- Types of Taxes as a Percent of GDP (1937-2014)

- Historical Comparison of Top Tax Brackets (1945-2010)

- Tax Receipt for 2009

- Tax Dollars and War

- “Donation” and “Welfare” States

- Where Did Your 2013 Taxes Go?

Some History

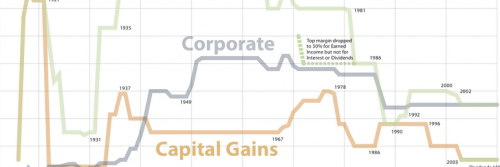

- Fluctuations in Top Tax Rates: 1910 to Today

- Raising Top Tax Rates Does Not Harm the Economy (pictured)

The Winners and the Losers

- Politics, Discourse, and the Real Tax Rate on the Rich and the Poor

- Recent Trends in US Income Inequality and the Tax Rate (1990-2010)

- Social Class and the Tax Burden

- Corporate Tricks of the Trade

- Mitt Romney and the 47% Meme

- How the Wealthy Design the Tax Code to Suit Themselves

- The Case for Raising Taxes

- Apple’s Tax Bill Rising Much Slower than Its Profits

- Who Benefited from the Bush Tax Cuts?

Tax Cultures

- U.S. Tax Rates in Comparative Perspective

- Income Tax as a Patriotic Duty

- Collecting Taxes in Pakistan

- Danish vs. American Attitudes Towards Taxes

- TurboTax Maps Out a (Conventional) Future

Comments 1

From Our Archives: Taxes | WalletAds — April 17, 2015

[…] Read More at Thesocietypages […]