Can you guess the decade in which the following words were written? How about the century?

…a certain class of dishonesty, dishonesty magnificent in its proportions, and climbing into high places, has become at the same time so rampant and so splendid that men and women will be taught to feel that dishonesty, if it can become splendid, will cease to be abominable.

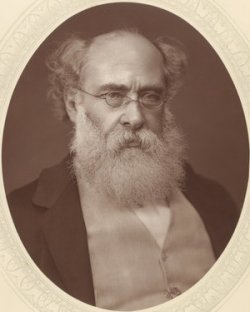

This quotation is from the 50s. The 1850s, that is. And the author was prolific British novelist (and postal service employee!) Anthony Trollope. The reflections on dishonesty come from his 1856 Autobiography, but he is probably best-known for his novel of greed and fraud, The Way We Live Now.

Trollope’s most famous creation is undoubtedly the flamboyant con artist Augustus Melmotte, to whom Bernard Madoff was often compared in recent years. In fact, a comparison between the two is illuminating. Like Madoff, who built his hedge fund on a “big lie,” Melmotte conjured a fortune out of smoke and mirrors, through moves like selling shares in a railway that never existed. And both parlay wealth into access to positions of social prominence and public trust—Melmotte buys a seat in Parliament, while Madoff chaired NASDAQ for several years during the 1990s. Life imitating art, or just tragedy following farce?

This kind of financial chicanery, “dishonesty magnificent in its proportions,” was very much on Trollope’s mind in 1856 because English law had recently re-legalized and expanded the rights of the joint stock company—the ancestor of the modern corporation, and a form of business enterprise so tarnished by fraud that it was outlawed for over a century in the UK.

What, you might ask, was the big deal? Why get so exercised about a change in the legal status of an organizational form?

Four words: the South Sea Bubble. Also known as the world’s first great financial fraud, the Bubble was so destructive to England’s economy and society that Parliament banned all new incorporations (with a very few exceptions) for more than a century.

The Bubble arose around the stock of the South Sea Company, an entity created by act of Parliament to trade exclusively with the Spanish colonies in South America—and, not incidentally, to rid the British Crown of a crippling national debt by raising capital through the sale of shares.

Even though, as UBC law professor Joel Bakan has written, “the South Sea Company was a scam from the very start,” it was wildly successful—until it wasn’t.

Investors flocked to buy the company’s stock, which rose dramatically, by sixfold in one year, and then quickly plummeted as shareholders, realizing that the company was worthless, panicked and sold. In 1720 — the year a major plague hit Europe, public anxiety about which “was heightened,” according to one historian, “by a superstitious fear that it had been sent as a judgment on human materialism” — the South Sea Company collapsed. Fortunes were lost, lives were ruined, one of the company’s directors, John Blunt, was shot by an angry shareholder, mobs crowded Westminster, and the king hastened back to London from his country retreat to deal with the crisis. The directors of the South Sea Company were called before Parliament, where they were fined, and some of them jailed, for “notorious fraud and breach of trust.” Though one parliamentarian demanded they be sewn up in sacks, along with snakes and monies, and then drowned, they were, for the most part, spared harsh punishment. As for the corporation itself, in 1720 Parliament passed the Bubble Act, which made it a criminal offense to create a company “presuming to be a corporate body,” and to issue “transferable stocks without legal authority.”

It was possible to outlaw the corporate form of organizations because at that time, they required a government charter to exist. If a corporation broke the law, it could be punished by revocation of its charter—sort of like the death penalty for juris persons (“legal persons,” which distinguished the status of corporate actors from that of “natural persons,” i.e., human beings).

This tight legal control was driven by deep suspicion of the corporate form which long predated the South Sea Bubble. In contrast to business partnerships, where the managers were also the owners of the firm, the corporation innovated by separating management from ownership, with the latter belonging to shareholders. Even Adam Smith thought this was a bad idea, warning in The Wealth of Nations that

The directors of such companies, however, being the managers rather of other people’s money rather than of their own, it cannot well be expected that they should watch over it with the same anxious vigilance with which the partners in a private copartnery would watch over their own….Negligence and profusion, therefore, must always prevail, more or less, in the management of the affairs of such a company…They have, accordingly, very seldom succeeded without an exclusive privilege, and frequently have not succeeded with one (1776: 439).

In other words, the corporate form had trouble written all over it. Specifically, it presented a built-in problem of moral hazard by given managers authority over “other people’s money.” Among other things, this created tempting conditions for financial fraud.

All these suspicions were borne out and more by the South Sea Bubble. But by the time of Trollope’s reflections, the memory of the disaster was fading, and the Industrial Revolution was generating tremendous wealth. By 1856, Parliament had not only repealed the Bubble Act, but expanded the powers of juris persons, clearing the way for super-charged economic growth—and for a return to the “magnificent” frauds perpetrated by corporations.

Yet, as Bakan writes, the corporate frauds that have come to light since the re-legalization of the corporation have not provoked anything remotely like the “Bubble Act” in response:

Today, in the wake of corporate scandals similar to and every bit as nefarious as the South Sea bubble, it is unthinkable that a government would ban the corporate form…over the last three hundred years, corporations have amassed such great power as to weaken government’s ability to control them. A fledgling institution that could be banned with the stroke of a legislative pen in 1720, the corporation now dominates society and government.

To Bakan’s power-based explanation—that the power of the corporation has simply outgrown that of the state—we might add Trollope’s notion of public tolerance for fraud in high places. That is, the state doesn’t crack down on corporations because it lacks the popular mandate to do so.

Indeed, the platform of Tea Party—a new political group predicted to win an influential number of Congressional seats in the upcoming midterm elections—seems to validate Trollope’s pessimism: the Tea Partiers want to repeal even the relatively limited regulatory reforms that were made in the wake of the 2008 subprime mortgage crisis. Because the answer to a crisis in which fraud flourished in the absence of proper oversight is…even less oversight!

Trollope would probably have appreciated John Kenneth Galbraith’s rueful observation that “There can be few fields of human endeavor in which history counts for so little as in the world of finance.”