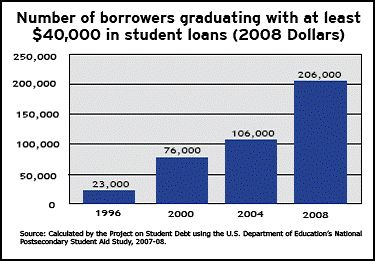

Data from The Institute for College Access and Success shows that the number of students who graduate with at least $40,000 in student loans increased nine-fold between 1996 and 2008.

Sally Raskoff at Everyday Sociologyoffers some explanations for the data: (1) College has been getting more expensive; among other reasons, states cut education budgets. (2) For-profit colleges have also become a larger proportion of all colleges and students in these colleges are more likely to take out loans. (3) Given a bad economy, students are less likely to have jobs while in school. Other explanations? Stories?

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 26

Anonymous — May 23, 2010

Parents may be unable (or unwilling) to help pay tuition or room & board (as a consequence of the bad economy).

archdiva — May 23, 2010

I've worked in private (read: expensive) institutions of higher education since 1996 (not including graduate school before that) and I tink all the above-named factors play into the equation.

During the same time period, I've also seen an uptrend in the general expectation that college will cost this much -- despite the fact that there are many. many options for lower cost options all across the country. The media screams about the $250K+ cost of higher education, which really only applies to the most elite institutions, yet has become the norm in our psyche. Yet if people expect to pay $250K+ for a college education, they will also expect to have to finance some portion of that with loans.

Perhaps also factoring into it is our credit-limit-be-damned attitude about debt in the last couple decades. People are more and more willing to go into debt for the things they think they need, whether they truly need them or not. yes, I think people greatly benefit from higher education. That doesn't mean it has to be from Harvard, Yale or Princeton...or that an elite institution is even the best fit for their needs. That might play into this as well.

There has also been an increasingly competitive application market -- students can now use the online Common Application to apply to dozens of colleges, which simply didn't exist in 1996. While fit with the institution may be a big determining factor of where one goes for college, so is the size of the financial aid package -- which includes an ever-increasing demand for loans. Cross reference this with the expectation of how much it's going to cost.

And let's not forget the emergence of the helicopter parent who is willing to sacrifice all for Darling Child to attend Elite Institution. I'm sure that factors in there somewhere.

As usual...it's complex!

thewhatifgirl — May 23, 2010

In my case, my undergrad career took two years longer because I was also struggling to work two jobs in order to earn enough money to feed, clothe, and house myself and my husband (he worked too), plus pay on his college debts. I had to borrow money for books and sometimes to help pay rent. With the cost of tuition going up every semester, that meant more money owed than if I hadn't taken so long. It was a big catch-22, too, that once I was forced to go below full-time coursework in order to keep up with my jobs, I couldn't get the small academic scholarship that I was getting before because they only give it to full-time students.

E — May 23, 2010

I am interested in this statement, "For-profit colleges have also become a larger proportion of all colleges and students in these colleges are more likely to take out loans."

Have the overall number of colleges changed that much? In fact the only change that I can see in regards to that is the proliferation of on-line colleges. If that is the case, and they are responsible for that many more loans, that is really scary considering the fact people with those degrees can't compete well with people degrees from traditional colleges.

I often wonder if those colleges are just praying on people who have a tough time getting into, or having the time for traditional schools. They help students take out loans, and the retention rates are so low that they often end up paying loans for either no degree or a degree that is worth a whole lot less.

E — May 23, 2010

I also have a hard time thinking the current economy has a lot to do with. While many people may have gone back to school when the current economic crisis hit in 2008, they most likely didn't start back until 2009. They also probably haven't had the chance to amass 40,000 in debt in less than a year.

archdiva — May 23, 2010

To E's point about the overall number of schools...the number is higher when you take into accout all kinds of institutions of higher ed (IHEs) - but even traditional bricks and morter schools include 4 year privates and publics, 2 year feeder and community colleges and now on-line ans for-profit schools (like Univ of Phoenix). It totals around 4000 in the US.

Note that many online schools are connected to accredited bricks and morter schools so are not diploma mills out to sucker people. They are simply responding to the changing needs of today's student.

In all of this, I think it's important to keep in mind that of the 18 million or so college students today, the majority are returning adult students commuting to campus, not traditionally aged 18 year olds going straight from high school into a 4 year residential college. That influences the loan situation greatly and may not involve parents at all.

NL — May 23, 2010

Perhaps more people in general are attending college? When I started college at 18 in 2001, my dad had just died and my mom could only send me a little bit to help out. (Eventually, she became more and more ill and wound up borrowing money from me.) I had a variety of scholarships, I worked 2-3 jobs, and I still had to take out loans.

I think in the past, someone in my position -- young female with a sick parent -- wouldn't have gone to school, or would have started much later. My family didn't have a lot to begin with, and Dad's death, obviously, caused a lot of problems.

Even among 18-year-olds, we are seeing more and more non-traditional students: students from disadvantaged backgrounds, with illnesses, caring for family members.

Anonymous — May 23, 2010

I was wondering, too, whether the total number of people progressing on to college after high school has increased significantly.

archdiva — May 23, 2010

I do believe the overall number of students enrolled *has* increased, but I can't quote you numbers without doing some digging. Though a better number to look at is how many completed their degrees since enrollment doesn't guarantee graduation.

Some of the increase likely has to do with greater online access and the flexibility of community and other 2 year schools to develop new degree programs in response to career field shifts. (4 year schools usually aren't quite as nimble in developing new majors.)

A portion of that increased enrollment also likely comes from the fact that campuses are providing more and more services that provide greater opportunities for students to attend who a couple decades ago couldn't -- disabilities services and counseling for those with mental health issues are two that come to mind immediately. Some of this is due to federal legislation and some from consumer demand. And let's add the increase in diagnosis and medication for mental health issues. All of that has allowed students who literally couldn't enroll 20 years ago the ability to get a degree.

Consider also the societal expectation that in order to succeed anymore, you need a college degree. That is pushing more people to seek out education, even if it's a 2 year associate's degree. A few decades ago, you could get by with a high school diploma. Give it a couple more generations and you'll need a master's degree to work on the line at McDonald's. (where's my sarcasm font when I need it?)

antigone — May 23, 2010

It's all about tuition inflation and the lack of any other method but loans to deal with the higher costs. In-state tuition at my local State U is up to $7600 per year for a full-time courseload. And it goes up significantly every year. My husband graduated from the same university 4 years ago and at the time the tuition was only about $5500 per year. You do the math. On top of that, you will probably be spending another $500 per semester on books. So books and tuition alone for four years is almost $40k before taking into account any living expenses. Unless you can live with your parents for free, living expenses will be substantial and it's unlikely that any part time jobs you can get will make much of a dent in that. We also know that grants and scholarships, much less incomes, have not kept up with tuition inflation, which means a larger portion of expenses have to be financed. But naive students are told by everyone that the loans are absolutely necessary to secure their financial future.

Unfortunately not all degrees are equal and even before the recession there were many college graduates who could not find jobs that even required a college education. I know as i was one of them. I finally managed to get a temp clerical job where I was able to make a positive enough impression to get promoted into a job worthy of my abilities. But it wasn't even close to being easy. Yet we're told that the solution to our economic problems is more education. That if more people just got college degrees, they could get better paying jobs and all our economic problems will be solved. Meanwhile, median real incomes have been stagnant since the 1970s, even as more and more people are going to college and taking on HUGE levels of non-dischargable debt to do so.

Anonymous — May 23, 2010

Wow, I'm one of 200,000. Don't I feel special.

In my case, it comes of going back to college, and then on to grad school, as a non-traditional first generation college student while raising four kids. Don't ask how I'm going to pay it back, since no one will hire me. I did the "right thing" and got my education, and now I'm screwed for life. Nice story, eh?

College Admin. — May 23, 2010

Increase in enrollment causes 1:1 increase in such students.

Colleges are increasingly willing to enroll anyone--even large numbers of underprepared students who will take longer to graduate, if they graduate at all.

Some colleges admit without regard to institutional fit. My college loses 25-33% of each freshman class when they realize they're at the wrong school. $40k wasted.

b — May 23, 2010

Other possible factors:

- A greater percentage of the population is going to college, and most of that increase is from the lower economic classes, who need more loans.

- Financial aid has gotten easier to obtain for many (not all) students, which both leads to more people who couldn't afford it without loans going to college and also, to some extent, allows colleges to continue raising tuition at insane rates without feeling guilty about it or losing good students.

archdiva — May 23, 2010

I think if you ask any college administrator if they WANT to raise tuition or how they feel about doing so, they will say it's not something they want to do but must do in order to stay in business. Colleges lose good students all the time because of a wide variety of factors, only one of which is money.

But remember that tuition is not the sole funding source for a college/university. We get grants, research dollars, large and small monetary donations, in-kind donations and more. We maintain endowments which fund a tiny percentage of our operating expenses (ideally, around 5-6%), but which are designed to last decades and decades to keep the institution going for the long term. Many of those funding sources are tied directly to the economy and other unpredictable sources...which means some cost increases will always get passed along to students in the form of tuition hikes.

I always encourage people to think about a college or university not as a school, but as a small city with the costs associated with maintaining the infrastructure of that city. Yes, it's a (highly complex) school first. But then we have our own police/security force, parking issues, retail space, health and counseling services (sometimes the size of a small hospital), food service, residential living areas, fitness & recreation facilities, athletic teams and facilities, heating/cooling plants, student clubs & organizations, religious venues, streets and sidewalks, etc. etc. etc.

And this isn't even to mention the faculty and staff who run the place. As in any organization, people are always your single largest expense. And to attract quality employees who support student learning, it takes money.

I don't like that tuition has to go up -- didn't as a student and don't as a mid-level college administrator. But it's that or we start hacking away at academic programs and campus services and firing people to keep tuition down.

victoria — May 24, 2010

One thing I've noticed is an ever increasing amount of general requirements or core curriculum classes, making it difficult to get in both the general courses plus the required courses for a student's major. Then add in trying to schedule all of the courses, especially somewhere like California's state colleges where budget cuts are leading to fewer sections of many courses, and students aren't able to work out a schedule in which they can manage to take all the required classes to finish on time. A four year degree that ends up taking five years to complete means extra loans and expenses while not necessarily being able to find work that can meet those costs until one graduates (and even then it's hard to say what kind of work can be found).

lucy0189 — May 25, 2010

Let me see... What factors have contributed to my massive and ever-expanding student loan debt?

1) Lack of financial support from family. I've finished undergrad and completed one third of my graduate education, and in that whole time, I've gotten zip from my parents. Although as an undergraduate the FAFSA refused to believe this, so to make up for the "expected family contribution" I ended up having to take out private loans to cover things like rent.

2) Lack of time to work more than 10-15 hours a week. Any scholarships I did get usually had a minimum enrollment of 15 credit hours per semester. When you are taking intro level classes and liberal education requirements, this isn't a lot, but once you are in more advanced courses it can consume your life.

3) I'm attending a state college, in a state where I am a resident. In the field of study I am in, which is not a commonly offered program, it is absolutely the least expensive option (vs. out-of-state or Ivy League). But tuition has gone up every year, and this year I realized pretty quickly that it is the graduate students that really get shit on in that arena.

In the last five years, my education has cost about $130,000, for tuition, fees, books and materials, rent and living expenses, health insurance, etc. Not all of it was financed through loans.

But if you are not amazing at some popular sport, you don't have a family that can afford to give you $25k a year, but you actually want to GO to school, and FINISH, instead of spending your life putting quarters in a college fund jar, what exactly are you supposed to do? Plenty of people "take a year off" to save up for school and never get around to going, or work full-time while in school to try to pay the bills and end up flunking out. I didn't want that to happen to me and now I have the debt to show for it.

Bankers Are Still Wrecking Housing Market Fundamentals « Reality Check — April 29, 2012

[...] families, normally the quintessential first time buyers. By 2008, over 200,000 young people had over $40,000 in student debt each, and given the explosive growth in debt, many more have that much now. In [...]

Lillian Ritter — March 19, 2020

Great article!

YaMal1 — March 16, 2025

Managing student loan debt feels impossible sometimes, especially when it starts affecting your credit. I wanted to check my credit report and make sure everything was accurate, so I went through Experian. Noticed an old loan still showing as unpaid even though I had finished paying it off. Had to reach out to experian customer service to dispute it. It took some time, but they finally updated my report. Keeping up with credit is stressful enough—errors like this just make it even harder!