Cross-posted at Caroline Heldman’s Blog.

On Monday, Mother Jones released a video recorded in May of presidential candidate Mitt Romney speaking at a $50,000-a-plate fundraiser in the Boca Raton home of “private equity party boy” and “sexy party” host, Marc Leder. A hidden camera caught controversial remarks about Israel, Iran, and a joke about being more electable if his parents had been born in Mexico, but the topic of this post is Romney’s use of the 47% Meme.

The 47% Meme is the idea that half of Americans take from rather than contribute to tax coffers. It sometimes surfaces in the form of the “takers vs. makers” frame. I have encountered this “argument” for years on Fox News, so it is surprising to see it gaining national attention now. Romney did a superb job articulating the 47% Meme in response to a question of how he might win in November:

There are 47 percent of the people who will vote for the president no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that’s an entitlement. And the government should give it to them.

Many myths start with a kernel of truth. The 47% Meme is loosely based on the statistic that 47% of Americans pay no income tax (down to 46% in 2011). This meme is wildly dishonest since people pay a host of other federal, state, and local taxes. It’s about as honest as saying a person doesn’t eat vegetables because she only eats carrots, celery, bell peppers, cucumbers, and cabbage, but not broccoli.

So who is paying taxes, and what taxes are they paying?

Federal Income Tax

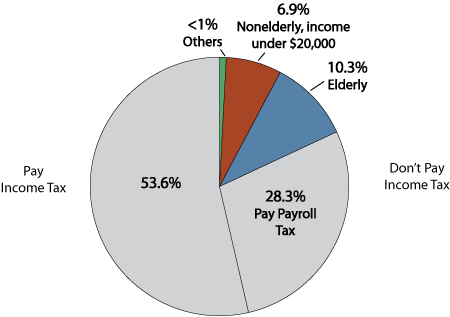

The Tax Policy Center finds that two main groups comprise the 46% who do not pay federal income tax: (1) The poor whose subsistence-level income is not taxable, and (2) those who receive tax expenditures. This chart shows that the lion’s share of tax expenditures goes to senior citizens, children, and the working poor, with the notable exception of 7,000 millionaires who paid no income tax in 2011.

Other Federal Taxes

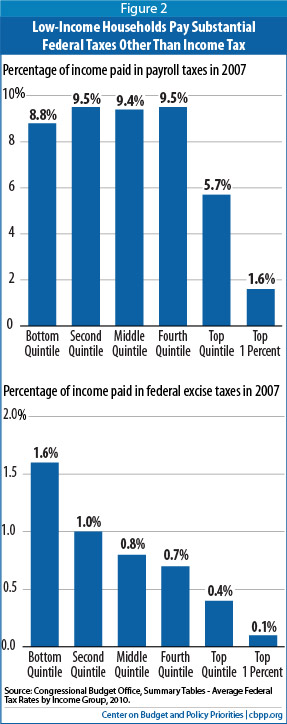

But enough about income tax since this narrow focus only serves to further the misleading 47% Meme. The chart below shows a more accurate picture of who pays federal taxes. If we don’t count retirees, only 8% of Americans pay no income or payroll taxes.

Americans also pay federal excise tax on gas, liquor, cigarettes, airline tickets, and a long list of other products, so virtually every American pays federal taxes in some form. And contrary to the 47% Meme, poor and middle-class Americans actually pay a greater percentage of their income in federal payroll and excise taxes than wealthier Americans.

State and Local Taxes

When it comes to state and local taxes, the Institute on Taxation and Economic Policy finds that the poor pay more in state and local taxes in every state except Vermont. As the chart below indicates, state and local taxes are regressive, meaning that those who can least afford to pay, pay more.

Romney has apologized for the inelegance of his statements, but stands by their substance, despite ample data debunking the dependency (above) and entitlement bases for the 47% Meme. I don’t believe that Romney believes that half of the people in the U.S. are pathetically entitled “victims.” He is a smart person, and this is a ludicrous line of reasoning. But what does it say about our bitterly partisan nation that heaping unmitigated scorn on the poor brings in big bucks from the base?

Comments 57

Umlud — September 19, 2012

Ed Brayton at Dispatches from the Culture Wars also points out that many of the people in Romney's 47% are actually Republicans:

http://freethoughtblogs.com/dispatches/2012/09/19/the-cluelessness-of-romneys-47-percent-statement/

Dianne — September 19, 2012

Yes, there is a lot wrong with the tax code, i dont think anyone would argue with that. However, there are still some people who do not contribute to the common good. They pay no INCOME TAX. They pay other taxes but not income taxes. They do not contribute to the common defense, education, EPA and may other things that society needs. Everyone should have some token amount that they pay for the shared services no matter what their income. Give them offsets for their incometax against other taxes if need be so that ehir total is the same (low) but all should contribute to the common good in some way.

Yannick — September 19, 2012

I'm super confused. What's the difference between an income tax and a payroll tax? Isn't income tax deducted directly at the payroll anyway?

Yrro Simyarin — September 19, 2012

I thought Ezra Pound's posts on the subject were interesting, and come to similar conclusions (although the graphs look significantly different):

http://www.washingtonpost.com/blogs/ezra-klein/wp/2012/09/19/other-countries-dont-have-a-47/http://www.washingtonpost.com/blogs/ezra-klein/wp/2012/09/19/heres-why-the-47-percent-argument-is-an-abuse-of-tax-data/

Overall, it sounds a very similar gaffe to the "bitter clingers" line from Obama last year. Something to get the opposition riled up, but very little change on the election.

Belinda Cech — September 19, 2012

i have to disagree. i believe that Romney wholeheartedly believes every word he said at that fundraiser. he was in a setting with like minded people who paid $50,000 to hear him speak and his comments were off-the-cuff. he felt comfortable enough to put it in such terms without offending anyone there. we've had a glimpse of the real Mitt Romney.

ewindisch — September 19, 2012

Including payroll taxes from 2007 is a bit disingenuous considering there has been a 2% cut in FICA in 2011 and 2012. Not that it bridges the gap entirely, but it helps a bit. Of course, a Romney administration could fail to renew that.

Dianne — September 20, 2012

I agree that many of this so called 47% pay taxes. The rich should pay more taxes. The society has a responsibility to take care of those in need. I have no issue with the old and very poor paying little to no INCOME Taxes. However, Payroll taxes as per the defintions used in this study are only medicare and SS. The Average person gets back all of their SS payments and gets more in medicare support than they ever paid in. That leaves the fact that most people do not pay for many of the things they want, demand or expect. They do not pay into the general fund for the EPA, college loans, education, defense, immigration, HUD, DOL, Justice, national parks, etc... Do we want a society where one set of people can demand that another set of people pay for stuff that they want but dont pay for? That seems like a bad path but lets let the sociologists answer that. I am all for other people paying for good stuff for me. There have been plenty of times when I paid zero in income taxes. I like paying zero. I like the government taking other people's $$ and spending it on me, but I can see how it could cause problems in a society if it isn't addressed.

Red, White & Meme — Matter — Medium — August 13, 2015

[…] we instantly grasp its meaning in context says more about American politics than all the ephemeral campaign memes put together. Our two-party system is so polarized, with each side’s loyalists so convinced […]