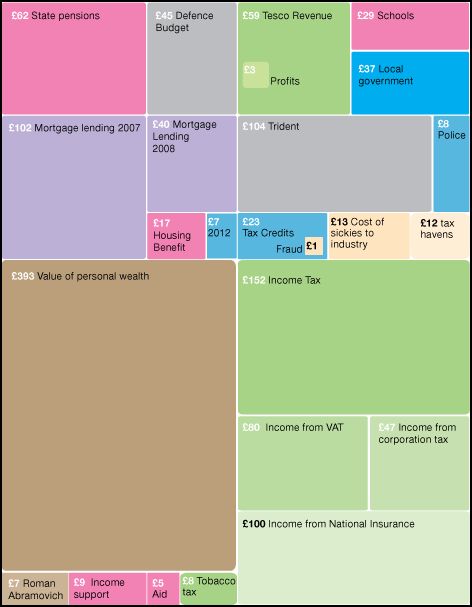

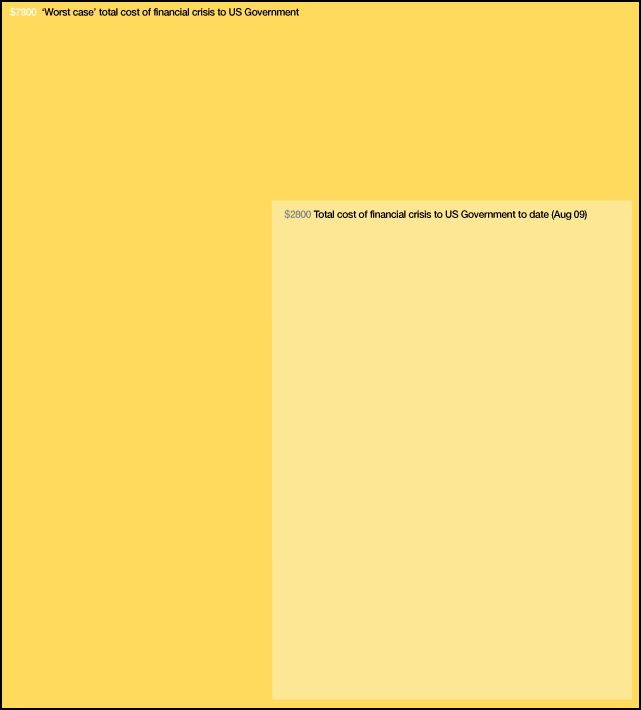

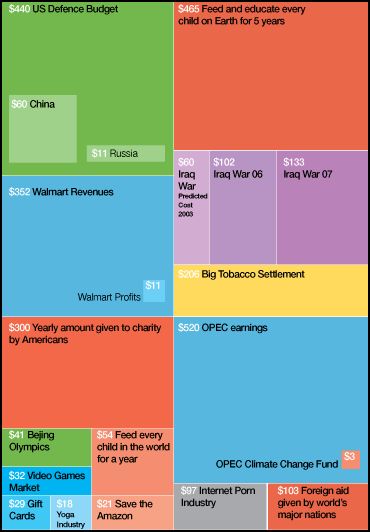

Tom Schaller at FiveThirtyEight posted this graph showing different types of federal taxes as a percent of total U.S. GDP (estimated through 2014 based on the current tax code):

Despite widespread beliefs that we’re all taxed to death, and that taxes are strangling the business sector, we can see that the only taxed that have clearly trended upward since 1935 are payroll taxes (SSI/Retirement). And corporate and excise taxes have actually decreased over time.

Total federal taxes make up less than 20% of our total GDP. Interestingly, a (non-random convenience) sample of Tea Partiers at a recent protest found that half of the attendees thought that federal taxes make up over 40% of GDP, and the mean answer was 42% (the highest answer being 99%).

This reminds me of watching The Price Is Right with some of my relatives as a kid. We’d watch, and inevitably someone would win a car or at the end get the Showcase Showdown package, and being kids my sisters and I would be agog over their riches. But one of the adults in the room would then give us a lecture about taxes, saying you’d have to pay a tax of 50% of the value of the winnings, so you’d really just end up owing money. The implication was that this was really unfair and robbed people like us of our birthright to go on TV and try to win stuff because we wouldn’t be able to come up with the money to pay the taxes on our winnings (though they did wonder if you could convince Bob Barker to just give you the cash value of the items rather than the things themselves so you’d have the cash to pay the taxes).

So basically, they would get riled up and resentful over the amount of taxes they thought they would have to pay if they flew to L.A., got on The Price Is Right, and won something of value. They were complaining about something that didn’t exist, a theoretical tax in a situation they were not going to face, ever.

The point is, a lot of the opposition to and anger about taxes strikes me as completely theoretical: it’s not derived from specific knowledge of tax codes or tax rates or how many services you got in return for the taxes you paid. It’s a more diffuse anger based on assumptions that the government is always out to over-tax you and that your life would be a lot better off if you could just reduce the tax burden and take the ski boat and bedroom set you just won on CBS home in peace, unmolested by the IRS.