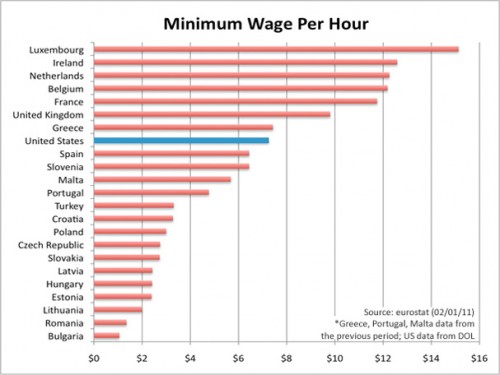

I am trying to re-enter society after several days being sick, so I’m going with something short and simple today. Eden H. sent in this chart, found at Business Insider, that compares hourly minimum wages in a number of European countries to the U.S.:

The European data are available from Eurostat (though note they report minimum wages in terms of Euros per month, not hour, so the data was converted for the chart).

It also fails to be true, as many anti-immigration people claim, that the U.S. accepts a uniquely large number of immigrants who need help once they arrive:

It also fails to be true, as many anti-immigration people claim, that the U.S. accepts a uniquely large number of immigrants who need help once they arrive: