- Types of Taxes as a Percent of GDP (1937-2014)

- Historical Comparison of Top Tax Brackets (1945-2010)

- Tax Receipt for 2009

- Tax Dollars and War

- “Donation” and “Welfare” States

- Where Did Your 2009, 2013, and 2014 Taxes Go?

Some History

The Winners and the Losers

- Politics, Discourse, and the Real Tax Rate on the Rich and the Poor

- Recent Trends in US Income Inequality and the Tax Rate (1990-2010)

- Social Class and the Tax Burden

- Corporate Tricks of the Trade

- Mitt Romney and the 47% Meme

- How the Wealthy Design the Tax Code to Suit Themselves

- The Case for Raising Taxes

- Apple’s Tax Bill Rising Much Slower than Its Profits

- Who Benefited from the Bush Tax Cuts?

Tax Cultures

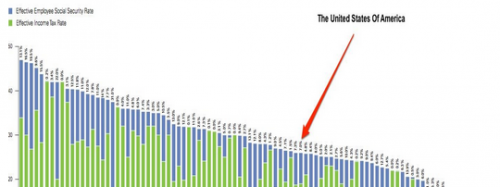

- U.S. Tax Rates in Comparative Perspective (pictured)

- Income Tax as a Patriotic Duty

- Collecting Taxes in Pakistan

- Danish vs. American Attitudes Towards Taxes

- TurboTax Maps Out a (Conventional) Future

Comments 1

Elizabeth Barnett — June 17, 2021

Taxes are the main source for the country to run its economy. Its the right of every person to give their taxes according to law. The Paper Writing Pro provide many assignment to the economics students about the taxes. They can also calculate your tax according to your income. Many student getting their help. I also pay my tax every year. So we all should encourage the peoples to give the taxes.