With all the emphasis on Halloween, you may or may not have heard that this year, October 31st was noteworthy for another reason: according to the United Nations, that’s the day the global population hit 7 billion. The UN has set up a website to provide information about population trends and estimates for the future. Here’s the current world population, by region:

The map is interactive, so you can click on a region to find out its population, as well as its percentage of the total world population.

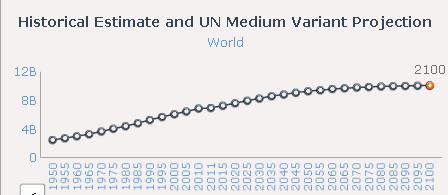

You can also estimate the population through 2100 based on various fertility scenarios. In the default medium scenario, fertility is expected to follow past trends, leveling out at a little over 10 billion by 2100:

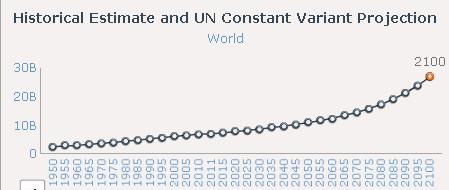

On the other hand, if we saw no further reductions in global fertility, the 2100 population would be over 26.8 billion:

There’s an enormous amount of data available at the site. For instance, if you select the Births tab, you can click on either a region or a specific country and find out what percent of births are to women in different age groups. Here’s the % of all births to women aged 15-19, by country:

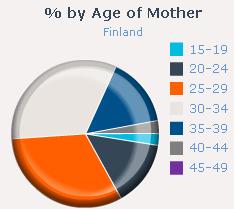

And the chart showing the total age breakdown for Finland (at the site you can hover over the graph to get the actual %):

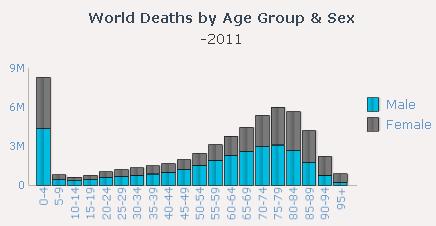

A chart of deaths by age and sex, illustrating the continued high mortality in infancy and early childhood:

There’s also a section of the site where you can enter information about your own date and place of birth and then get a snapshot of what the global population was when you were born. Since I entered the world:

Overall, it’s a pretty great resource, and another one of those websites that can easily eat up a significant amount of your time without you realizing it.