Performativity is becoming one of those terms that every economic sociologist—if not every sociologist—has to know. Unfortunately, it can also be difficult to grasp, as evidenced by the variety of attempts to explain it, from the highly-regarded work of Michel Callon, along with Fabian Muniesa and Donald MacKenzie, to the more informal (but very insightful) accounts available in the blogosphere.

To my own great vexation, I suffered for a couple of years under some sort of mental block about the term. I understood performativity in its original context, in the work of linguistic philosopher J. L. Austin, who observed that language can do more than simply state facts: it can also be a kind of action. Statements such as “I dub thee Sir Galahad, Knight of the Round Table” doesn’t describe a condition, but instead makes something happen. Austin called these “speech acts” performative utterances.

So far, so good. But once scholars in other fields—including gender and queer theory, as well as sociology—adopted the term to their own ends, I lost the thread of meaning. Every time I learned what performativity was supposed to mean in economic sociology, that knowledge promptly got dumped out of my short term memory buffer rather than going into long-term storage. Then I’d have to start all over again.

And then I was lucky enough to hear David Stark give a short lecture in Paris last summer—at the annual meeting of the Society for the Advancement of Socio-Economics—and he solved my performativity problem just like that. His explanation was so elegant and concise that I wrote it on a Post-It note and put it up on my office wall. The Post-It reads:

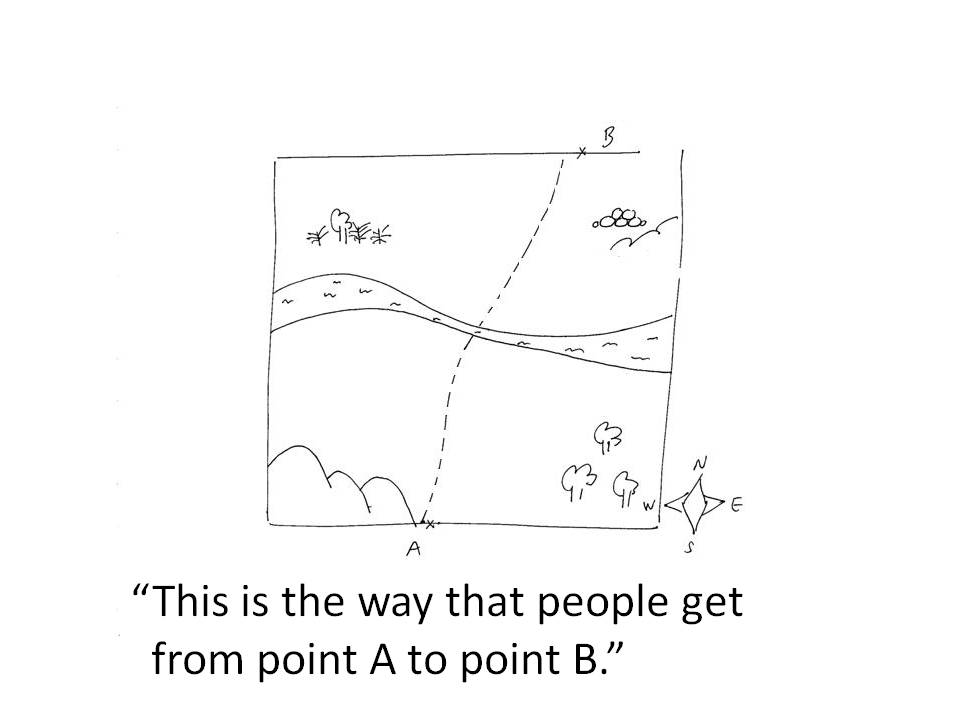

If you show someone a map and say ‘this is how people get from Point A to Point B,’ the statement is performative when it creates the behavior it describes. In this case, a path gets worn in the ground between Point A and Point B.

Thus, performative statements don’t reflect reality (as in the declarative statement ‘this is a pen’), but intervene in it. Performative language is an engine, not a camera.*

A model becomes performative when its use increases its predictive capabilities.

—David Stark, Paris, 17.07.2009

The elegance of this statement still delights me. It’s like the Gettysburg Address of sociology in terms of its parsimony.

This doesn’t entirely capture what was so compelling about Stark’s presentation, however. The missing piece is the visual: images of a path, drawn first as a set of directions, and then as a description of actual travel routes. Every time I saw the Post-It, it called up those images from Stark’s presentation, but I couldn’t easily convey the images to others.

So I asked if I could post the original presentation slides that were such a revelation for me. Stark graciously agreed, so here are the core ideas of his talk in three images, forming what he has elsewhere called a “silent lecture.”

By way of context, assume that you start with a location, as in slide 1; then someone asks for directions through that location, resulting in slide 2, and ultimately slide 3.

_____________________________

* Stark borrows the phrase from the title of a well-known book by Donald MacKenzie.