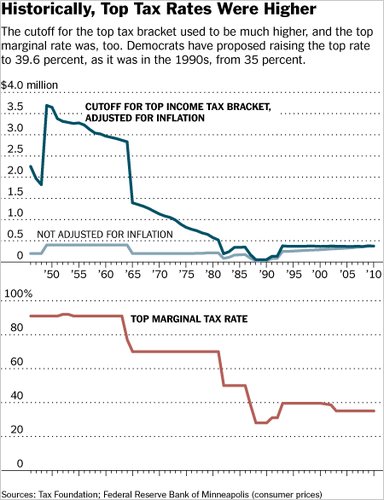

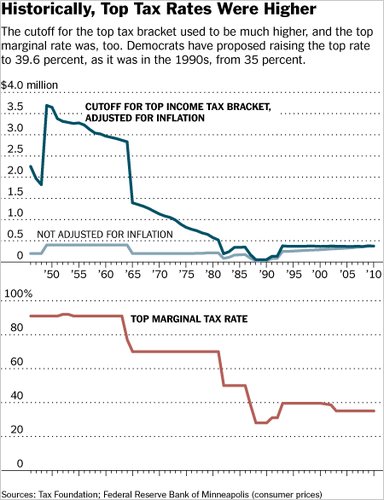

To provide a little context to the current discussion about extending the Bush-era tax cuts, the New York Times has an interesting graph up that shows changes in the level at which the top tax bracket kicked in, as well as the % tax rate in the top bracket:

So on the one hand, in constant dollars, you used to have to be quite a bit richer before you hit the top marginal tax bracket, because we had a wider range of brackets and differentiated incomes more than we do now (taxing an income of $500,000 differently than one of $5 million, whereas now we’ve basically collapsed all those brackets). But now, the highest income tax rate is well under half of what it was in the ’50s.

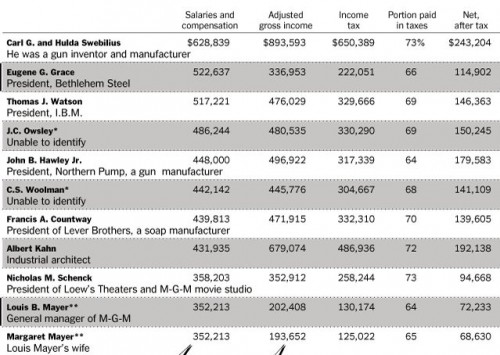

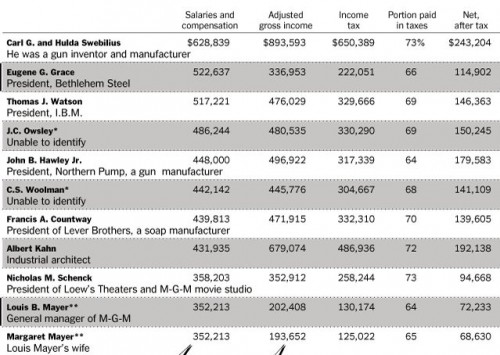

This chart shows the incomes and tax levels of the 10 Americans with the highest salaries (as opposed to wealth from investments, capital gains, etc.) in 1941, data we have because in 1943 President Roosevelt asked for a report on top earners:

I keep hearing news organizations discuss the existing tax cuts, and their possible extension, in a way that seems a bit confusing, by saying it’s a tax cut for people making “up to” $250,000, or $500,000, or however much the cap is for the different plans being thrown around. That seems to imply that, say, everyone making $250,000 or less gets a tax cut, and anyone making $250,001 gets nothing at all. Just to clarify, under all these plans, everyone would receive (or, more accurately, keep the existing) cut on their first $250,000 (or whatever the chosen cutoff would be).

At issue is whether that same tax rate should apply to all income, or whether beyond a chosen cutoff, the Bush tax cuts would expire. In that case, if you made $300,000, say, you would keep the tax cuts on your first $250,000 in income (and thus pay roughly 35% in taxes), but pay a higher rate on that last $50,000 (about 39%). You wouldn’t pay the higher tax rate on your entire income. And I think that’s getting lost a bit in the use of phrases like “middle class tax cuts” or “tax cuts up to X dollars.” That’s separate from whether or not you think extending the tax cuts are a good idea, but I just wanted to take a second to clarify what I think is an easily misunderstood point, made worse by the way it’s being reported on.