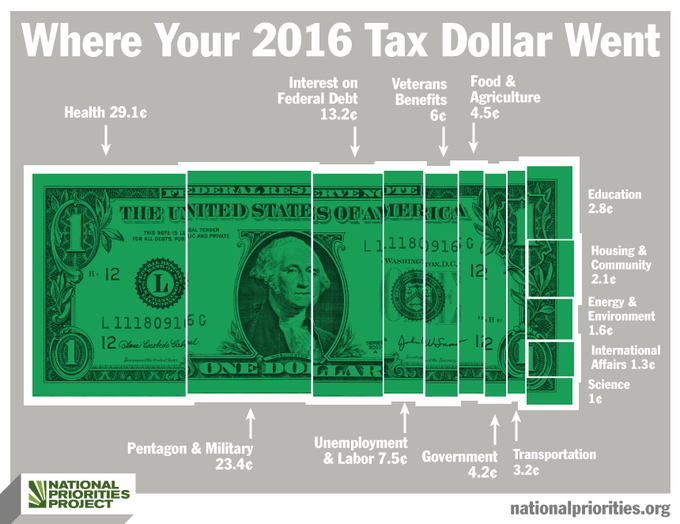

More than 80% of the US federal government’s budget comes from payroll and income taxes. The National Priorities Project is dedicated to helping Americans understand how that money is spent. Here’s the data for 2016:

The highest individual income “top” tax rate in history was 94%; that was the rate at which any income above 200,000 was taxed in 1945, equivalent to almost 2.8 million today. Today it’s 39.6%. The Nobel laureate Peter Diamond and economist Emmanuel Saez argue that the top tax rate should optimally be 73%.

Last year corporate taxes made up only about 11% of the federal government’s revenue; this is down from a historic high of almost 40% in 1943. This is partly because of a low tax rate of 35% and partly because of legal loopholes. According to the Project’s 7 Tax Facts for 2017, 100 of the 258 most profitable Fortune 500 companies paid zero in taxes for at least one of the last eight years. General Electric, Priceline, and PG&E haven’t paid a penny in taxes for almost a decade.

Visit the National Priorities Project here and find out how each state benefits from federal tax dollars or fiddle around with how you would organize American priorities.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments