When my primary care physician, a wonderful doctor, told me he was retiring, he said, “I just can’t practice medicine anymore the way I want to.” It wasn’t the government or malpractice lawyers. It was the insurance companies.

This was long before Obamacare. It was back when President W was telling us that “America has the best health care system in the world”; back when “the best” meant spending twice as much as other developed countries and getting health outcomes that were no better and by some measures worse. (That’s still true).

Many critics then blamed the insurance companies, whose administrative costs were so much higher than those of public health care, including our own Medicare. Some of that money went to employees whose job it was to increase insurers’ profits by not paying claims. Back then we learned the word “rescission” — finding a pretext for cancelling the coverage of people whose medical bills were too high. Insurance company executives, summoned to Congressional hearings, stood their ground and offered some misleading statistics.

None of the Congressional representatives on the committee asked the execs how much they were getting paid. Maybe they should have.

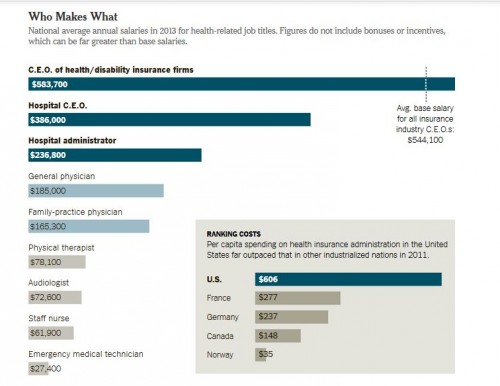

Health care in the U.S. is a $2.7 trillion dollar business, and the New York Times has an article about who’s getting the big bucks. Not the doctors, it turns out. And certainly not the people who have the most contact with sick people — nurses, EMTs, and those further down the chain. Here’s the chart from the article, with an inset showing those administrative costs.

As fine print at the top of the chart says, these are just salaries — walking-around money an exec gets for showing up. The real money is in the options and incentives.

In a deal that is not unusual in the industry, Mark T. Bertolini, the chief executive of Aetna, earned a salary of about $977,000 in 2012 but a total compensation package of over $36 million, the bulk of it from stocks vested and options he exercised that year.

The anti-Obamacare rhetoric has railed against a “government takeover” of medicine. It is, of course, no such thing. Obama had to remove the “public option”; Republicans prevented the government from fielding a team and getting into the game. Instead, we have had an insurance company takeover of medicine. It’s not the government that’s coming between doctor and patient, it’s the insurance companies. Those dreaded “bureaucrats” aren’t working for the government of the people, by the people, and for the people. They’ve working for Aetna and Well-Point.

Even the doctors now sense that they too are merely working for The Man.

Doctors are beginning to push back: Last month, 75 doctors in northern Wisconsin [demanded] . . . health reforms . . . requiring that 95 percent of insurance premiums be used on medical care. The movement was ignited when a surgeon, Dr. Hans Rechsteiner, discovered that a brief outpatient appendectomy he had performed for a fee of $1,700 generated over $12,000 in hospital bills, including $6,500 for operating room and recovery room charges.

That $12,000 tab, for what it’s worth, is slightly under the U.S. average.

Cross-posted at Pacific Standard.

Jay Livingston is the chair of the Sociology Department at Montclair State University. You can follow him at Montclair SocioBlog or on Twitter.

Comments 16

PhoebeCDonmoyer — June 25, 2014

Insurance company executives, summoned to Congressional hearings, stood their ground and offered some misleading statistics. http://num.to/7455-5745-8441

Happy Blogiversary, Judicial Edition – Bridget Magnus and the World as Seen from 4'11" — June 25, 2014

[…] Closing: girls; your money or your life; modern slavery; prudence; someone got paid to find out that a lot of people have no […]

Bill R — June 26, 2014

Interesting data, but useless to your argument. Your story needs to explain to us why the % of total $ spent on healthcare that ends up in non-loss payments by insurers is excessive. That would be the insurers' overhead payment for managing things. Obamacare sets this at 80% overall and 85% for large group policies. So the insurers are supposed to get between 15% and 20% of their premium dollars to cover administration (including all those salaries) plus profits for their shareholders. Companies are not going to earn big PE ratios that way...

Talking about the salaries of CEOs vs. EMTs is a story for an different agenda entirely and is out of place in your argument. And paying someone less than $600,000 to act as CEO seems like a bargain to me.

Finally, we can argue about the efficacy of having insurers manage the system in the first place, and while I'm not a fan I have no idea how anyone could change it politically in America at this time. But that's a different issue too.

Gregkumar — June 28, 2014

Hi Jay Livingston, I love your site and what you’re doing to educate people interested in Insurance Companies. I’m also very interested in Insurance Companies and found some great videos that helped me learn quite a bit more on the subject. Check them out when you get a chance; I think you and your readers will appreciate them too. http://www.viddy-up.com/learn-howto/health-fitness/

Tips On How To Get Cheap Car Insurance Rates | Insurance Advisor — July 2, 2014

[…] rating. It’s not wellknown that car insurance companies will run a check on your credit. Auto insurance companies started pulling credit when it was found that people with bad credit make more claims. If you keep […]

Tips For Understanding The World Of Insurance | Insurance Advisor — July 7, 2014

[…] When you want to look for a newer insurance plan, check if your state provides insurance companies’. Information and rates. The state insurance department can give you a general overview of insurance rates. They can also provide specific information about insurance agents and insurance companies. […]

Henry Mozes — July 28, 2021

And what about commercial general liability insurance? Can you share additional information about this?

Henry Mozes — July 29, 2021

Hello Henry Mozes. It is quite simple. Simply put commercial general liability insurance can protect your business/company from different variants of liability for covered claims of damage to a third party’s property and harm to a third party’s body or reputation. These situations are quite common, so you should definitely have such insurance policy!

Danny Morrison — October 1, 2022

I think insurance companies are great, because they help people who can’t afford to pay for their own health care. They do this by taking a small portion of the money that people make, usually 2% to 5%, and paying for your health care. I often visit buy psilocybin mushrooms source where I baught fresh food. If you make more money than the insurance company does, then you should be able to afford your own health care.

Danny Morrison — October 29, 2022

The cost of health care for an individual depends on a variety of factors, including age and medical history. The average cost of a hospital stay can be more than $5,000. This is not the only expense associated with health care. Drug costs can be considerable, especially if your doctor prescribes a drug that you don't need or that you can find cheaper elsewhere. Try this rcbi investor platform for best platform. Lifestyle changes: If you smoke or eat unhealthy foods, these habits could affect how much coverage you need in order to remain healthy. You may need to pay more if you have high blood pressure or diabetes, or if you have had a stroke or heart attack in the past 10 years.

David Willy — March 3, 2023

Cleansing is the foundation of any effective skincare routine. It's essential to choose a gentle cleanser that won't strip your skin barrier of its natural oils. The wrong cleanser can lead to dryness, irritation, and breakouts. Look for a cleanser that is suitable for your skin type and avoid harsh ingredients like sulfates and alcohol.

alan luiz — January 15, 2024

Hello. I have problems with men's health, namely erectile dysfunction. I would like to undergo gainswave therapy in one of the clinics, as I have heard that it is very effective. I am interested in the question, what are the medical insurances that can cover my costs for this therapy? Thank you.

sam 8659960 — April 27, 2024

A personal trainer is a fitness professional who works closely with individuals to help them achieve their health and fitness goals. They provide personalized exercise plans, nutritional guidance, and motivation to clients, tailoring their approach to each person's unique needs and abilities. Personal trainer typically conduct fitness assessments, monitor progress, and adjust programs as needed to ensure clients stay on track.

Fillin Brown — February 16, 2025

American Income Life is a dependable option, particularly for those seeking health insurance services. To get a better understanding of their offerings, check out complaints and reviews on this page https://american-income-life.pissedconsumer.com/review.html . Many customers highlight their reliability and quality service, making them a trusted choice. If you're considering their services, these reviews can provide valuable insights into customer experiences.

farima — June 20, 2025

It made me think about my own experiences with insurance, and I couldn’t help but wonder how often companies prioritize customer service over claims processing. I looked up https://allstate.pissedconsumer.com/customer-service.html to see what others were saying about their experiences with Allstate. It's interesting to see how different people have had mixed feelings, especially when dealing with claims. Hopefully, future policies shift towards more transparent and customer-friendly approaches.

Milu — January 28, 2026

As the Best Insurance company in Nepal, we understand how frustrating rising healthcare costs can be. Our focus is on improving efficiency, reducing administrative overhead, and ensuring more of every premium dollar goes toward actual patient care. Transparency and fair practices are priorities for us as we work with providers to deliver quality care while keeping the system sustainable.