This post originally appeared on Sociological Images in 2010. Cross-posted at The Huffington Post.

Bob Z. and Dmitriy T.M. sent us a link to a vintage collection of gun advertising, organized by decade, that shows some interesting trends.

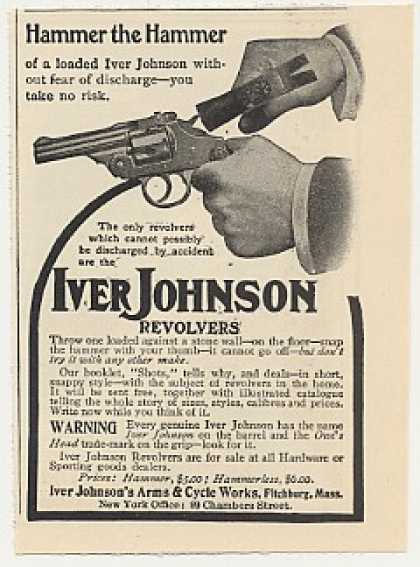

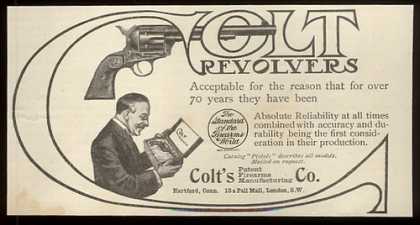

In the 1900s and 1910s, gun advertising frequently simply touted the benefits of the gun itself, ignoring completely any indication as to what the gun was for:

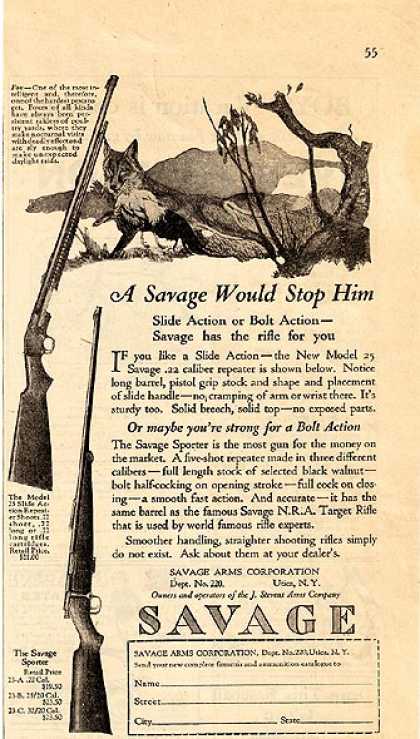

In the ’20s and ’30s, gun advertising more frequently involved a hunting or pest-reduction theme:

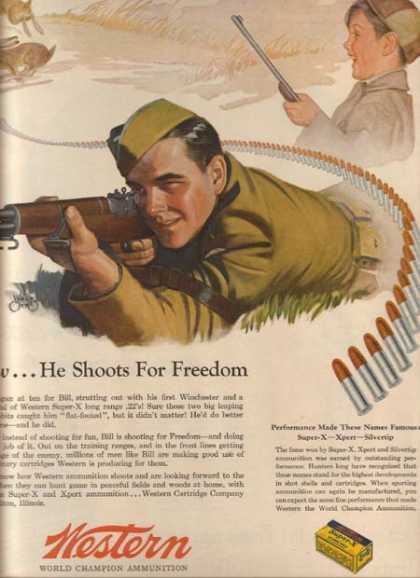

This theme continued through the 40s, but alongside a new theme, war (i.e., World War II):

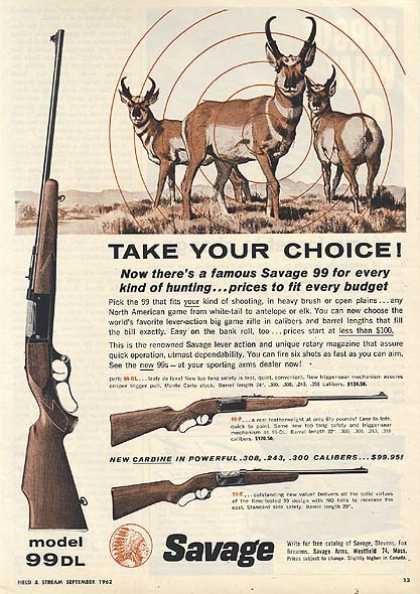

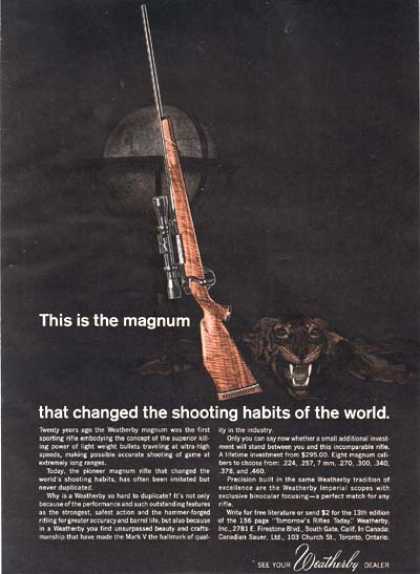

Then, in the 1960s, the war theme disappeared and the hunting theme continued, this time with a new twist. Instead of just hunting for food (and sport) or to protect your property, ads included the hunting of exotic game solely for sport:

Since the 1990s, we’ve seen a new kind of gun advertising in which self-defense is the selling point. Interestingly, this new marketing strategy is designed to bring in women, gays and lesbians, people of color, and kids.

Notably, if you are unfortunate enough to be assaulted, carrying a gun makes it more likely that you’ll be shot in the encounter.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.