Cross-posted at Ms.

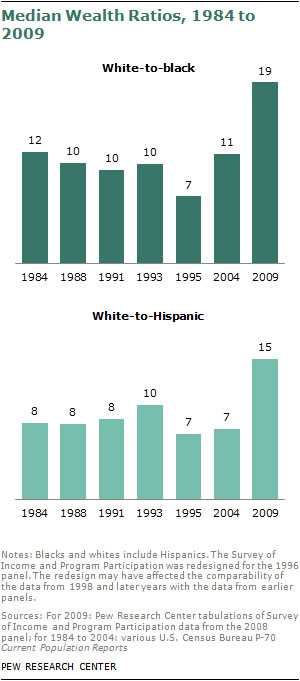

A new study from the Pew Research Center reports staggering racial gaps in median wealth — a person’s accumulated assets minus her debt — between whites ($113,149), blacks ($5,677) and Latinos ($6,325). That’s a 20-to-1 white-to-black ratio of wealth and a 18-to-1 white-to-Latino ratio.

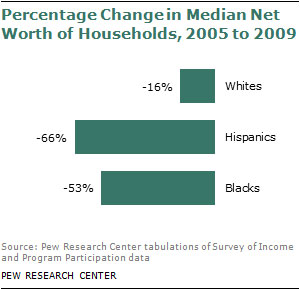

Essentially, all of the economic gains made by people of color since the Civil Rights Movement have been erased in a few years by the Long Recession. Whites experienced a net wealth loss of 16 percent from 2005 to 2009, while blacks lost about half of their wealth (53 percent) and Latinos lost two-thirds of their wealth.

Media outlets reporting on the Pew study point to housing loss as the primary culprit, since the net worth of blacks and Latinos is heavily reliant on home ownership, while whites are more likely to have retirement accounts and stock.

While this is certainly accurate, it obscures the core racism at play. Public policy decisions have been responsible for the speedy recovery of the financial market and the slow recovery of the housing market. From the start, the Troubled Asset Relief Program (TARP) favored Wall Street recovery over homeowner recovery, with only $12 billion of the $700 billion bailout spent on foreclosure programs. (To be fair, most of the Wall Street money was eventually paid back.)

So prioritization of corporate interests disproportionately assisted whites in the recovery — but (perhaps) not intentionally. The same cannot be said for actual lending practices.

Rampant– — and racist — fraud in the home loan industry was a primary contributor to the collapse, with 61 percent of sub-prime loan holders actually qualifying for prime loans that would have been easier to maintain. Blacks and Latinos were especially targeted for sub-prime loans, a practice called “reverse redlining.” Wells Fargo loan officer-turned-whistle blower Elizabeth Jacobson admitted that her company specifically went after African Americans for sub-prime loans through “wealth building” conferences hosted in black churches.

The employment gap between whites and blacks is also a contributor to the wealth gap. While white American are suffering through the Long Recession with 7.9 percent unemployment, blacks are experiencing Great Depression-like figures of 16.1 percent unemployment. This figure jumps to 31.4 percent for blacks ages 16 to 24, and black Americans have consistently had the higher rate of unemployment compared to white Americans since 2007.

Not surprisingly, the employment gap, too, has racist origins. The Center for American Progress analyzed unemployment data from the last three recessions and found that black unemployment starts earlier, rises faster and lingers longer. Explanations include the concentration of black workers in the stumbling manufacturing sector, the cutting of public sector jobs — and racial discrimination. This last finding is no shock given that employers are more likely to call back a white job applicant with a criminal record than a similarly qualified black man without a record.

The role of racism in poverty is important to keep in mind at a time Washington politicians are manufacturing crises that will slash the entitlement programs that 1 in 6 Americans rely on. It’s ironic that we’re cutting safety nets for the poor just as we’re experiencing the highest poverty rate since 1960, with blacks and Latinos three times as likely to live in poverty. Public policy is supposed to knock down racial and other non-meritorious barriers to pursuing life, liberty, and happiness, not jack them higher.

Comments 13

Gilbert Pinfold — July 29, 2011

From Wikipedia: "In 1993 President Bill Clinton made changing the Community Reinvestment Act to make mortgages more obtainable for lower and lower-middle class families. The changes ushered in during the Clinton Presidency encouraged banks to make mortgage loans to people who otherwise would not have qualified for them. In 1998 the Federal Bank of Boston issued a report entitled “Closing the Gap: A Guide to Equal Opportunity Lending." The 30 page document was intended to serve as a guide to loan officers to help curb discriminatory lending [10] "Closing the Gap," instructs banks to hire based upon diversity needs, sweeten the compensation structure for working with lower income applicants, encourages shifting high risk, low income applications to the sub prime market, by saying "the secondary market [Subprime Market] is willing to consider ratios above the standard 28/36," and "Lack of credit history should not be seen as a negative factor."

The banks acted on greed and compliance with anti-discrimination statutes. Unfortunately for everyone, the market was indifferent to both.

Yrro Simyarin — July 29, 2011

Of course, restoring higher home prices is just going to make it *more* difficult for current low-income, minority renters to find a new home. In general, low housing prices are considered good for low income people.

The high prices were a bubble. Propping home prices back up to that level is just setting things up for another crash.

Maybe it wasn't a good idea to encourage banks to lend money to low income people who couldn't afford it, just because of some vague idea that home "ownership" was better for minorities.

I'm not one of the people who blames the financial crisis in general on the Community Reinvestment Act... but it seems like it would have a heck of a lot to do with this specific aspect of it.

AlgebraAB — July 29, 2011

The state of financial education in the U.S. is simply atrocious. The fact that there are millions of people signing mortgage documents (and purchasing a home is the biggest financial decision the average person will make in their life) without really understanding what they're signing says it all.

This post completely misrepresents the history of the housing bubble, however.

Fraud went both ways. While banks did commit fraud, there were also a multitude of individuals who lied about their income or misrepresented their financial situation in order to secure mortgage loans they would not have been able to secure otherwise.

This article suggests that the housing bubble was perpetuated by predatory lenders using coercive tactics but, in reality, it was very much driven by demand. A simple look at newspapers or other media from the time reveals this. I remember regularly reading news stories about new subdivisions opening up in Las Vegas or in the Inland Empire of Southern California and then selling out within days or even within hours. I remember seeing lines that were multiple-blocks long, early in the morning, full of people who were eager to be the first to buy into a new housing development. Yet we are to believe that these people were the victims of "predators" and they were strong-armed into buying homes they couldn't afford. Banks perpetuated fraud because they saw an unprecedented level of demand and they did whatever they could, including committing illegal acts, to meet that demand with supply before their competitors did. It's a case of mutual responsibility. When you let the consumer off the hook, as you do in this article, you not only shoot your own credibility but you distort the history of an important economic event that we should understand in its real totality if we are to prevent it from happening again.

Furthermore, articles such as these fail to mention that a very significant percentage of homes that have been foreclosed on were purchased as investments. This is especially true in Nevada, Arizona and Southern California. There are entire subdivisions in the Inland Empire that were purchased and then foreclosed upon but never had more than a 10% occupancy rate. Individuals purchased these homes in order to "flip" them for a profit, not to use them as habitation. This was predicated on the false notion that home prices would perpetually go up. Articles such as these leave out this fact because they're all about generating sympathy for the foreclosed-upon and it's hard to do that when we're talking about people who were motivated by greed and who were taking a calculated investment risk.

I oppose foreclosure programs and President Obama's support for these programs (as limited as it is) is one of the primary reasons why I hope he isn't re-elected. First and foremost, as Yrro points out, an economic bubble represents an unsustainable and unjustified peak in prices. It's an abnormality, in other words. Allowing prices to "crash" is a return to normality. It's a return to a sustainable price-level that is justified by supply-and-demand. Bolstering prices through these foreclosure-support programs is only keeping prices artificially higher longer. Not only is that hurting poor people by keeping prices unaffordable for the majority of the populace but it is further distorting our economy and setting us up for another crash. As of yet, there has never been an economic bubble in the Western world in history that wasn't resolved by a massive debt default and a subsequent decline in prices (one much larger than the price decline we saw from 2007 - present). This suggests that prices will inevitably crash the moment that government support ends and all of this effort will be for naught.

There is also the ethical element in all of this. I find it offensive that the government expects me to acquiesce to the use of my tax dollars for these foreclosure-support programs. In essence, they're saying that I should pay in order to support the poor-investment decisions of others (which in many cases was the result of nothing other than ignorance and laziness) and that I should pay to price myself out of the housing market (because my tax dollars are being used to bolster and prop up artificially high prices that are now unaffordable to me) and this is justified because I made the prudent decision of not buying real estate during the housing bubble. It's nothing but a straight slap in the face. It's called "socializing the losses while privatizing the profits."

Of course, President Obama isn't enacting these policies because he actually cares about individuals who were foreclosed upon or because he wants to screw people like me over. He's just trying to save his friends and donors on Wall Street. Many of the major national banks still have "toxic assets" on their books (a.k.a. significantly devalued investments) and they need to keep asset prices high so that these banks don't become insolvent. If prices reset to their "real" level (i.e. sustainable in the long-term and justified by supply-and-demand) you'd see a lot of major banks go belly-up.

Shale — July 29, 2011

You know, people of colour are complex multifaceted human beings, just like white people. Just because something disproportionately impacts them, doesn't mean that it is because they are black. Yes, racism is rampant in America, but sometimes there are things that happen to poor people---or less educated people, or people that live in the city, or people that have a history of crime or unemployment, etc... I wonder what the stats for white folk would look like if we only looked at those of similar socio-economic standing as the black folk. Calling everything racist glosses over the causal processes that determine these sorts of injustice and is a disservice to everyone.

Employment unequal « Family Inequality — August 1, 2011

[...] — how many people have jobs? By that measure, the news is flat-to-down without letup. The Black-White discrepancy in the trends is [...]

Ellie — August 4, 2011

Where are the Asian Americans?

Relevant Readings: Economics | Occupy Baltimore The People's Library — December 17, 2011

[...] http://thesocietypages.org/socimages/2011/07/29/a-recession-for-white-americans-a-depression-for-bla... [...]