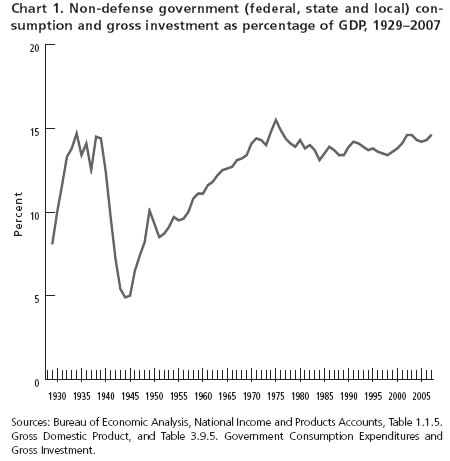

Crossposted on Rhizomicomm

I’m currently working on an ethnographic paper examining innovation in a global context. The above map is a depiction of innovation clusters throughout the world, on the dimensions of patent growth and firm diversity. As it turns out, the area I’m looking at is off the chart with very high growth and few firms. The area is also one where western notions of property rights are out the window. The main question we are addressing is how should firms innovate globally when their intellectual property {IP} rights are tenuous or uncertain? The economic argument for granting exclusive property rights is to ensure an entrepreneurial entity has the incentives to commercialize an idea. So, an innovator is allowed a monopolist position for a period of time, allowing for a path to cash and attracting investors, in order to ensure there is grist for the innovative mill. In our research, exclusive property rights may exist, but aren’t enforced. This begs the question, why is there growth? Why would anyone invest in such a chaotic environment? There must be some value in doing so. Finally, I think it would be interesting to re-examine the above map with cultural dimensions, not in terms of sweeping generalizations, but nuanced, regional differences like the ones AnnaLee Saxenian found between Silicon Valley and Route 128 in Massachusetts.

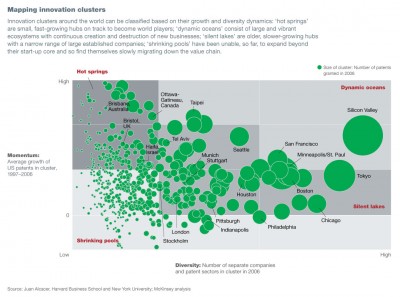

Macleans had two articles on the buzz generated by Chris Anderson’s {Wired editor and proponent of the long tail} new book, Free: The Future at a Radical Price, which Russell has referred to. The first article talked Anderson’s ideas of “freeconomics,” where costs of storage and distribution are approaching zero and consumer behavior can go viral when the price is free. It goes on to describe how critics were lambasting Anderson for his notions, including Malcolm Gladwell’s savaging of the book in the New Yorker. The other article invokes Frankfurt School critical theorist Walter Benjamin to highlight a trend where what is valued is what cannot be readily reproduced and digitized…the return of aura of the experience.

Macleans had two articles on the buzz generated by Chris Anderson’s {Wired editor and proponent of the long tail} new book, Free: The Future at a Radical Price, which Russell has referred to. The first article talked Anderson’s ideas of “freeconomics,” where costs of storage and distribution are approaching zero and consumer behavior can go viral when the price is free. It goes on to describe how critics were lambasting Anderson for his notions, including Malcolm Gladwell’s savaging of the book in the New Yorker. The other article invokes Frankfurt School critical theorist Walter Benjamin to highlight a trend where what is valued is what cannot be readily reproduced and digitized…the return of aura of the experience.

How does this relate to global IP concerns?

Let’s assume that we’re in an economic reality where intellectual “work” can often be readily digitized and reproduced infinitely. We’re talking creative content, educational resources, biotechnology/genetic information, etc., so it would seem that the producers of music, film, news journalism, the university lecture, and the sequenced genome all have a dog in this fight. Producers of valuable things want to profit from their efforts. Their investors demand it. Here comes Chris Anderson saying that the new economic model is to offer things for free.

Enter Malcolm Gladwell and other naysayers. Gladwell asserts that Anderson is wrong on several counts. The YouTube business model has failed to make money for Google, hence the “free” business model is untenable. The logic of “free” is flawed, as capital-intensive infrastructures, costly complementary goods and services, and downstream costs often mean that goods simply cannot be free. One can nitpick the flaws in Gladwell’s arguments. He cites that the costs of clinical trials is what drives up pharmaceutical prices, which is true today, but the objective with biotech. is to use genomics to better target the use of molecules for specific therapies geared towards specific diseases and specific people, based on genetic profiling. To use an “Obamaism,” the idea is to bend the innovation curve.

When IP faces rampant piracy or when property rights are not or cannot be enforced, globally, the potential of infinite reproduction puts pricing pressures towards the free, whether the producer likes it or not. This is what’s happening to the firms in our research. The successful global firms we studied are the ones that are embracing cultural particulars and negotiating as best they can their claims to IP revenue streams.

Interestingly, Chris Anderson has been accused of cribbing IP from sources like Wikipedia, acting like a veritable Web 2.0 Jack Sparrow. The question I have is does this or should this diminish the value of his book by readers? Is this a violation of some “authorly” ethics or is this just the new IP where everything is up for grabs and the key is deliver value. Anderson even stated that one could get the information in Free by compiling blog posts and articles, but that the book adds value by synthesizing it. He also practices what he preaches. One can read Free for free, but just because it’s free, doesn’t mean it will be easy. The free versions of the book text are limited by format or are DRM-protected. Some consumers are complaining because of different expectations of what “free” means, but this approach is consistent to Anderson’s core ideas. Being in Canada, I’ll have to jump through more hoops to read this for free, due to publishing restrictions, but I’ll figure it out and I’m actually looking forward to reading it.

Is this commerce or is this anarchy? The lessons being learned are similar to those in the second Macleans article. The focus needs to be on the delivery of value, rather than the protection of rights. Globalization is achieving what a thousand socialist mandates could not. The erosion of property rights is forcing firms to figure out how to deliver value when an innovation is free. Web 2.o has offered firms the ability to do what I have called “stagesetting” in several research projects and a case on Pixar. Stagesetting is where a firm has a sequential approach to its ultimate strategic objectives. We see firms trying to leverage network effects to create value for users through sites and technologies using social media. Flickr has no value with hundreds of users, but has tremendous value with millions. One can talk about MySpace, Twitter, and Facebook revenues in terms of advertising, but the holy grail is the data mining and finding what the exact value proposition is to generate revenues from business and institutional clients. The “freemium” model of the basics for free, but added features are extra, is based upon stagesetting, where value is created. What Anderson offers is a glimpse into a global economic reality and gives firms the incentives to rethink the nature of value…or they can try their luck in the courts, like the RIAA did with prosecutions of a Minnesota mom and college kids.

Twitterversion:: Will IP matter in global contxt?ChrisAnderson=Web2.0 JackSparrow decentrng IP auth,making value-creation salient. http://url.ie/23kj @chr1sa @Prof_K

Song:: O.P.P – Naughty By Nature lyrics

I’ve been thinking about José’s blog on

I’ve been thinking about José’s blog on