Donna Bobbitt-Zeher, a sociologist at Ohio State University, set the world a buzz when word got out of her research on the wage gap over a twenty year span:

The good news for women is that during the time period studied, their average salary increased from 78 cents for every male dollar earned to 83 cents. But when Bobbitt-Zeher controlled for various factors, she found that the share of that gap attributable to selection of major had increased…When controlling for all available factors, [she] found that the choice of major explained 19 percent of the income gap between college-educated men and women for the high school class of 1999, nearly twice as much of an impact as could be documented for the class that graduated 20 years earlier. (emphasis mine)

This wasn’t a shock to me as it was something that many of us who work to increase the number of women in science and engineering already suspected. So when Kate Harding from Salon Broadsheet emailed me for a response I wanted to make sure that people know that it’s not just as simple as English versus Chemistry. “Harder,” male-dominated science and engineering fields, such as computer science, are paid more than female-dominated biological sciences, a “softer” science.

The real question that this wage gap research leads us to is whether or not the increase of women in a career leads to lower wages or not. In 2006, Paula England et al appear (I admit, I only read the abstract) to prove that there is no direct correlation between the increase in women entering a field and the lowering of that field’s wages. But a gendered wage gap is there. England showed it and now Bobbitt-Zeher shows it.

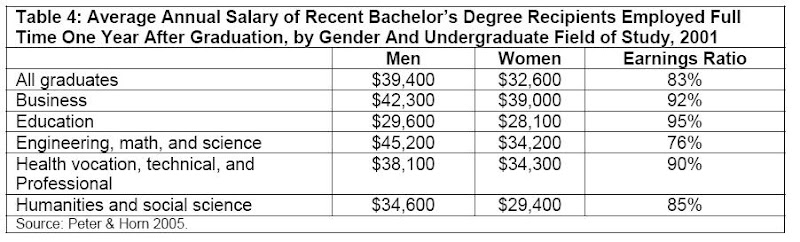

The AAUW also showed this wage gap difference based on major earned 2005 in their “Public Perceptions of the Pay Gap” report, but with a twist:

Ironically, the biggest wage gap is in science and engineering! But even with a 24% gap, women are still earning more than almost any other career field. *shaking head*

So what does this all mean?

There isn’t one reason for the wage gap. We can’t wave it away with one explanation (women’s choices) or correct it with one solution, even comparable work legislation.

For me there is an economic justice reason for women to look to science and engineering for a career. Wage gap or not, they will be earning more money. For women who have a gift for math and science and find joy in the work, go for it. But I would never say do it for the money.

Is it gender? Is it how much society respects the vocation? Is it unionization (teachers have smallest gap)?

Again, further research is needed. But whatever it is, women are getting the short end of the pay stick and all of these numbers are about the average man compared to the average woman. I can only imagine what the gap looks like for people of color!

Well now isn’t this interesting: Just as we learn that the

Well now isn’t this interesting: Just as we learn that the  And more importantly, what can be done?

And more importantly, what can be done? A simply-must-read over at American Prospect,

A simply-must-read over at American Prospect,  Was Wall Street’s crash due, in part, to an overload of testosterone?

Was Wall Street’s crash due, in part, to an overload of testosterone? I am SO late to posting this today, but here goes. Today is (still!) Equal Pay Day. And this morning, the National Women’s Law Center released some new

I am SO late to posting this today, but here goes. Today is (still!) Equal Pay Day. And this morning, the National Women’s Law Center released some new  Travels and graduations behind us, we’re back! This month foremost on our minds is the issue of budget cuts. How many times will history have to repeat itself before we get it right?

Travels and graduations behind us, we’re back! This month foremost on our minds is the issue of budget cuts. How many times will history have to repeat itself before we get it right? Check out this article in the LA Times,

Check out this article in the LA Times,  My latest at Recessionwire.com is now up:

My latest at Recessionwire.com is now up: