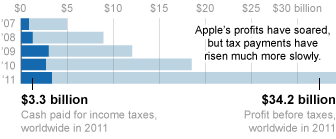

Apple’s profits more than quintupled in the last five years, but their tax burden has risen much more slowly. Last year, just 9.8% of their profits went to taxes. “By comparison,” writes economist Marty Hart-Landsberg, “Wal-Mart was downright patriotic — paying a tax rate of 24 percent.”

How does the company do it? Hart-Landsberg summarizes the New York Times: “The answer is tax loopholes and a number of subsidiaries in low tax places like Ireland, the Netherlands, Luxembourg and the British Virgin Islands. ” More details at Reports from the Economic Front.

Lisa Wade, PhD is an Associate Professor at Tulane University. She is the author of American Hookup, a book about college sexual culture; a textbook about gender; and a forthcoming introductory text: Terrible Magnificent Sociology. You can follow her on Twitter and Instagram.

Comments 4

decius — June 9, 2012

OK, now adjust that figure to include -all- taxes paid, including import duties, user fees, sales/use/VAT taxes, payroll taxes, and everything else I've forgotten. Then you'll have a meaningful comparison.

gglick — June 9, 2012

The Times report was proven to be mistaken weeks ago. The 9.8% figure is derived from comparing 2011 profits against 2010 taxes: http://www.forbes.com/sites/timworstall/2012/04/30/apples-9-8-tax-rate-new-york-times-ignorance-again/

Whimsical Branding Obscures Apple’s Troubled Supply Chain | Work in Progress — August 20, 2013

[...] Suicide at Foxconn. Poisoned workers. Colluding to inflate the price of e-books. Tax evasion (albeit, legal). Shady suppliers who can’t toe the line of labor or environmental laws in China. Apple’s [...]

Gary — July 5, 2024

Taxes are necessary for a country to function and everyone must pay them. red river beauty