Originally posted at Organizations, Occupations and Work.

Last week I discussed the connection between the Occupy Wall Street protests and the long-term transfer of national income into the finance sector. Well the problem is worse than Wall Street’s power over the national economy and polity.

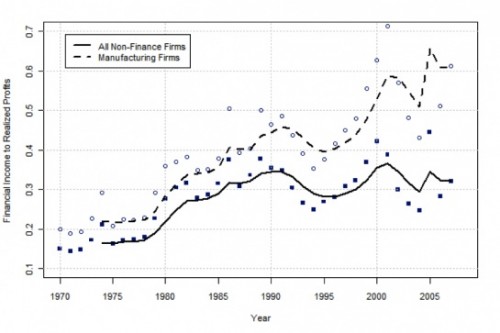

There really are two faces to financialization. The most familiar face is the dominance of the finance sector over the rest of us: the giant profits and bonuses at the big banks and investment houses and the instability generated by too big to fail but rapaciously imprudent financial services firms. The other face is the financialization of the rest of the economy. Greta Krippner figured this out first. Greta discovered that since the 1980s firms in the non-finance sector have increasingly invested, not in the production of goods and services, but in financial instruments. The productive economy, Main Street in some formulations, has increasingly abandoned production in favor of financial shenanigans. Finance related income, including interest, foreign exchange profits, and stock market investments have risen from about 1/8th of corporate profits to around 30%. In the manufacturing sector the move from production to financial strategies has been even more dramatic, rising to a ratio of finance revenue/profit as high as .60 after 2000.

The most well-known examples of this type of financialization might be the financial arms of automobile manufacturers. General Motors established its financial arm General Motors Acceptance Corporation (GMAC) in 1919 and Ford established its financial service provider Ford Motor Credit in 1959. Before the 1980s, the main function of these financial institutions was to provide their automotive customers access to credit to increase car sales. Starting in the 1980s, these firms broadened their portfolio. GMAC entered mortgage lending in 1985. In the same year, Ford purchased First Nationwide Financial Corporation, the first thrift that operated at the national level, to enter the savings and residential loan markets. In the 1990s both GMAC and Ford Motor Credit expanded their services to include insurance, banking, and commercial finance. In 2004, GM reported that 66 percent of its $1.3 billion quarterly profits came from GMAC; while a day earlier, Ford reported a loss in its automotive operation but $1.17 billion in net income, mostly from its financing operation.

Founded in 1943 GE Capital was designed to provide loans for the customers of home appliances. However, under the post-1980 leadership of Jack Welch, its scope rapidly expanded to small business, real estate, mortgage lending, credit cards, and insurance. After running a close second for more than two decades, it topped GMAC as the largest nonbank lender in 1992. The profit return to financial expansion was extraordinary. In retrospect this should not be surprising; the same financial deregulation than broke down the walls between various types of financial firms also freed non-financial firms to enter these markets. Simultaneously deregulation created fertile fields in which to capture income in multiple financial markets.

This kind of financialization is in many ways more insidious than the concentration of wealth and power on Wall Street. At this point many of us, including political movements such as Occupy Wall Street and even the Tea Party movement can see that financial power and concentrated wealth undermine democracy and capitalism respectively. I think that the financialization of the non-finance sector has undermined the real economy by reducing capital and management commitment to production and further marginalizing labor’s role in U.S. corporations. The result has been an incremental exclusion of the general workforce from revenue generating and compensation setting processes. While once CEOs were celebrated for expanding employment and market share, they are now lauded for increased profitability and decreased employment. They have accomplished this transition by shifting the creative energies and investment strategies of their firms away from the production of goods and services and into financial investments.

Recently Ken-Hou Lin and I have found that as financial strategies replace production ones, income inequality climbs dramatically. In fact as industry financialization rises so does capital’s share of income. In addition, financialization is associated with higher compensation for corporate officers and higher income inequality among employees. We estimate that about half of the post 1970s decline in labor’s share of income, 10 percent of the growth in officers’ share of compensation, and 15 percent of the growth in earnings dispersion between 1970 and 2008 are linked to the financialization of the non-finance sector. One way to think about financialization is that it is a system of income redistribution which strengthens the hand of finance capital and weakens the hand of labor associated with the real economy.