As the Wall Street Journal reports:

Four years into the economic recovery, U.S. workers’ pay still isn’t even keeping up with inflation. The average hourly pay for a nongovernment, non-supervisory worker, adjusted for price increases, declined to $8.77 last month from $8.85 at the end of the recession in June 2009, Labor Department data show.

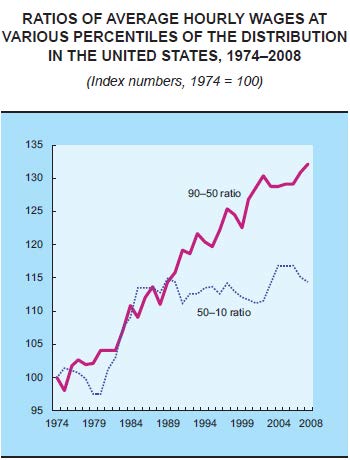

In other words, as the chart below illustrates, the great majority of workers are experiencing real wage declines over this expansion”

Growth also remains sluggish, increasing “at a seasonally adjusted annual pace of less than 2% for three straight quarters — below the pre-recession average of 3.5%.” But by intensifying the pace of work and reducing the pay of their employees, corporations have been able to boost their profits despite the slow growth.

The following chart from an Economic Policy Institute study shows the continuing and growing disconnect between productivity and private sector worker compensation (which includes wages and benefits) using two different measures of compensation.

As the Economic Policy Institute study explains, “there has been no sustained growth in average compensation since 2004. The stagnation began even earlier, in 2003, when considering wages alone. Since 2003, wages as measured by both the ECI and the ECEC (not shown) have not grown at all — a lost decade for wages.”

The point then is that we need a real jobs program, one that is designed to create new meaningful jobs and boost the well-being of those employed. Government efforts to sustain the existing expansion have certainly been responsive to corporate interests. It should now be obvious that such efforts offer workers very little.

Martin Hart-Landsberg is a professor of economics at Lewis and Clark College. You can follow him at Reports from the Economic Front.