Shamus Khan posted a link to a great slideshow put together by the Business Insider that summarizes the current state of our economy. It’s a one-stop illustration of, in their words, “What the Wall Street protestors are so angry about,” and definitely worthy of clicking over to see the whole thing. I’m posting just a few of the images here.

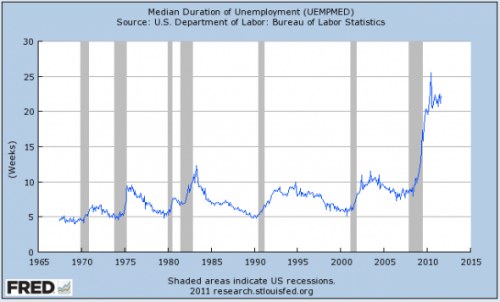

The median length of unemployment for those who lose their jobs is now over 20 weeks:

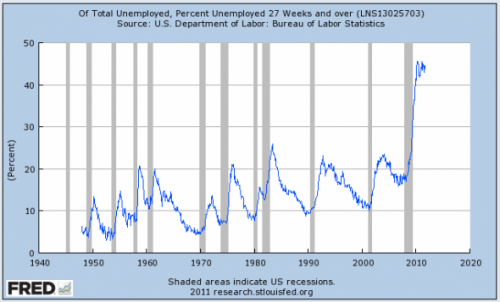

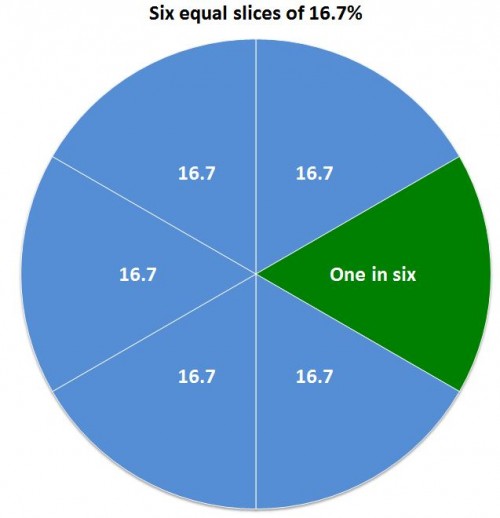

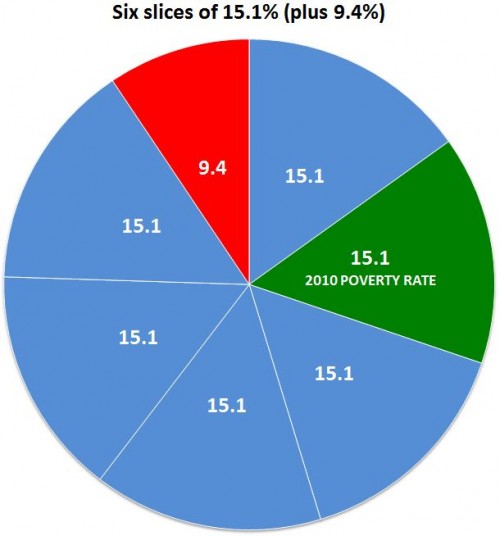

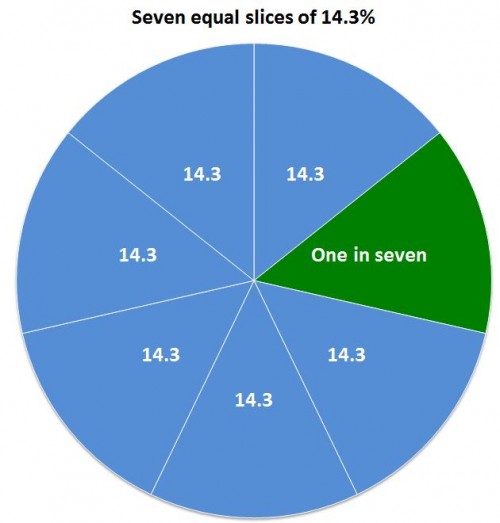

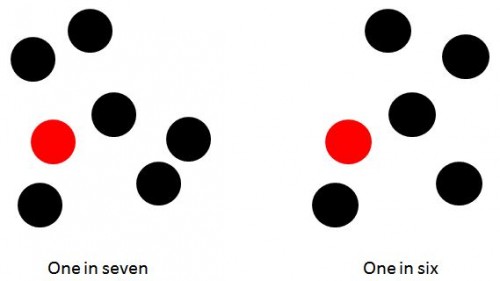

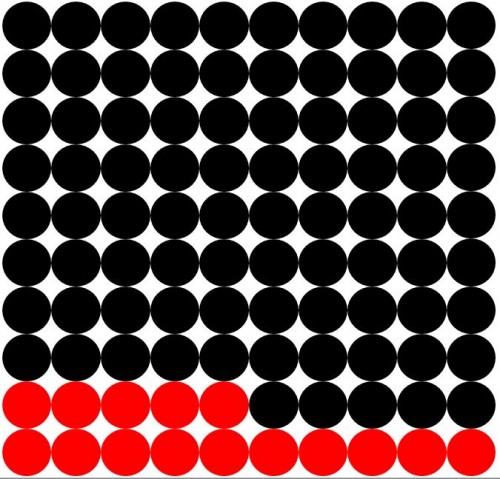

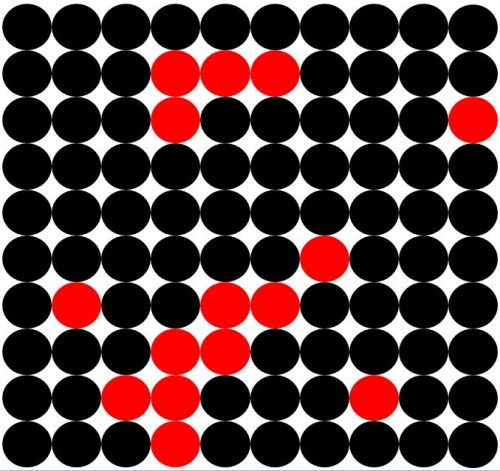

About 45% of the currently unemployed have been without a job for at least 27 weeks — six to seven months without a job:

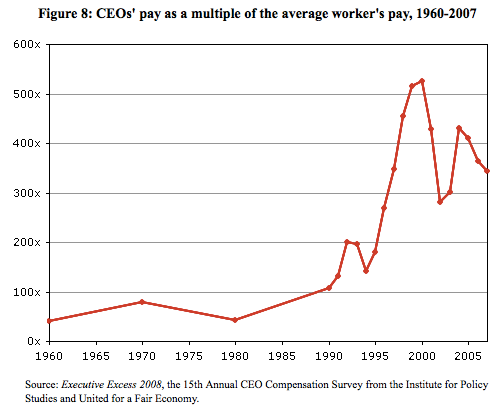

CEO pay is now roughly 350 times higher than the average worker’s:

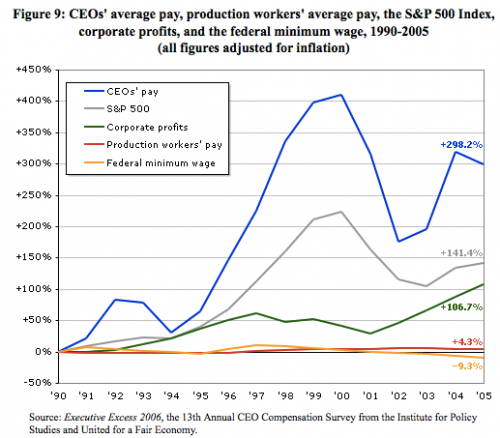

And CEO pay has grown dramatically since the early ’90s, though production workers’ pay has barely budged and the minimum wage has actually dropped if you adjust for inflation:

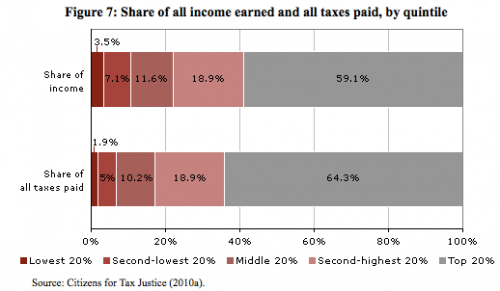

We often hear that the extremely wealthy pay a very disproportionate amount of U.S. taxes. It is true that they pay a large share. But it’s not so imbalanced compared to how much of all income they earn. For instance, the richest 20% of earners receive 59.1% of all U.S. income but pay 64.3% of taxes:

There’s much, much more in the full slideshow; go check it out.