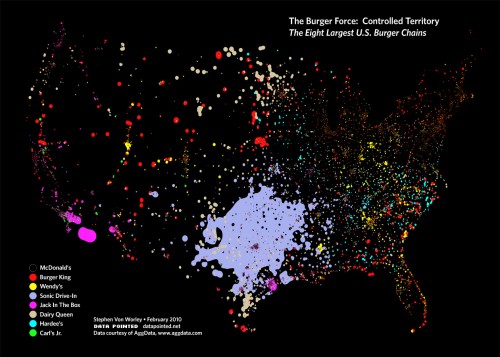

A couple of years ago, Lisa posted about the ubiquity of McDonald’s in the U.S., highlighting a map that showed the distance from the nearest McDonald’s. As a follow-up to that, Data Pointed posted a map that illustrates the unevenness of its market dominance across the country. If we plot the markets dominated by the top 8 hamburger-based chains (in terms of sales), we see that though McDonald’s is the single largest burger chain in most of the U.S. (all the black territory), other chains outsell McDonald’s in many markets, with the Sonic-dominated Southern Plains the most obvious:

In fact, there are relatively few places where McDonald’s has an outright majority of the market share; in most areas, the combined sales of its 7 largest competitors are more than McDonald’s:

This illustrates the importance of the ubiquity shown in the map Lisa originally posted. McDonald’s might like to truly dominate every market; it ideally would probably like to have a monopoly on them. But it doesn’t have to in order to successful and to exert incredible market power. It doesn’t need to control every individual market in order to exert enormous influence on the fast food industry, from setting the standard for labor practices to influencing which varieties of potatoes farmers grow for the french fry market. The “be everywhere” model allows it to win the larger burger chain war, even if it loses some regional market battles.

Comments 10

geoffreyarnold — May 4, 2012

"In fact, there are relatively few places where McDonald’s has an outright majority of the market share"

That's not what I see at all. If you notice, McDonald's is shown as the black areas of the map. Almost the whole map is black, with the exception of the blue "Sonics" spot around Texas. And I find that extremely hard to believe. In what sense does Sonics take more market share than McDonald's in any place on earth? Ive eaten at a Sonics before.

Here is an excerpt from a financial article published just last month:

"McDonald's may soon account for more than half the fast-food hamburgers sold in America for the first time. The Golden Arches, whose menu has spread beyond burgers to include more than 100 items, tacos to oatmeal, on its menu, is gaining market share while Burger King, Wendy's and other chains lose customers.

McDonald's market share rose to 49.5%, its eighth straight annual increase, according to 2010 data from industry consultant Technomic,

Chicago. Burger King fell to 13.3%, down from over 20% in the late

1990s. Wendy's fell to 12.8%, down from a peak of 14.5% in 2005. The

Sonic and Jack in the Box chains were also down."Read more: http://www.philly.com/philly/blogs/inq-phillydeals/McDonalds-crushing-Wendys-Burger-King-all-others.html#ixzz1txoND7cp

PNW Tom — May 6, 2012

My sense is that per-unit sales would be a better measure than market share. And the map is a fun exercise, but a closer look at the article reveals it to be silly, viz.:

In this and the following graphic, each individual restaurant location has equal power. The entity that controls each point casts the most aggregate burger force upon it, as calculated by the inverse-square law – kind of like a chart outlining the gravitational wells of galactic star clusters, but in an alternate, fast food universe.

This is absurd. While Subway, for example, has a lot more outlets than does McD's, their per-unit sales are small. The recent article in the NY Times suggests that McD's per unit sales are about $2.3 million on average (http://www.nytimes.com/2012/05/06/magazine/how-mcdonalds-came-back-bigger-than-ever.html). This number matters more than the inappropriate application of "gravity" to the mere existence of a location.The article this links to also suggests that the other chains are "rebels" in some implied "alliance" against McD's. As it turns out, they are fiercely competitive with each other for market share. No one of these can be expected to have the majority of sales (and, indeed, McD's sells more chicken than beef now, and a lot of coffee, per the NYT article, so "sales" is more than burgers and fries.)

Here's the Times: "Based on 2011 sales data, Technomic estimates that McDonald’s owns nearly 17 percent of the limited-service restaurant industry in the United States. That’s not only the largest share, according to the analysis, but also nearly as much as the next four restaurants in that category combined — Subway, Starbucks, Burger King and Wendy’s."

Nowhere near the 50% level of all "limited service restaurants," but the lion's share. Notice that Sonic doesn't even show up there. There are so many burger and other fast-food joints that expecting a 50% or higher market share is daft.The strategic or foolish manipulation of data, in the form of maps (or, as Tufte calls it, chartjunk) can lead people to make some seriously flawed conclusions. The conclusion: McD's is big, getting bigger, and will be the biggest player in its market.

Timothy Rivera — July 23, 2025

McDonald’s is one of the most popular fast-food chains globally, known for its consistent taste and quick service. There’s a good chance that their lunch menu becomes available at most locations, although the exact lunch hours for mcdonalds can vary depending on the region or individual franchise. Customers often find a wide range of burgers, fries, and combo meals once the lunch period begins. It’s possible that some branches may start a bit earlier or later, especially in busy or rural areas.

Lemota — December 6, 2025

This was an interesting breakdown of how uneven the fast-food landscape actually is. It shows how big chains can dominate certain regions while smaller concepts still manage to build loyal followings. I’ve been exploring more niche burger options lately, especially smashburgers, which feel like a completely different experience compared to the big chains. For anyone curious about Smashburger’s menu and pricing, I’ve been using https://smashburgermenu.com

— it’s just an informational site, but it helps compare what smaller brands offer against the major players mentioned here.

shaei — December 6, 2025

This was an interesting breakdown of how uneven the fast-food landscape really is. It highlights how major chains dominate certain regions while more localized concepts still manage to build strong followings of their own. Lately, I’ve been looking into Southern-style comfort food options, and it’s surprising how different the experience can be when you compare smaller regional brands to the bigger nationwide names.

For anyone who wants a simple overview of Bojangles menu items and pricing, I’ve been using

BojanglesMenus.us — it’s just an informational site, but it makes it easier to compare what regional chains offer versus the major players discussed here.

Interesting read overall.

lisaor — December 6, 2025

This was a really interesting look at how uneven the fast-food market can be. Even with huge chains dominating certain regions, there’s still plenty of space for smaller concepts to stand out. I’ve been more into smashburgers lately since they offer a very different style compared to the big brands. For anyone curious about Smashburger’s menu and pricing, I’ve been checking SmashBurgerMenu.com, which is just an informational site but helpful for comparing options.