It’s that time of year when we savage the world with our unbridled consumerism. If it’s not a Black Friday stampede at Target, it’s a news story of a shopper who camped out in front of a Best Buy for over a week to score some discounted gadgets. Everywhere you turn consumers are whipped into a frenzy, children’s eyes are glazed over as they think of what gifts they’ll open, and romantic partners are stressed over what they will give their loved one to demonstrate the depths of their love.

When consumerism is exaggerated, as it is this time of year, it’s easier to see the cultural scripts and rituals that surround it. These cultural scripts tell us:

- How to feel when we come into a lot of money or even just get a good deal

- How to act when we receive a gift

- And how to impute love from inanimate objects.

1. The Rapturous Consumer Windfall

Next to presentations of sex and bad karaoke there is arguably no other scenario played out on television ad nauseam more than the consumer windfall. Turn on your TV right now, and find an advertisement or game show and you will almost certainly see someone falling to their knees, eyes full of tears, as they praise the gods of capitalism for blessing them. Bob Barker (er, Drew Carey) play the role of Benny Hinn in this consumer revival smashing their open palms on the foreheads of game show contestants as they exclaim, “The. Price. Is. RIGHT!” (Watch at 0:51):*

Television advertising is a wellspring for this type of consumer exaltation. The best example of this consumer rapture is the @ChristmasChamp campaign from Target. Watch the video below and you tell me; is this woman having a consumer-gasm or what?**

Maybe it’s just me, but this ritualized consumer rapture gives me the heebie geebies.

2. The “Show Us What You Got” Photo

Leaning on the arm of your parent’s love, seat slightly sauced, your aunt turns to you and says lovingly, “oh show me what Santa brought you!” After you halfheartedly motion to the pile of loot on the floor she puts her glass down, grabs the family Polaroid and says, “Let’s take a photo to send to [fill in name of absentee relative].”

If we were to flip through your family photo albums I bet we’d find page after page of people cheesing with their unwrapped gifts held head level. This obligatory photo is the classic post gift exchange cultural script. Somehow a gift is only properly received when there is a photo to document it.

From my point of view, it is strange that we take photos of the things we receive during holidays which are tangible and will be around well after the event. But many of us don’t take photos of the moments with our loved ones that won’t linger and fill up our closets.

3. The Hand Dance of Love

Does he love you? Does your hand show it? The holiday season is a time when many will pop the question and boy do advertisers know it. While the issues surrounding jewelry ads are well documented on this site, I’d like to talk about the hand dance women are socialized to do after their love has been verified by an appropriately large shiny rock. After a woman says “yes,” she walks around with one arm sticking out like a zombie for the next few months doing the hand dance. This cultural script dictates that women flaunt their recently acquired diamond ring and then all women in their surround give their requisite “Oh, that is GORGEOUS!” There is a sad sizing up that goes on here, where women are shamed or praised for the size of ring bestowed upon them.

In Conclusion

Most of these cultural scripts and rituals go unnoticed or at the very least unquestioned. These acts are the mechanisms through which we objectify the social world and alienate ourselves from our loved ones. So this year why not participate in Buy Nothing Day and double down on some quality time with your loved ones.

———————————

* We should acknowledge that sometimes the people who are receiving these windfalls are desperate and totally deserving. I don’t want to shame or cast dispersions on anyone in this situation, but these are exceptions to the rule.

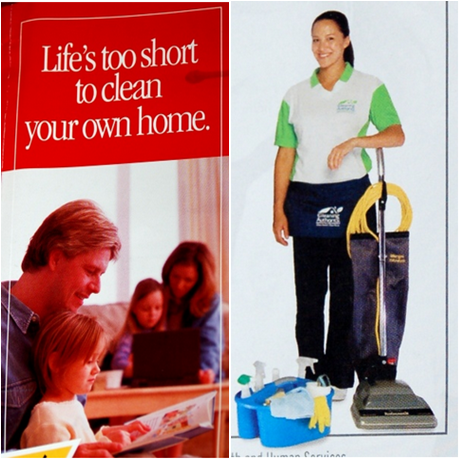

** Forgive me for sexualizing this, but I mean come on, that’s an apt description. While we are at it, this ad is chock full of sociology. We have an “empowered woman” who uses her power to consume; it’s the classic redirection of feminist energies into consumer. This woman, who appears to be the epitome of the middle class, white, privileged consumer, is flexing her muscles, exerting her power, and being aggressive enough to make Betty Friedan blush… ’cept she is using her power to purchase consumer goods from a capitalist system that creates and maintains her oppression. Maybe it’s just me, but I think feminist scholars would have a (justified) objection if I called this “champ” a feminist. I dunno.

Nathan Palmer is a faculty member at Georgia Southern University, editor-in-chief of SociologyInFocus.com, and the founder of SociologySource.com.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.