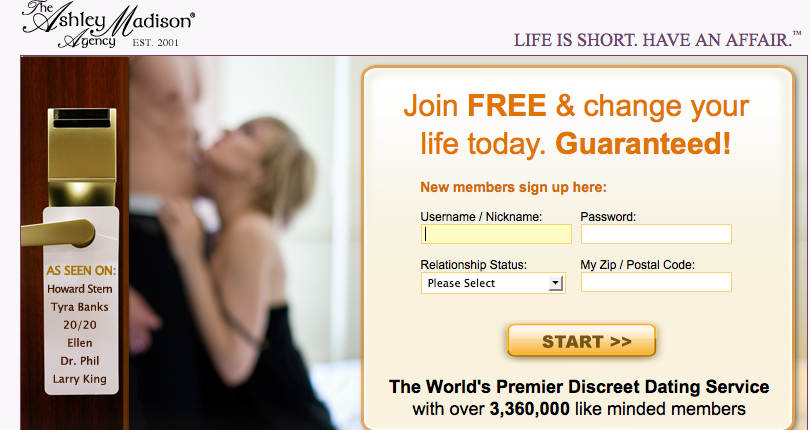

Two years ago we posted about the Ashley Madison Agency. Several readers brought our attention to a new ad campaign for the company, so we’re reposting it; scroll down for new material.

Lisa C. sent in a link to the Ashley Madison Agency, which she heard advertised on a talk radio station that generally targets a male audience. The site specializes in providing dating services to married individuals looking to have an affair:

The company clearly plays on its notoriety and the shock value of the idea that a dating site would cater to married people looking to cheat on their partners — as well as, in this case, appearing to promise men oral sex.

The company has come out with a new ad campaign that has received significant criticism. The ads, sent in by Danielle Q., Christie W., and an anonymous reader, combine “promotion of adultery, body shaming, and female objectification,” according to Christie. They present wives as fat (and therefore presumably unappealing) women who practically drive men to cheat on them with the thin, hot women they deserve to have sexual access to:

(Via.)

(Via Jezebel.)

One source of criticism comes from Jacqueline, the plus-sized model used in the two images. She apparently posed for a photographer years ago and is now faced with seeing her image used to elicit disgust at large bodies. As Jacqueline pointed out in a post she wrote for Jezebel, these images aren’t just about mocking large women; they’re about policing all women’s bodies:

A size 2 woman who sees this ad sees the message: “If I don’t stay small, he will cheat”. A size 12 woman might see this ad and think “if I don’t lose 30lbs, he will cheat”. A size 32 woman could see this ad, and feel “I will never find love”.

Thus, all women are told that they are perpetually in competition with all other women for the sexual attention and approval of men, and always on the verge of being ridiculed for the failure to meet impossible standards of feminine attractiveness.