In the past week, three different people—a journalist, a former student and the PR director of a non-profit organization—contacted me seeking an expert opinion on investment clubs. This is terrific, but I’m slightly puzzled by this sudden, tightly-clustered burst of attention, because my book on investment clubs, Pop Finance (Princeton University Press) was published last April, meaning that the novelty factor is long gone.

Moreover, my experience—having followed the investment club phenomenon over a decade—was that the interest of both investors and the media waxed during boom times, and waned during economic downturns. Now that the market had well and truly cratered, I expected that popular attention would be focused for some time to come on the periodic clinkety-crash! sounds of skeletons falling out of financial institutions’ closets. From the demise of Bear Stearns through the collapse of Bernie Madoff’s Ponzi scheme, the noise has been deafening.

As for the fate of investment clubs during the meltdown, I hadn’t heard a thing. But that was the implied question behind all three queries I received, so I’ve been trying to figure it out. One thing that hasn’t changed since I conducted my study is that reliable data on investment clubs are really difficult to find. That’s because, while the term “club” understates the legal and organizational formality of these groups, they are just like book clubs in the sense that there is no one keeping track of how many exist at any given time. While investment clubs are subject to American securities laws and must file state and federal tax returns, just like miniature mutual funds, they can form or disband at will, like more casual hobbyist groups. This provides ample opportunity for erroneous speculation about what investment clubs are doing, as in this recent article from CNN.com.

We probably won’t know the real impact of the crisis on investment clubs until six to 12 months down the road, when the National Association of Investors Corporation (NAIC)—the only national organization to keep track of investment club participation in the United States—releases its 2008 member data. Right now, all we can say for sure is that as of 2007, NAIC (also known as BetterInvesting) claimed 9,500 member clubs. That’s certainly a precipitous drop from its high-water mark of just over 37,000 clubs in 1998, when an estimated 11 percent of the US adult population belonged to an investment club (not necessarily affiliated with NAIC). But it would be premature to conclude that this past Fall’s market crash sounded the death knell for investment clubs as a socio-economic phenomenon. In fact, I can think of three reasons to expect that most existing investment clubs will stay together through the crisis, and that enrollment may even increase.

1. Their 50-year track record

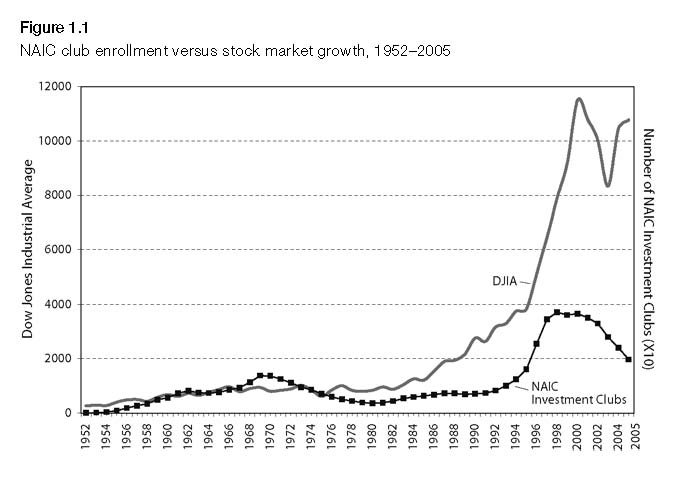

Investment clubs have existed in the United States for over a century, and participation has fluctuated in direct relationship to the market indices ever since NAIC first starting keeping records in 1952. As the chart below—excerpted from Pop Finance—shows, the ups and downs of investment club participation are much less extreme than those of the market. That’s partly because of “centripetal” social forces that act upon groups to maintain their cohesion despite disappointments, including poor performance in their stated task. Sometimes, failure can even increase group cohesion, as with some of the investment clubs I followed in my observational study (see chapters 3, 4 and 5 in Pop Finance; for a really extreme illustration of the phenomenon, I recommend the 1956 social psychology classic, When Prophecy Fails).

This means that downturns in the market, and the scarcity of profit-making opportunities, has little relationship to enrollments. Statistically speaking, we would say that the correlation between market indices and investment club enrollments is weaker for market declines than upswings. Optimism seems to dominate among amateur investors, as it often does in the United States generally. Perhaps that’s one reason international news organizations like CNN maintain an interest in investment clubs as a sort of bellweather of Americans’ socio-economic attitudes—like a less-formal version of the Fed’s Survey of Consumer Finance.

So even when the market takes a nosedive, investment clubs hang in there, as they did following the crash of October 1997, near the height of club enrollments nationally. On October 27th of that year, when the Dow Jones Industrial Index experienced its largest single-day point drop to date (550 points), financial pundits and Wall Street professionals crowed that the mini-crash would finally allow the market to shake off all the pesky amateurs who had started buying stocks in the early years of the decade. These amateurs, including investment club members, were expected to do what their parents and grandparents had done in October 1929: sell their stocks and accept that investing was best left to the professionals.

These reports turned out to be greatly exaggerated. In fact, the post-mortem of the 1997 crash revealed that most amateur investors held firm and didn’t sell (which the experts said was the right decision). There was panic selling, but virtually all of it was done by professionals, like fund managers. Unlike investment clubs, which are accountable only to themselves and tax authorities, fund managers have to report their performance to investors at least quarterly; this creates enormous pressure to make ill-considered trades based on short-term motivations—including the overriding fear many finance professionals express of being out of step with their peers. For many fund managers, it’s preferable to wrong in a group than right alone.

Investment clubs don’t experience those quarterly reporting pressures, plus most only meet once a month and have bylaws stating that portfolio transactions can be made only during a regularly-scheduled meeting with a quorum of members present. That rule creates a formidable structural barrier to quick trades, including panic selling. So while economic downturns may reduce investment club enrollments somewhat, particularly among newly-formed clubs, existing groups tend to remain robust and stable in the face of economic adversity, both because of their structure and because of the social cohesion that often results from long-term group activity.

2) The betrayal of public trust by the finance profession

Investment clubs are, and have always been, premised on the notion of self-reliance. That’s one reason the clubs—which originated in Europe, and were brought over in the waves of immigration that occurred in the late 19th and early 20th centuries—flourished in the United States. There’s a Thoreauvian quality to the whole enterprise that resonates with, and is reinforced by, core values in American cultural life. Walden meets Wall Street, if you will.

In the publications of NAIC/BetterInvesting, the following is repeated with mantra-like regularity: the primary purpose of investment clubs is to educate members, who can then make independent, informed choices with their money. Enthusiasm for this grassroots endeavor springs in part from the failure of formal, institutional sources of investment advice to respond to (or even acknowledge) the needs of the non-rich, non-white and non-male. As the Beardstown Ladies (an NAIC investment club that shot to fame in the 1990s with three back-to-back New York Times bestsellers) explained in their books, their club was formed out of necessity, when many of the women simply could not find a stock broker who would accept their money.

Strange as this may seem to those who don’t remember an era before online banking and brokerage services, once upon a time it was only possible to buy and sell stocks via the services of a licensed stock broker, who advised clients and invested their money in return for a commission. Since brokers made money on their clients’ transactions, they sought out people with lots to invest and a willingness to trade frequently, thus generating more commissions for the broker. Brokers, like sociologists and many others, knew that women on average had much less capital to invest than men, and that women were also more conservative investors: that is, they liked to “buy and hold” stocks rather than trading frequently. In consequence, many brokers practised a form of statistical discrimination, declining to accept any women clients on the basis of the poor-and-conservative stereotype. Several members of the Beardstown Ladies group tried to open their own brokerage accounts during this era, only to be met with a frosty “have your husband come back and talk with me” by the brokers. Similar refusals of service have been reported among people of color, apparently on the same basis: brokers didn’t think non-whites had enough money to make it worthwhile to accept them as clients.

Brokers’ role as gatekeepers of the stock market effectively excluded any but a tiny (white male) elite from investing in the stock market prior to the early 1990s, when defined contribution pension plans (like 401ks) began to proliferate in earnest, and discount brokerages like Charles Schwab Inc. changed the industry’s business model, slashing commissions and minimizing the broker’s role in investing. Both of those factors were catalysts for the sudden explosion in investment club membership in the last decade of the 20th century, providing Americans with a means to invest as independently as they wished.

But until that time, investment clubs were the only means through which the financially-disenfranchised majority could accumulate enough capital and credibility to persuade a stock broker to accept their business. While brokers may have considered any individual woman unworthy of their time, their cost/benefit analysis was quite different when faced with 20 women pooling their money to invest together. Only by forming an investment club were the members of the Beardstown Ladies—and countless others—able to access the securities markets.

Thus, investment clubs have flourished largely in opposition to, or in spite of, business practices in the financial industry. The founding premise of educating members so that they can make their own investment decisions, independent of brokers, has only been reinforced by the ongoing revelations of corruption, self-dealing and incompetence among finance professionals and corporate leaders since the beginning of the new century. As I documented in Pop Finance (see chapter 5 in particular), distrust of market insiders and financial advisers has been on the rise for years. If anything, last autumn’s financial collapse administered the coup de grace to any remaining public confidence.

All the more reason to stay in an investment club, or to join one. As their history in America suggests, investment clubs are precisely the kinds of organizations that thrive when formal institutions are broken or non-existent. It’s the same reason that micro-finance and rotating credit associations flourish in countries with under-developed or dysfunctional economies; the table below, excerpted from Pop Finance, presents a comparison of the two models of “financial self-help.”

As this table suggests, people around the world have similar needs to save, trade and invest, regardless of whether a formal financial sector exists to serve them. When those needs aren’t met by banks and other institutions, we find grassroots collective action arising to fill the gap. If anything, the Third-World-ification of the American economy only solidifies the position of investment clubs as a enduring feature of the socio-financial landscape.

3) Social structural necessity

Most of the social structural conditions that led people to join investment clubs en masse in the 1990s are still very much with us. If anything, those conditions—which include declining real wages, and the shift of risk and responsibility for the provision of retirement wealth from employers and the government to individuals—are intensifying. Americans need to invest because they believe, with good reason, that there is no social safety net to keep them from falling into poverty if they become unable to work, whether through illness, layoffs or old age. Thanks to fear-mongering about the alleged “inefficiency” of Social Security, and its purportedly imminent demise, retirement tops the list of financial anxieties in the US. More than 80 percent of NAIC members say that saving for retirement was their primary motive for joining an investment club.

One of Ronald Reagan’s most enduring achievements was to undermine the notion of public good in America, and to create intense hostility toward and suspicion of government. This provided the cultural and moral authorization to destroy generations’ worth of practices and institutions designed to provide the financial stability and security necessary for people to make long-term plans and prudent decisions—as opposed to the kind of panicked, crisis-driven decision making we see now, with Americans undertaking desperate measures to raise money for medical expenses or to prevent foreclosure on their homes. Even as Barack Obama sets about repairing our social fabric, it will be a long time before these “push” factors diminish significantly. And as long as Americans are economically insecure enough to perceive investing as a survival necessity, investment clubs will thrive.

As part of age-old confusion about correlation and causality, it may have seemed to some observers that the surge in investment club enrollments during the 1990s was driven entirely by rising stock prices. The implication being that people saw money to be made in the stock market, and joined investment clubs to get in on the action. But that may invert the real causal order, or at least obscure the reciprocal causality at work: as increasing numbers of people joined investment clubs (pouring hundreds of millions of dollars into the US stock markets every month), they drove up share prices, which in turn attracted more investment club members, and so on.

In ways I cannot document here without recapitulating large sections of my book, my research indicates that “pull” factors—like the get-rich-quick fantasy, or the status bump attendant upon joining a trendy social movement—had a relatively weak and temporary role in building investment club participation. While there certainly were people who joined clubs because it was “the thing to do” during the mid-1990s, or because they imagined that it was an easy way to make money, they probably are among the thousands who dropped out when the dot.com bubble burst, or Enron imploded, or the options backdating scandal broke…etcetera, ad nauseum. So those 9,500 investment clubs still on the rolls of NAIC/BetterInvesting as of late 2007 are a tenacious bunch, and I expect most of them will stick it out through the current crisis, adding to their numbers if conditions worsen still further.