Cross-posted at Reports from the Economic Front.

“Too big to fail” — that was the common explanation voiced at the start of the Great Recession for why the Federal Reserve had no choice but to channel trillions of dollars into the coffers of our leading banks. But, the government also pledged that once the crisis was over it would take steps to make sure we would never face such a situation again.

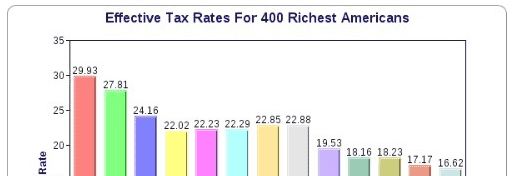

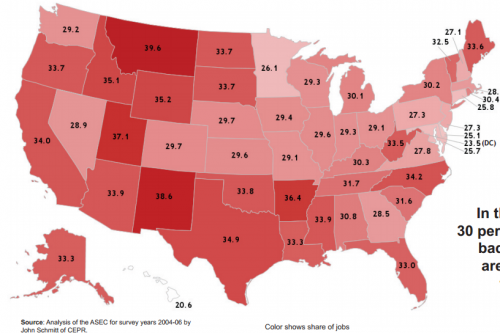

The chart below shows the growing concentration of bank assets in the hands of the top 3 U.S. banks. The process really took off starting in the late 1990s and never slowed down right up to the crisis. It was the reality of the top three banks controlling over 40 percent of total bank assets that gave meaning to the “too big to fail” fears.

But what has happened since the crisis? According to Bloomberg Businessweek, the largest banks have only gotten bigger:

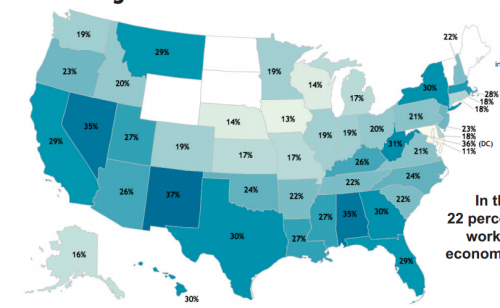

Five banks — JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs — held more than $8.5 trillion in assets at the end of 2011, equal to 56 percent of the U.S. economy, according to the Federal Reserve. That’s up from 43 percent five years earlier.

The Big Five today are about twice as large as they were a decade ago relative to the economy, meaning trouble at a major bank would leave the government with the same Hobson’s choice it faced in 2008: let a big bank collapse and perhaps wreck the entire economy or inflame public ire with a costly bailout. “Market participants believe that nothing has changed, that too-big-to-fail is fully intact,” says Gary Stern, former president of the Federal Reserve Bank of Minneapolis.

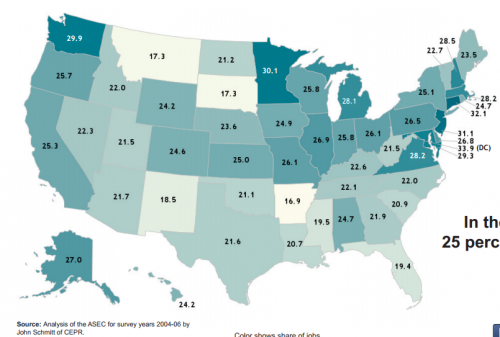

Not surprisingly, this kind of economic dominance translates into political power. For example, the U.S. financial sector is leading the charge for new free trade agreements that promote the deregulation and liberalization of financial sectors throughout the world. Such agreements will increase their profits but at the cost of economic stability; a trade-off that they apparently find acceptable.

The recently concluded U.S.-Korea Free Trade Agreement is a case in point. Leading financial firms helped shape the negotiating process. As a consequence, Citigroup’s Laura Lane, corporate co-chair of the U.S.-Korea FTA Business Coalition, was able to declare that the agreement had “the best financial services chapter negotiated in a free trade agreement to date.” Among other things, the chapter restricts the ability of governments to limit the size of foreign financial service firms or covered financial activities. This means that governments would be unable to ensure that financial institutions do not grow “too big to fail” or place limits on speculative activities such as derivative trading. The chapter also outlaws the use of capital controls.

These same firms are now hard at work shaping the Transpacific Partnership FTA, a new agreement with a similar financial service chapter that includes eight other countries. Significantly, although the U.S. Trade Representative has refused to share any details on the various chapters being negotiated with either the public or members of Congress, over 600 representatives from U.S. multinational corporations do have access to the texts, allowing them to steer the negotiations in their favor.

The economy may be failing to create jobs but leading financial firms certainly don’t seem to have any reason to complain.