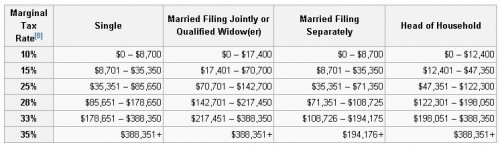

There are six (progressive) tax brackets for income. The tax rate paid by earners is bumped up each time they reach a bracket threshold. The threshholds are determined by type of household. Here’s a handy chart for 2012 from Wikipedia:

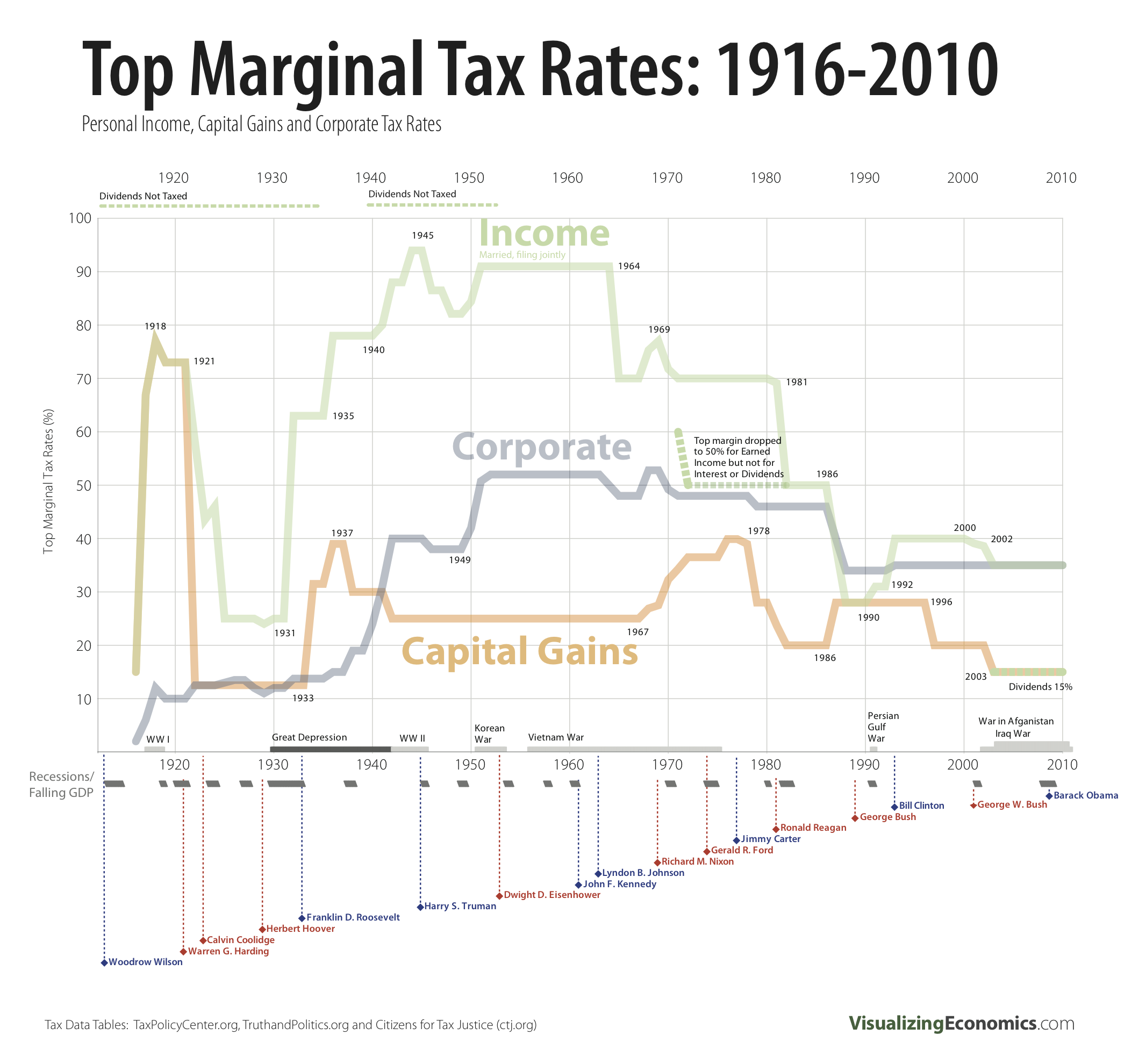

U.S. politicians are now debating how these tax rates should change and they often focus on the “marginal” or “top” tax rate. That’s the one that applies to the highest tax bracket, right now at 35%.

Dylan Matthews at the WonkBlog notes that the squabbling has been mostly over a percentage point or two. Small beans, he asserts. To put this in perspective, he includes this graph of fluctuations in the top tax rates throughout history (click to enlarge):

The green line labeled “income” correlates to the chart above. You can see that especially income, but also corporate and capital gains top tax rates, have been shockingly variable since 1910. They were about 25% right before the Great Depression, raised to about 95% during World War II, dropped to about 70% in the ’60s, and have been on the decline ever since.

Matthews refers to a pair of economists, Nobel laureate Peter Diamond and Emmanuel Saez, who argue that the top tax rate should optimally be 73%. Sociologist Jose Marichal, however, at ThickCulture, observes that tax policy has rarely been about what is optimal for society. Instead, he writes:

What these wild shifts in tax policy suggest is that our determination of how much we should tax our wealthiest is not based on any pragmatic assessment of what would result in the best policy outcome, but is rather guided by foundational assumptions about what is fair.

Beliefs about what is fair are, of course, strongly influenced by cultural ideologies and group stereotypes. Politicians both fall victim to their own biases and strategically invoke and create ideas and resentments. We shouldn’t expect the current debate over how to change our tax code to be either rational or practical, then. The debate will be political, but you already knew that.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 22

MPS — December 3, 2012

It seems that marginal tax rates are not as informative as one might think:

http://www.baldingsworld.com/2012/11/30/the-obsession-with-nominal-tax-rates-or-the-twinkie-romanticism/

Actual tax rates among the top 1% have gone down but not so drastically.

MinervaB — December 3, 2012

The phrasing here is a little off: "The tax rate paid by earners is bumped up each time they reach a bracket threshold." The tax rate doesn't go up on all income earned when a household reaches a new bracket - just the income earned above the threshold amount. A lot of people don't know that and think you get a huge tax bill on your previous earnings when you cross a threshold, so I think it's important to clarify.

MPS — December 3, 2012

"The tax rate paid by earners is bumped up each time they reach a bracket threshold."

This is a very poor way to say what actually happens. In fact an earner pays the listed tax rate on income in each bracket. So, for instance, a single person with a $200k income does not pay 33% tax on all taxable income. She pays 10% on the first $8,700, 15% on the next $35,350 - 8,700 = $26,650, etc.

MPS — December 3, 2012

Also: "marginal" tax rate is not the tax rate on the highest tax bracket. Your marginal tax rate is the tax rate paid on your next dollar of income. So, for instance, in the example I gave below, a single person making $200k does NOT pay a tax rate of 33%, but she does pay a marginal income tax rate of 33%, because the next dollar she makes will fall into that tax bracket and be taxed at that rate. (As I explained below, other income she makes falls into lower brackets and is taxed at a lower rate.)

I'm a bit surprised that you decided to write about tax rates without knowing these basic facts.

Nizam Arain — December 3, 2012

Alongside the top marginal tax rate, another key factor in taxation policy (which is often overlooked in these discussions) is the income threshold of the top tax bracket.

Today, we have six tax brackets. The top bracket (35% marginal tax rate) starts at the income threshold of ~$379k. This is basically the top 1%.

For historical comparison, during the 1950s we had 24 tax brackets, and the top bracket (91% marginal tax rate) applied to income over $200k, which is $2.3 million in 2011 dollars.

We have had, at various times, as many as 55 tax brackets, and a top bracket starting as high as $80M (in 2011 dollars).

So our discussion has to be about raising the top tax rates, but also restoring higher tax brackets to address the increasing income inequality that has pushed into the stratosphere not only the the top 1%, but really the top 0.1% and the top 0.01%. (Also, we need to crack down on off-shore tax shelters, equalize the capital-gains rate, and raise the cap on income subject to social security tax.)

AllisonXX — December 3, 2012

There are certainly more questions at play than what is fair. Nowadays we have to worry about "capital flight" because of a globalized, mobile class of top earners. In addition, arguments about what tax rates will stimulate the economy and create jobs are trotted out.

Yrro Simyarin — December 3, 2012

I really wish the Right would just give up on the tax rate for the rich issue. A week later when we've already spent all of the revenue we earned off of the new higher rates, maybe we can talk seriously about the deficit. There just isn't enough total revenue from the proposed tax increases to matter at all in the grand scheme of the federal budget.

Kimberly Lenhardt — December 3, 2012

It is really too bad the inital chart is from wikipedia as it reduces credibility for the entire article. Wikipedia is not a reliable source and yet the IRS.gov has the same chart. It concerns me that such a simple path to a reliable source was not used despite its ready availibility. I expect better research from this site.

FLUCTUATIONS IN TOP TAX RATES: 1910 TO TODAY | Welcome to the Doctor's Office — December 3, 2012

[...] from SocImages [...]

Wondering — December 3, 2012

What is this "Head of Household" thing? How does it differ from "Married, Filing Jointly"? Yeah, not an American, in case that wasn't clear.

Andy — December 4, 2012

FWIW, the consensus among public finance economists is that the top tax rate should be much lower than 73%. Diamond and Saez are excellent economists, but that figure is very controversial.