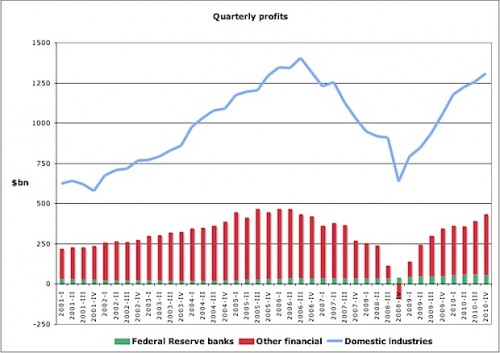

Over at Reuters, Felix Salmon posted a chart I found rather stunning given that we’re hearing new warnings about the dire situation the economy is in and the slow job growth we’re experiencing. Using Bureau of Economic Analysis data, he looked at total U.S. domestic profits, as well as the proportion of all domestic profits earned by the financial sector, between 2001 and the end of 2010. And what we see is that both overall corporate profits, and the finance sector so central to the economic crisis, have bounced back quite well, returning to the levels we saw just before the peak of the boom period:

Now, one caveat here: the data are annualized quarterly figures. That means to get the total profits for the year, you don’t just add them up, as you’d expect — each annualized quarterly data point apparently represents profits for the entire year if the growth rate at that point had continued. If you really care, here’s one explanation of annualizing and why you’d do it. If you want, the BEA website allows you to look at profits annually, instead of quarterly, so you don’t have to worry about it.

Anyway! Point is, it complicates the general perception we might get from news reports that everything in the economy is awful and there are no profits to be made. Ongoing job stagnation and media focus on the negative economic news doesn’t mean all parts of the economy are suffering equally, or that as soon as corporate earnings rebound, the benefits would quickly reach workers in the form of new job opportunities.

Comments 6

Yrro — June 14, 2011

The problem, of course, is that business don't just make money and immediately decide they can afford to hire new people. There has to be an expectation of continued growth, or those additional staff will just get laid off again in six months. Lately it has less been that businesses are actively failing as it has been that they are unsure whether we have actually recovered, or if it's all going to come crashing down again.

Mike — June 14, 2011

Couple things it'd be interesting to see:

The impact of inflation (core, and real) on the profits for this time period.

Some calculation of overhead per employee for the same time period. Minimum wage, health care, etc. have all gone up. This raises the bar on a decision to hire...and it might make you more likely to increase current payroll slightly while squeezing more productivity.

Could the profits be the *result* of high unemployment? If you survive hard times, then actually operate and make a larger profit after layoffs, why hire back?

Oh hey, corporate profits are up, everyone must be doing better, right? « Dead Wild Roses — June 14, 2011

[...] all the doom and gloom being written about the economy, despite a rebound of corporate earnings. Sociological images provides a graph and analysis about the [...]

NG2 Will — June 14, 2011

The profits are the result of sacking workers and suppressing their wages below their labour productivity increase.

Gio Wiederhold — June 15, 2011

You can't look at just look at such data with a US centric view. US domestic corporations report consolidated incomes, including substantial foreign income.

There are two problems:

1. Profits are earnings after taxes, but most foreign-sourced income can escape taxation.

2. When hiring occurs it is likely to happen where it most effective, and where the profits will be better, and that is outside of the U.S.

It is naive to assume that higher income by U.S. corporations will be matched by U.S. job growth.