Designing for Aggregate Welfare

Pension systems describe the rules of the road for accumulating capital to deliver retirement income, or pensions. In designing pension systems, policymakers must evaluate alternative methods for both financing and distributing pensions. Integral to pension system design is consideration of whether specific policies can provide beneficiaries with a secure retirement (1). Policymakers must consider the following questions:

- What is meant by “a secure retirement”?

- How should a pension system be financed?

- How should benefits be dispersed?

- How much responsibility should be placed on individual investors?

- What is the role of insurance?

Answering these questions using thoughtful economic analysis will help policymakers identify tradeoffs and the consequences of alternative policies. The current state of pension funding in the U.S. and abroad suggests that there is fertile ground for deeper economic analysis of pension issues.

- A recent Citigroup study found that aggregate national debt could be 75% higher once unfunded pension liabilities in the G-20 countries are taken into account (2)

- Pension liability and funding rules differ for U.S. Corporate and U.S. Public pension funds

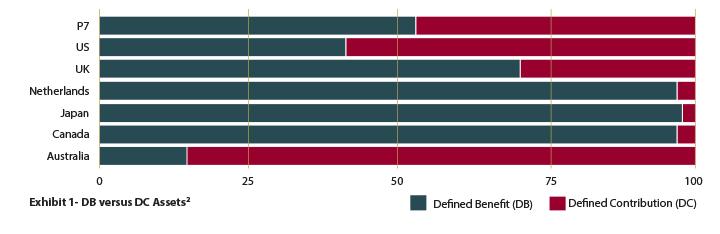

- Pension systems in the U.S. and Australia are predominantly defined contribution, while in the Netherlands and Canada they are principally defined benefits

As the examples illustrate, there is no widespread agreement on the structure of pension policy. Furthermore, the consequences of poor policy design could be devastating - pension policy has significant implications for both public and personal finance.

This policy brief is the first in a series that will suggest pension policy design should be evaluated in terms of impact on aggregate welfare. When aggregate welfare is used as the yardstick for pension systems policy evaluation, the tools of modern quantitative economic analysis can be applied. Using tools such as lifecycle portfolio choice, general equilibrium, and mechanism design (contract theory) provide important insights into designing better pension systems.

No Consensus on Optimal Policy

Currently there is little agreement on optimal pension policy. The simplest example is that some governments have pension systems that are defined contribution (DC) while others have defined benefit (DB). This distinction is critical - in DC systems, individuals are responsible for their investment choices. By contrast, in DB systems, assets are aggregated across beneficiaries and managed by an agent. Individuals are then paid a fixed benefit (in either real or nominal terms) during their retirement.

Visual representation of the allocation of assets to DC versus DB systems in seven countries: P7, the U.S., the U.K., the Netherlands, Japan, Canada, Australia

Visual representation of the allocation of assets to DC versus DB systems in seven countries: P7, the U.S., the U.K., the Netherlands, Japan, Canada, Australia

Exhibit 1 shows the allocation of assets to DC versus DB systems in seven countries. The assets in these countries represent 93% of the world’s 20 largest pension systems. As the graph shows, pension systems in the U.S. and Australia are principally DC systems whereas in Canada and the Netherlands the systems are predominantly DB.

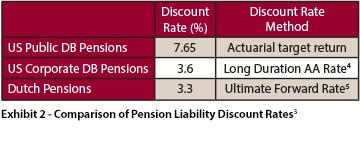

A second example illustrating disagreement in pension policy is the variance in liability discount rate, defined as the interest rate used to value retirement obligations (i.e., liabilities) in a DB pension plan. Comparison of the value of retirement obligations with the value of pension assets determines the health of a pension system. All else equal, higher liability discount rates decrease the value of retirement obligations and improve the funding status of the pension system. Thus, the choice of liability discount rate has important consequences.

Pension Policy Brief Issue 1 Exhibit 2 v3

Pension Policy Brief Issue 1 Exhibit 2 v3

Exhibit 2 shows three examples of liability discount rates from the Dutch, U.S. Corporate, and U.S. Public Fund DB systems. As the chart shows, there is neither agreement globally nor within the U.S. on how to set the liability discount rate.

The Regulator’s Policy Toolbox

Differences in pension systems arise from specific choices made by regulatory agencies and accounting bodies, and the interaction of these choices with the choices made by individual investors and their agents. Regulators have a limited number of policy levers at their disposal. These can be broken into four categories: valuation, penalties, financing and distributions.

Valuation refers to whether some form of market interest rate is used to value retirement obligations, and the degree of valuation smoothing allowed for asset and liability valuation in DB plans.

Liability valuation is important because of its impact on penalties. Pension health is measured by the funding ratio (the value of pension assets divided by the value of pension liabilities). Regardless of the type of pension system, regulators can set penalties when the funding ratio falls below a prescribed level.

The third broad policy choice is the contribution rate. For private (corporate) DB plans, policymakers can set a minimum level of contributions to the plan. For public DB plans, policymakers trade off between levels of taxation, pension contribution rates and alternative uses of tax revenue. Finally, in DC pension systems, policymakers can set minimum contribution levels for both the sponsoring entity and the individual.

The final policy choices surround retirement distributions, or, the level of retirement income and the age at which the individual can begin to receive pension benefits. These choices are relevant for the design of both DC and DB systems.

Although the number of broad policy choices is relatively small, each category includes many options. To further complicate policymaking, decisions made within one category are likely to interact with those in others. Consequently, it is important that policymakers make choices based on solid analytic foundations.

Pension systems provide the rules of the road for the provision of retirement income. These rules help investors make choices about lifetime consumption and saving and they drive decisions about the types of investment vehicles investors choose to use. They also help investors decide what risks they want to insure against and which investment options are appropriate for their insurance needs. Furthermore, these rules determine who makes these selections - individuals, their agents or some combination.

Policymakers should be concerned about the ability of many of the world’s pension systems to deliver on their promises. It is time for a fresh look at how pension systems are designed and to build a new foundation using the tools of quantitative economics. The design of DC systems and the tradeoffs between DB and DC systems are best analyzed in the context of lifestyle portfolio choice models. Basic concepts such as general equilibrium provide a foundation for analyzing the provision of insurance, risk hedging and differentiated portfolio advice. Finally, contract theory can be applied to determine pricing systems that better align the interests of investors and their agents.

Footnotes

(1) A current concern among policymakers in the U.S. is that current systems will NOT provide for a secure retirement. See, for example, The New York Times, February 24, 2015, for a discussion of the pension funding for New Jersey public employees.

(2) Towers Watson Global Pension Survey, 2016. The countries are ordered by size of pension market.

(3) The actuarial target return is the rate of return assumed for pension assets.

(4) Long-duration AA rate is the average interest rate of AA-rated corporate bonds that mature over 5 years. The corporate discount rate is taken from the Citigroup Pension Liability Index, as of June 2016. In actual practice, discount rates are smoothed over long time periods, thus reducing the valuation of large changes in interest rates.

(5) The ultimate forward rate is a weighted average of observed 1-year forward rates, 20-years hence. It was designed by the Dutch Central Bank to provide guidance for discounting long-dated pension obligations. See the Dutch Central Bank website (www.dnd.dl).

References

Dutch National Bank website, www.dnb.nl.

“Judge Rejects Christie Move on Funding State Pensions.” The New York Times, Feb. 24, 2015.

Willis Tower Watson Global Pension Survey, 2016.