Every year the National Priorities Project helps Americans understand how the money they paid in federal taxes was spent. Here’s the data for 2014:

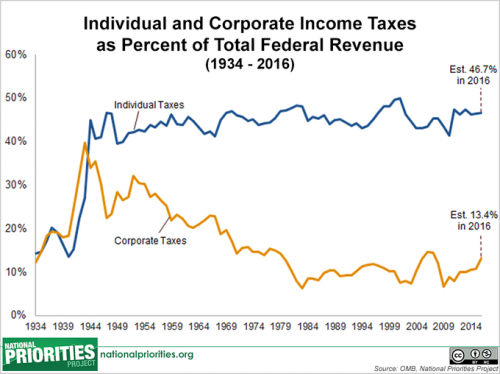

Since the 1940s, individual Americans have paid 40-50% of the federal government’s bills through taxes on income and investment. Another chunk (about 1/3rd today) is paid in the form of payroll taxes for things like social security and medicare. This year, corporate taxes made up only about 11% of the federal government’s revenue; this is way down from a historic high of almost 40% in 1943.

Visit the National Priorities Project here and find out where state tax dollars went, how each state benefits from federal tax dollars, and who gets the biggest tax breaks. Or fiddle around with how you would organize American priorities.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 12

Japaniard — April 16, 2015

That is a terrible graphic. The rectangle for science (1.1) is both too big because it is bigger than the rectangle for transportation (1.9) and too small because it is nowhere near 10x the size of Housing & Community (0.1)

Bill R — April 16, 2015

Hello?

Corporate taxes make up a smaller share of taxes paid because corporate profits combined is a far smaller amount than the cumulative earnings of individuals. It's just the math.

And yes, corporations do take advantage of tax breaks but the big gainers with tax breaks are, again, individuals.

In any event, we ALL pay too much for what we get.

Sam — April 16, 2015

The amount spent on maintaining our oversized military is appalling. The US could save the most by trimming the fat there. And nationalizing the Fed would help with how much we're spending on federal debt interest.

Also, corporate profits are higher than ever, so why is the percentage of corporate tax revenue so low? Worker wages haven't been increasing, at least not faster than the cost of living anyway. The bottom graph makes it pretty clear that as corporations pay less, individuals have to pick up the tab. The budget needs to be trimmed, but taxes on businesses and the wealthy need to be reformed as well.

food for thought: post-marathon edition | Amiable Archivists' Salon — April 22, 2015

[…] do you feel about where your 2014 tax dollars […]

Occidental College Professor Lisa Wade 'Horrified' by Conservative Student Group, Calls Economics Majors "anti-social", More - The Liberty Standard — September 1, 2015

[…] with Guns, or White American men with their weapons and the bloody summer of 2015, or how about Where Americans’ 2014 Tax Dollars Went. This last one should be good, after all she knows so much about […]