I love this podcast conversation with Rachel Sherman and Anne Helen Petersen about Sherman’s recent book, Uneasy Street: The Anxieties of Affluence. It is a great source for introduction to sociology courses looking to open up a conversation about differences in social class, especially because it draws attention to the fact that people do a lot of work to hide that social class position.

When we think about wealth, it is tempting to focus on flaunting riches through conspicuous consumption of flashy clothes, large homes, and other reality TV fodder. Sherman’s work makes an important point: phrases like “middle class” actually do a lot to hide our economic positions in society, and wealthy people often work to manage others’ perceptions of their wealth.

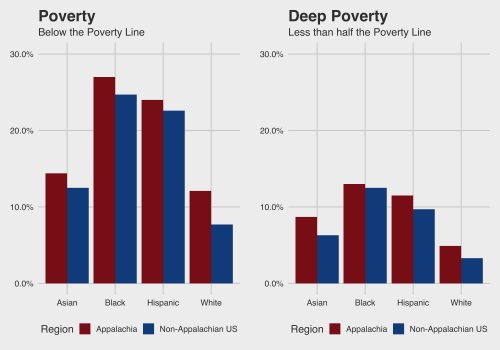

The podcast pairs well with a recent Twitter thread from John Holbein tracing research from around the world on how people’s perceptions of their economic position line up with their actual income and wealth. In case after case, many people report a social class that doesn’t line up with what they actually have.

This is a point I always try to make with my students: our social relationships are as much about the things we hide and avoid talking about as the things we openly share with each other. One of the most powerful points sociologists can make is to show these hidden patterns in the way we interact. The goal is not to call people out or to accuse them of lying, but rather to ask ourselves what it is about our economic lives that makes us want to work so hard to manage others’ perceptions in this way.

Evan Stewart is an assistant professor of sociology at University of Massachusetts Boston. You can follow his work at his website, on Twitter, or on BlueSky.