketing arm of the U.S. Department of Agriculture. It has a budget of nearly $140 million per year… and it is in cahoots with pizza chains.

“This is one way that we can support dairy farms across the country: by selling a pizza featuring an abundance of their products,” a Domino’s spokesman said in a news release. “We think that’s a good thing.”

…

“Let’s sell more pizza and more cheese!” said two officials with Pizza Hut, which began putting cheese inside its crust after holding development meetings with Dairy Management, according to a memorandum released by the Agriculture Department.

Random suspicious documents:

Dairy Management’s Pizza Hut promotion in 2002 (the “Summer of Cheese”) reportedly pushed an additional 102 million pounds of cheese into American bellies. And consumers are eating up Domino’s new pie. The Times reports that sales have “soared by double digits.”

It is a deeply, deeply divided government entity, with the “let’s sell more!” side almost always better funded… [than] the “but it kills people!” side.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Cross-posted at Reports from the Economic Front.

How do corporations escape paying taxes? Businessweek recently ran a story on Google that helps to explain how they do it.

The story begins by noting that: “Google has made $11.1 billion overseas since 2007. It paid just 2.4 percent in taxes. And that’s legal.” This is pretty incredible because Google does business in many advanced capitalist countries with high tax rates. For example, “The corporate tax rate in the U.K., Google’s second-largest market after the U.S., is 28 percent.”

While the article focuses on Google, and how it avoids paying taxes, it made clear that most of the leading high-technology companies use remarkably similar techniques to achieve similar results.

Ok, so how does Google do it? Google’s office in Ireland is the center of the company’s international operations. In 2009 it “was credited with 88 percent of the search juggernaut’s $12.5 billion in sales outside the U.S.” But Google doesn’t pay taxes on that amount, because most of the profits went to Bermuda, where there is no corporate income tax.

So, how did Google get its profits to Bermuda? Businessweek explains:

Google’s profits travel to the island’s white sands via a convoluted route known to tax lawyers as the “Double Irish” and the “Dutch Sandwich.” In Google’s case, it generally works like this: When a company in Europe, the Middle East, or Africa purchases a search ad through Google, it sends the money to Google Ireland. The Irish government taxes corporate profits at 12.5 percent, but Google mostly escapes that tax because its earnings don’t stay in the Dublin office, which reported a pretax profit of less than 1 percent of revenues in 2008.

Irish law makes it difficult for Google to send the money directly to Bermuda without incurring a large tax hit, so the payment makes a brief detour through the Netherlands, since Ireland doesn’t tax certain payments to companies in other European Union states. Once the money is in the Netherlands, Google can take advantage of generous Dutch tax laws. Its subsidiary there, Google Netherlands Holdings, is just a shell (it has no employees) and passes on about 99.8 percent of what it collects to Bermuda. (The subsidiary managed in Bermuda is technically an Irish company, hence the “Double Irish” nickname.)

This set-up (as Businessweek describes it) also helps Google lower its tax bill in the U.S. Google Ireland licenses its search and advertizing technology from Google’s headquarters in Mountain View, California. Obviously this technology is worth a lot—but Google headquarters keeps the licensing fee to Google Ireland low. Doing so means that Google headquarters can minimize its U.S. earnings and thus its tax obligations to the U.S. government. And of course, Google Ireland knows how to move its profits around to minimize its tax liabilities.

Not surprisingly, corporations are always eager to learn from each other. Thus, “Facebook is preparing a structure similar to Google’s that will send earnings from Ireland to the Cayman Islands, according to company filings and a person familiar with the arrangement.” Microsoft already has one in place.

According to one study cited by Businessweek (done by Kimberly A Clausing, an economics professor at Reed College), these kinds of profit shifting arrangements cost the U.S. government as much as $60 billion a year. And of course Ireland also loses plenty. Too bad that the governments of Ireland and the U.S. are suffering from large federal deficits and under immense pressure to slash spending. Collateral damage I guess to the profit-making drive.

What is being done to change this apparently legal racket? According to Businessweek:

The government has made halting steps to change the rules that let multinationals shift income overseas. In 2009 the Treasury Dept. proposed levying taxes on certain payments between U.S. companies’ foreign subsidiaries, potentially including Google’s transfers from Ireland to Bermuda. The idea was dropped after Congress and Treasury officials were lobbied by companies including General Electric, Hewlett-Packard, and Starbucks, according to federal disclosures compiled by the nonprofit Center for Responsive Politics. In February the Obama Administration proposed measures to curb companies’ ability to shift profits offshore, but they’ve largely stalled.

A nice cozy system, isn’t it.

In consumer society, products sell an image of the consumer to others. Chocolate, for example, can bring prestige if it comes from a particular manufacturer and falls within a certain price range. The design and ideology behind Godiva for example, promotes a sophisticated chocolate and uses powerful imagery to convince consumers that they may attain an unparalleled experience of high-class luxury.

Godiva promotes the idea that consumers of their chocolates are somehow “higher class” and more “tasteful” than people who do not consume them. As a result, their chocolates have a higher exchange value than the everyday, $1 chocolates meant for middle and lower-class consumers.

Many chocolate connoisseurs argue that Godiva chocolates taste like sugar and candle wax, failing to satisfy the European taste criteria for elite chocolate. Nevertheless, the reputation of Godiva as luxurious is enough to satisfy many non-connoisseurs and it, accordingly, maintains a high exchange-value. Hoping to capitalize on the trend, many popular brands have released their own line of “premium” chocolates hoping to reap profits far out of proportion to the cost of production.

From a Marxist viewpoint, status-symbol chocolate advertising exemplifies how fetishization helps maintain capitalism. Such advertising tacitly legitimizes the elite class by reinforcing the image of upper-class superiority and by presenting the luxurious lifestyle as something to aspire to. It also helps foster false consciousness, which lulls the oppressed working class into complicity, even or especially when prices for “premium” chocolates fall suspiciously low.

Is fair trade a resolution to chocolate’s fetishism?

Chocolate’s fetishism is partially resolved through Fair Trade, which redistributes some of those profits back to the working class and makes the consumer conscious of the worker.

The fetishism of chocolate is only partly resolved, however, since the owning class continues to profit from the fetishism of the commodity and from the enhancing status of the “Fair Trade” label. The purchasing of Fair Trade chocolate, you see, provides the consumer with some emotional comfort; it flatters them just as a high end chocolate product flatters buyers who identify themselves as elite. Therefore, there is an increase in the consumer’s cultural capital with the purchase of Fair Trade chocolate. It is still fetishism to the extent that the consumer is purchasing a comforting emotion or an image of themselves saving the world, which is encouraged by advertising campaigns and wrapper designs. However, in an interesting twist, fetishism is used to reverse the effects that it is traditionally guilty of: benefiting the upper-class at the expense of the lower-class.

————————-

Jamal Fahim graduated from Occidental College in 2010 with a major in Sociology and a minor in Film and Media Studies. He was a member and captain of the Occidental Men’s Tennis team. Jamal currently lives in Los Angeles with the intention of working in the film industry as a producer. His interests include film, music, digital design, anime, Japanese culture, improvising, acting, and of course, chocolate!

If you would like to write a post for Sociological Images, please see our Guidelines for Guest Bloggers.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.