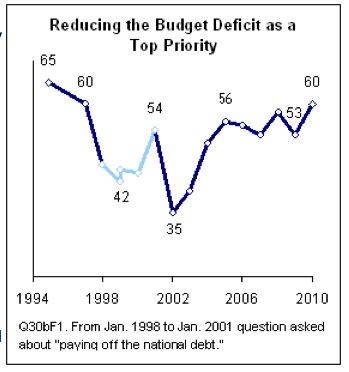

First off, I think there’s little that can be done about the forthcoming yearly deficits and total debt of the US federal government. Reigning in spending at this point will just make a bad situation worse. Nevertheless, what are the implications of the deficit. People have views about it, as Pew Research shows. It is currently #7, in terms of people’s top priorities and for the past two years, both Republicans and Democrats see it as a priority, being within a percentage point of each other. Over the years, the concern has gone up and down::

What I’m not sure is whether or not people get the implications of a huge debt. I remember in macroeconomics being taught about “crowding out”, where government spending and resultant borrowing “crowds out” entities seeking capital in lending markets and drives up interest rates. Now, the Wall Street Journal is singing cassandra’s tune, warning that foreign creditors holding US Treasury securities is a threat to the nation’s national security and Leon Panetta, CIA Director, agrees::

What I’m not sure is whether or not people get the implications of a huge debt. I remember in macroeconomics being taught about “crowding out”, where government spending and resultant borrowing “crowds out” entities seeking capital in lending markets and drives up interest rates. Now, the Wall Street Journal is singing cassandra’s tune, warning that foreign creditors holding US Treasury securities is a threat to the nation’s national security and Leon Panetta, CIA Director, agrees::

I don’t see this happening. Why? I think we’re in for the dollar depreciating, as I see policies on the horizon that will lead to inflation, higher interest rates, and a devalued dollar, as does Jim Jubak at MSN. Holding the dollar won’t have the appeal it once had, given that it’s likely to devalue, and the Chinese are already curbing their appetite for US debt. In any case, this level of debt isn’t a “game over” situation and the US won’t go bankrupt, no matter which “expert” says it on CNN.

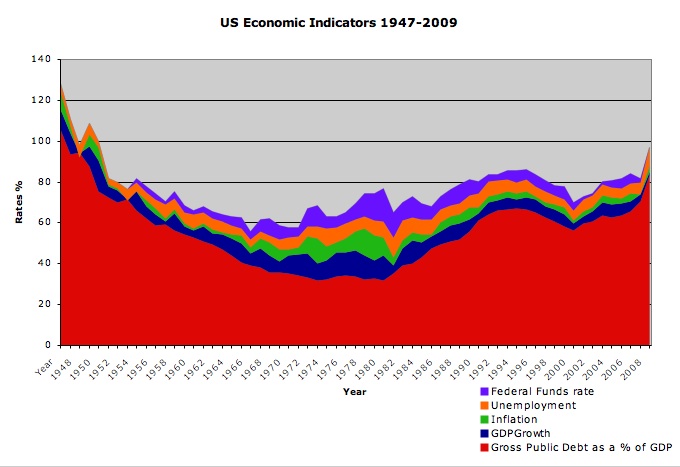

Currently, inflation is practically non-existant, as is nominal GDP {i.e., national income} growth, and interest rates are rock bottom. The inflation and interest rates give the economy some degrees of freedom. A more troubling issue is GDP growth, which might be hindered by structural problems in the economy. We may not “grow” out of this, where economic growth increases incomes and tax revenues. Unemployment is the highest it’s been since 1983 and will be a political hot button issue in 2010.

As for deficit spending and the increasing debt, total public debt as a percentage of GDP {a debt to income ratio} is high, approaching the levels it was in the late 1940s. While the numbers are mind-boggling, the debt isn’t unprecedented.

I’m not staying up at night worrying about the deficit, although there will be several policy implications::

- The true danger of the deficit spending is if there isn’t a multiplier effect, i.e., the impact of a dollar spent is some multiple of that dollar. I’m afraid that spending may not be directed towards projects/endeavours that get the most “bang” for their buck.

- Too much emphasis on the deficit may hamper spending that achieves multiplier effects.

- Read my lips, expect higher taxes in the long haul.

- There will political pressure to reduce unemployment and {in my opinion} spending should focus on this, in ways that achieve a multiplier effect, e.g., jobs that also increase innovativeness and/or productivity or improve infrastructure.

- Expect programme cuts and pressures towards privatization.

- Expect reductions in military spending.

Ideally, deficit spending is an “investment” in the country when there aren’t tax revenues to cover it, as in a recession. The real question shouldn’t be how much is being spent, but how and where it’s being spent.

Twitterversion:: Are you concerned about the US deficit? Blog post focusing on the real implications of running up the bills. @Prof_K

Song:: Hem-“When I Was Drinking”

“Living it up when the rent was due

With nothing and no one to live up to”

Comments 2

jose — February 4, 2010

Nice Analysis Ken! Great to have someone who speaks math among us!

Ralph Musgrave — September 21, 2010

Kenneth: even if there is no multiplier, it doesn’t matter. If a government just prints extra money and spends it, the fact of spending it will increase jobs. Second, the expanding stock of money in household bank accounts will at some point reach the level where households try to get rid of the stuff. I.e. they’ll raise spending to the point where demand rises enough to bring full employment.

Keynes made that point, as did Milton Friedman as did numerous other economists. Unfortunately the dick heads in charge governments nowadays aren’t aware of this piece of basic economics.

The above idea is sometimes called Modern Monetary Theory and sometimes “Functional Finance”.