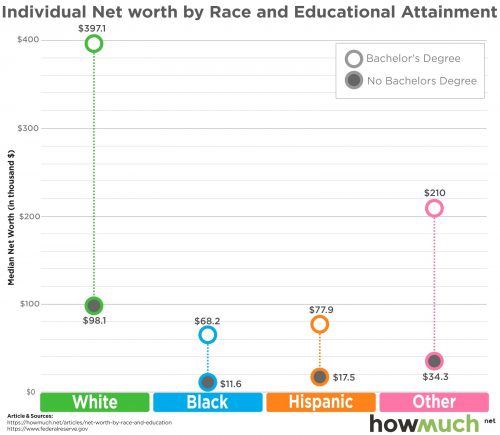

The staff at How Much recently visualized summaries from a Federal Reserve analysis showing how much a college degree can matter for your net worth. It turns out education can really pay…if you’re white.

This illustrates an important sociological point. When we talk about structural inequality, critics often note that we shouldn’t disregard individuals’ efforts to work and earn a better life. Getting a college degree is one of the centerpieces of this argument. These gaps show it’s not that effort doesn’t matter at all, but that inequality in social conditions means those efforts yield wildly different outcomes.

Want to read more on higher education and America’s wealth gap? Check out Tressie McMillan Cottom’s Lower Ed, Thomas Shapiro’s Toxic Inequality, and Dalton Conley’s Being Black, Living in the Red.

Evan Stewart is an assistant professor of sociology at University of Massachusetts Boston. You can follow his work at his website, on Twitter, or on BlueSky.