Cross-posted at Reports from the Economic Front.

Media and policy-makers seem anxious to convince us that the economy is in strong recovery mode, therefore, no further significant policy interventions are needed.

Their optimism appears to rest heavily on the recent acceleration in consumer spending. After all, there are strong reasons for concern with the other major sources of growth: government spending on all levels is being cut, exports face a weakening world economy, and business investment remains largely stagnate.

But there are also strong reasons to challenge this optimistic view of consumer spending as a growth engine. The charts below, from a Wall Street Journal article, highlight some of the most important.

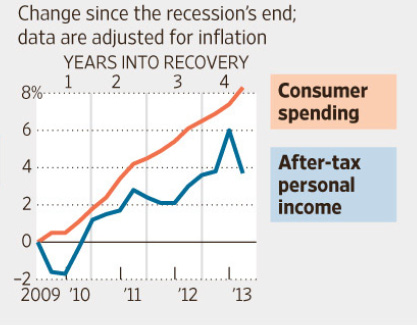

As we see below, while consumption spending is indeed accelerating, after tax personal income is falling. In other words, there appears little reason to believe that there is a solid foundation for sustaining this trend.

Additionally, after four years of recovery we still have 2.4 million fewer jobs than we had at the start of the recession. Moreover, as we see below, there has been no real wage growth. In fact, real average wages have fallen for most of the so-called expansionary period.

Yes, housing values are finally starting to rise and household debt payments as a share of after-tax income are declining. But to a large extent the new burst in consumption spending has more to do with renewed borrowing than solid gains in job creation and income.

Unfortunately, there is little reason for us to have confidence that the economy is gathering strength in ways that will be sustainable or benefit the great majority of working people.

Martin Hart-Landsberg is a professor of economics at Lewis and Clark College. You can follow him at Reports from the Economic Front.

Comments 5

Larry Charles Wilson — July 5, 2013

The TV news I've been watching today (3 July 2013) certainly did not talk abot a robust economy. The reporter (on the NBC Evening News) mentione that most of the new jobs are low-paying and that a large number of those more than 55 y/o had dropped out of the labor market.

Brutus — July 6, 2013

How much of the increase in consumer spending is driven by money that isn't personal income?

Ricky — July 10, 2013

I don't know why we would expect anything different. We keep electing politicians who are hostile to business. The media (except for FOX) tries its best to paint a rosy picture for O, but their lies can only cover so much.

Clarence Seedorf — July 13, 2013

From a classically Marxian, as opposed to a pseudo-Keynesian posing as a Marxian, perspective, the degradation of the living standards of most wage-labourers, post a recession, is in fact part of the economic recovery. Insofar, that is, that the recreation of a large reserve army of labour enables business, as a class, to further raise the rate of exploitation, i.e. to increase the value difference between wage input and commodity (goods and services) output (and thus increase profits). Labour, or labour power, remember, is nothing but another cost to be lowered for the sake of the owning class’s profit(s). Ergo, given the occurrence of many similar situations in the past two centuries or so, one shouldn’t be too surprised by figures of the sort that are included in this post. Worsening living conditions for the

majority are to be regarded as a means by which conditions conducive for

renewed investment are once again created; the business cycle starts again, and at one point due to increased demand for working hands, at least in theory, albeit mitigated somewhat by technological development and the globalising or globalised labour market, wages will rise again (or not, depending the level of class struggle and the current composition of the forces of organised labour) [the reason then for our current distinct lack of recent jobs expansion is that the business classes do not yet think that the economic situation is as of yet profitable enough to risk the further investment of their capital].

Anyhow, as a Brazilian general is apocryphally said to have said, ‘the economy is doing well, but the people are doing badly’.

As Andrew Kliman has noted,

'... working people's gains are not compatible with the continued functioning of the capitalist system. The reason why they are not compatible is that capitalism is a profit-driven system. So what is good for capitalism - good for the system - as distinguished from what is good for a majority of people living

under it - is high profits, not low profits. Higher pay for workers cuts into profits, as do increases in corporate income taxes to fund social programs [social security, obviously rj], a shorter work week, health and safety regulations in the workplace and so on. There is no solution to this dilemma within the confines of the capitalist system.'

Therefore there is a sense in which our reactionary friend above or below is quite right, although as an antidote to the economic difficulties of normal folk I wholeheartedly suggest the firm application of proletarian revolution.

The Continuing Unsatisfactory Economic Expansion - — August 7, 2013

[...] post originally appeared on Sociological Images, a Pacific Standard partner [...]