Cross-posted at PolicyMic.

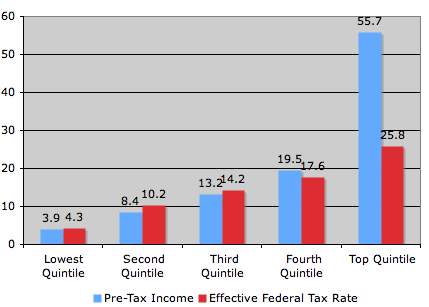

I recently came across two really fascinating figures. The United States has a system of “progressive taxation.” This means that the richer you are, the more you pay in taxes. This first figure, found at The American Prospect, shows the percentage of total income earned by Americans (split up into quintiles) and the tax rates for each group. The poorest quintile, then, pays 4.3 percent of their income to the government, but only makes 3.9 percent of all income dollars each year. In contrast, the richest quintile brings home 55.7 percent of all income dollars each year, and pays 25.9 percent of that in taxes.

Ezra Klein writes:

When you look at percentage of total tax liabilities, the rich do in fact bear a heavier burden. But it’s because they have so much more money. They are not bearing a heavier burden as a percentage of their incomes. They’re bearing it in relation to everyone else’s incomes… People hear that the top 20 percent pay almost 70 percent of the country’s income taxes and nod their head. That’s unfair! But it mainly seems unfair because people don’t know the top 20 percent accounts for almost 60 percent of the national income.

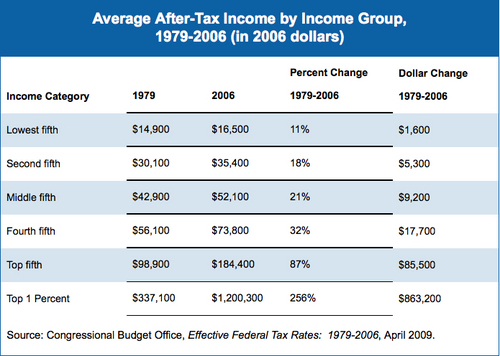

This second figure (from Matthew Yglesias via Thick Culture) illustrates increasing income inequality. It compares the average after-tax income for each quintile, and then the top 1 percent, in 1979 and 2006. During that time, the poorest fifth saw their incomes increase 11 percent, the middle fifth saw their income increase by 21 percent, and the richest fifth saw their income increase by 87 percent. Check out the percent increase for the top one percent!

(For more great illustrations of income inequality in the U.S., see here, here, and here; for a comparison of income inequality in the U.S. and elsewhere, see here.)

What does fair look like?

Is this kind of income inequality fair? Is it fair to take a higher proportion of taxes from richer people? Should we be taking even more from the rich? Should we be taking less from any group?

Does it matter where the money is going? I have to admit, I was feeling a little crappy about taxes when we were spending billions of dollars on war, but now that we need to kick start the economy and deal with our debt, I feel fine about them.

Has the economic crisis affected your opinions on (progressive) taxation? How?

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 20

Duran — April 19, 2009

This is an interesting post.

First off, I'll state that I'm not wealthy by American standards, but I'm definitely in an upper tax bracket. So in questions of taxation, I have "skin in the game" in that I regularly see >40% of my income go to federal taxes.

Anyway, I don't feel bad at all about asking richer people to shoulder more of the tax burden. Taxes pay to keep our society running, and an inherent aspect of our society is that it's pretty damn good at giving people chances to make a boatload of money. Our society rewards hard work, entrepreneurialism, and risk taking -- and not just culturally, but financially and legally. These are the very values that cause most wealthy people to be able to make and enjoy the kind of wealth they do.

So, from that perspective, I am fully behind a progressive tax system, that can support these core values in our society while still allowing the wealthy to reap the benefits of their wealth.

At the same time, we have to be extremely careful not to set up a system that financially rewards poor choices or lack of contribution. I'm not going to get into a debate over entitlements, but I think we can all agree that humans are creative creatures, and will exploit any system that's exploitable. And we have to be careful not to set up adverse incentives.

The one problem I do have with progressive taxation is that it's very, very easy to spiral out of control. When the majority of the people (non-wealthy) can vote up taxes for minority (the wealthy), that's something we have to keep an eye on. I don't like that it's so easy for the federal government to raise taxes - it should be really freaking hard, and it should also be hard to increase spending. I don't subscribe to the opinion that the feds are good stewards of our tax money (I worked for the federal government WAY too long to continue to hold that view from my youthful naivete), and I want them to have as little as possible while still having enough to protect the core values of our society.

BTW, this is semi-related, but I had a revelation a couple weeks ago...I was getting kind of pissed because I read an article about a family below the poverty line who was getting state welfare assistance. The family had 2 cars, a TV, washer/dryer, dishwasher, internet access, etc. I was wondering how that kind of life, with in home broadband, can be considered "poverty". But after a while, it dawned on me that it really is almost a minimum standard of living to fully engage in and participate in this society. For instance, if you lose your job...how the hell are you going to find a new one w/o the internet?

Matt K — April 19, 2009

Duran, very rarely do we see that the poor (the majority, relatively) "soak" the rich by taxing them highly. I'm sure a Marxist would have something to say about this -- something like the poor have internalized the values of the powerful (that hard work is rewarded and that high taxes are bad) so they do not vote for policies which are in their best interest.

Chris L — April 19, 2009

I don't live in the states, so I guess it doesn't apply much, but I've got little problem with soaking the rich. Even looking at the 1979 figures on that chart, we've got the lowest fifth earning $14,900 a year, and $337,100 in the top percentile: more than 22 times as much. What purpose is served by any individual having that much money? Especially if the lowest 5th can somehow survive on that limited income?

Carla — April 19, 2009

Chris -

Without people who are very wealthy, you don't get private investment, which is the backbone of an economy. $300,000+ isn't even THAT much money, really.

People become rich because of talent, ability and intelligence. People tend to forget that. The idea that we should take even more money from the wealthy to subsidize the lives of the unsucessful is not only stupid; its bad economics.

chuk — April 19, 2009

Carla, people make 100, 000$ because of "talent, ability and intelligence"; people make 300, 000 or more because they have figured out how to manipulate the system (whatever that entails). Please, don't make me explain to you how that sort of behaviour f*cks up economies.

We need to completely recast how we talk about taxes in western societies. We need to talk about who uses infrastructure the most, rather than simply who pays into it and how much. You can't make a shit ton of money without benefiting from a hell of a lot of resources, a lot of that public infrastructure (Duran goes there a bit). This will be the beginning of public discussions about profits and externalities.

And done.

Jesse — April 19, 2009

That first graph is terrible. What's the point of comparing the blue and red bars? One number reflects the % of income, and the other reflects the tax rate. The graph makes it seem that the two bars should be the same height, and that the top quintile is unusual in this regard, but that's mostly a coincidence: if we combine all the quintiles, the blue bar would be at 100%, but the red bar should not be anywhere close to 100%.

Jesse — April 19, 2009

I mean, when Ezra Klein writes "They are not bearing a heavier burden as a percentage of their incomes" he is simply reading that stupid graph wrong -- the rich are paying a higher percentage of their incomes. Not that much higher, but clearly higher.

People who say things like "The top 1% pay X% of the taxes" drive me nuts, because the main reason X is so high is because the top 1%'s share of income is so incredibly high. But man, that graph sucks.

Carla — April 19, 2009

Chuk,

Way to pull statistics entirely out of your ass. Someone making 100k is OK, but someone making 300k is exploiting the system? Please. I'd love to hear your explanation for how that "fucks up economies." I have my MA (working on a PhD) in econ, so I'd LOVE to hear your explanation.

Amy — April 20, 2009

Carla! I do not believe you are telling the truth about MA, PhD in econ and btw it's called an MBA...

In case you have been living in a cave this past year...read the news and you will have realize that private investment and the "talented" hedge fund and all of that are the MAJOR cause of this shithole we are in right now. Perharps you should read this book to help you with your fake MA/PhD in econ "House of Cards: A Tale of Hubris and Wretched Excess on Wall Street by William D. Cohan"

George — April 20, 2009

(I was going to respond, but Amy beat me to it, it seems. Oh well, I will go anyway):

Carla says: "People become rich because of talent, ability and intelligence."

Carla's not wrong here, but her comment seems to imply that this is always a good thing, which it isn't. (One example: The "talented and intelligent" banks that promoted sub-prime loans to the point of lying)

Plus, the same can be said for a (money) counterfeiter, but does that mean that their devaluing the currency is helping people? And what about when a meatpacking corporation threatens to outsource it's jobs if it doesn't receive frivolous government subsidies? It does take "talent, ability and intelligence" to counterfeit money, make poop look like gold and blackmail the government, but that doesn't mean that it doesn't end in moderate to huge financial loss on the peoples'/government's part.

Carla also says: "The idea that we should take even more money from the wealthy to subsidize the lives of the unsucessful is not only stupid; its bad economics."

I'll agree with you when the financial black hole called the US auto industry gives us ALL our money back and the CEOs and Board of Directors fund the ailing industries (that made them so rich) instead. I support that kind of private investment.

But if you're talking about the rich people that invested and saved their money wisely, I have nothing against them at all.

chuk — April 20, 2009

Sorry Carla, my tone was pretty lousy last night, I'm normally more diplomatic. First off, "talent, ability and intelligence," don't necessarily correlate with wealth. The fact that most entry level high paying position require massive human capital investments well beyond the means of most Americans already has you trumped on that front (this ignores all the less obvious, some of which non-monetary, factors that precede even having a shot at getting into a school you can't afford to go to.)

You're right Carla, I did pull the difference between 100,000$ and 300,000$ out of my ass. I realized after I wrote it that there would be some grey area between them. Somewhere there is some clever individual that played by the rules and made a shit ton of money. We should ask ourselves though, do resourceful mill workers, carpenters, and nurses, even the most able and talented among them, make 300,000$ a year. No. Doctors and lawyers, however, can expect those kinds of salaries.

The question is really one of who gets to be a price setter rather than taker, and how and why. This is very similar to the problem of how corporations maintain monopolies. This never begins and ends with a market--in fact, these forces undermine the smooth operation of markets, and all of the superficial microeconomics 101 deductions that follow from it--like the one that you expound above. This is very important to things like public policy, because the a priori econometric argument for the efficiency of markets to regulate themselves is also trumped--as we have seen, in reality, in the past few months.

Anyways...

Cecil — April 20, 2009

Those who become incredibly successful do so because of the plethora of opportunities they had when they were young learning minds. Those without the resources do not have the OPPORTUNITIES to take private lessons, get tutoring help, have the time to participate in extracurriculars, or even afford a good college etc. Without these sorts of opportunities, you are not eligible to move up the social class ladder.

It is not hard work, I would argue, that make people incredibly successful, but the luck they had to be born into a family that could provide them with the opportunities to learn how to be successful and explore talents that they have.

Matt — April 20, 2009

Seconding Jesse - that graph is godawful, just as bad as saying that the top 20 percent pay 70 percent of the country's taxes. The most sensible (to me) graph would show average income vs. average taxes paid.

I suspect that the poor not soaking the rich on taxes has very little to do with internalized values and much more to do with relative political power.

How much people make is a mixture of talent, intelligence, ability, ambition, upbringing, education, connections, the market they're in and the way the government has structured that market, and luck. Some people are talented and make a lot of money because of it; some people are talented at capturing the government and making a lot of money because of it; some people are talented but go into low-demand fields.

And Amy: WTF is up with that ad hominem? There most certainly are MAs and PhDs in economics.

Lauren — April 21, 2009

I would like to know how come everyone assumes that wealth is always desired if possible. I know that with my qualifications I could get a better paid job than I currently have but I choose not to because my type of work, and who I work for, is important to me. I am no less successful because of this, just poorer. Success and wealth are not synonymous.

Aaron W. — April 21, 2009

"People become rich because of talent, ability and intelligence. People tend to forget that. The idea that we should take even more money from the wealthy to subsidize the lives of the unsucessful is not only stupid; its bad economics."

You and I obviously have a fundamental misunderstanding of the world. It's the Social Darwinist theory if people are poor, it's their fault for not working hard enough or being intelligent enough, etc. And conversely, that rich people are those being rewarded for hard work and intelligence.

I take this very personally. My family was poor for generations back. To say that my grandfather was poor because he didn't work hard enough or wasn't intelligent enough is a personal insult. He worked all his life and would have died penniless if it hadn't been for the United Mine Workers.

Are things really so different now? Maybe you don't see the real lives of poor people because it's not a part of your reality. I know people who work two jobs AND go to college, but can't get ahead in the world because two jobs doesn't bring in much income at minimum wage, and a two-year degree in any field is barely even a foot in the door.

Rich and poor has much more to do with how you are born, not who you are. I was lucky enough to be born into the middle class, go to a good high school and go to a private college thanks to big scholarships. Now, my four-year degree isn't worth the paper it's printed on; I'll be burning it for heat next winter.

If you take a hard look at America, you will see a lot of "intelligent, hard-working" poor people and a lot of rich people with neither characteristic. I can't say that there's no correlation between intelligence or dedication and income; I'm just saying that it's not as strong as you think it is, and it's particularly skewed among certain groups.

No one wants to admit that they're rich because they were lucky. Social Darwinism makes people feel okay to be rich. So they're less inclined to give up their money to the "undeserving." If we could realize that we're all in the same boat and that there's a lot of luck involved in achieving the American Dream, it would be easier to adopt a more progressive tax system.

If you really think that most poor people are unintelligent or lazy, I challenge you to seek them out. Prove me wrong.

Chris — April 22, 2009

Not to put too fine a point on it, but a progressive tax system that discriminately makes the wealthy pay a higher percentage of taxation than the rest of nation's citizens is inherently unconstitutional, especially considering each citizen is inherently an equal stakeholder in the experiment of America. By all means, change the constitution to suit one's own ideas of socio-economic justice and equality, but in its current form our tax code is unconstitutional... as are many government departments and programs that we currently have...

I guess ignoring the laws we set out to guide our country is the "in" thing these days...

Village Idiot — April 23, 2009

There is no correlation between intelligence and income. A post (including a graph) illustrating this was posted on this site a while back. There might be a correlation between intelligence and keeping one's income, though.

Emergent Culture - Deconstructing the Biblical “Fall of Man”: Insight into the Source of our Ancient and Modern Misery — April 28, 2009

[...] SOCIAL CLASS AND THE TAX BURDEN Sociological Images I recently came across two really fascinating figures. The United States has a system of “progressive taxation.” This means that the richer you are, the more you pay in taxes. This first figure, found at The American Prospect, shows the percentage of total income earned by Americans (split up into quintiles) and the tax rates for each group. The poorest quintile, then, pays 4.3 percent of their income to the government, but only makes 3.9 percent of all income dollars each year. In contrast, the richest quintile brings home 55.7 percent of all income dollars each year, and pays 25.9 percent of that in taxes. [...]

Analiese’s Reading 4/30 | Quiche Moraine — April 30, 2009

[...] Sociological Images [...]

The Rich Get All The Breaks » Sociological Images — November 2, 2009

[...] Also see our post on social class and the tax burden. [...]