The New York Times recently reported the results of a study of racial disparities in bankruptcy filings. When filing personal bankruptcy, most people have two options: Chapter 7 and Chapter 13. With Chapter 7, you have to turn over all non-exempt assets, which will be used to pay off as much of your debts as possible; you’re then free from any further obligation regarding the debts included in the case. Under Chapter 13, on the other hand, you have to continue to try to pay your debts for 3-5 years. There are reasons a person might sometimes prefer Chapter 13 (especially if they have particularly valuable assets they do not want to turn over), but generally it’s more expensive to file for and, obviously, provides less financial relief from debts. According to Braucher et al. (2012), the authors of the study, overall about 30% of personal bankruptcies are filed under Chapter 13.

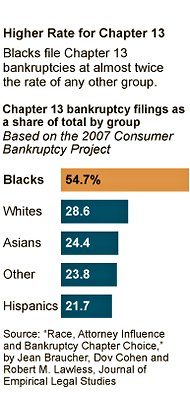

But in their study, Braucher et al. found that African Americans were significantly more likely to file for Chapter 13, and more likely than they would expect when controlling for things that might make Chapter 13 more attractive. As this NYT chart shows, over half of African Americans file under Chapter 13, compared to just over a quarter for Whites and even less for other groups:

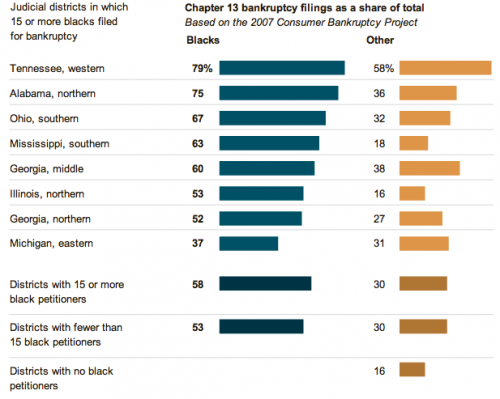

Rates of Chapter 13 filings vary quite a bit across different judicial districts, but African Americans consistently filed Chapter 13 at a higher rate than other groups, regardless of what the overall rate was:

Braucher et al. suggest that attorneys play a key role here. They sent surveys to 596 randomly-selected attorneys who represent individuals filing for bankruptcy, providing information about a married couple considering bankruptcy; 262 of the attorneys responded. When the potential filers gave the names Reggie and Latisha, attorneys were more likely to recommend Chapter 13 than when they gave the names Todd and Allison, suggesting that attorneys may play a role in tracking clients toward different bankruptcy options based on race.

The result is that African Americans are, overall, more likely to use the version of personal bankruptcy that costs them more and requires them to continue struggling to pay their debts for several more years, reducing the immediate relief most people assume bankruptcy provides.

Source: Braucher, Jean, Dov Cohen, and Robert Lawless. 2012. Race, Attorney Influence, and Bankruptcy Chapter Choice. Forthcoming in the Journal of Empirical Legal Studies. Available free online here.

Gwen Sharp is an associate professor of sociology at Nevada State College. You can follow her on Twitter at @gwensharpnv.

Comments 18

Jeffrey Cuscutis — February 6, 2012

Why is that? What benefit do Lawyers get for pushing Chapter 13 on African Americans vs everyone else?

Is Chapter 13 cheaper to process than chapter 7?

Racial Disparities in Bankruptcy Filings » Sociological Images – How Do You File Bankruptcy — February 6, 2012

[...] overall about 30% of personal bankruptcies are filed under Chapter 13. … Original post: Racial Disparities in Bankruptcy Filings » Sociological Images ← Some of the Reasons You File for Bankruptcy | Welcome to [...]

Disparities in Bankruptcy Filings « Welcome to the Doctor's Office — February 6, 2012

[...] RACIAL DISPARITIES IN BANKRUPTCY FILINGS by Gwen Sharp [...]

Anonymous — February 6, 2012

I'm wondering if the assumption is that their assets are less that other races, so the money from them wouldn't cover as much of the debt, increasing the financial burden on whoever gets to eat the rest of the cost. (I'm not sure who that is, the credit card companies? the government?) Depending on who it is, there could be some incentives for the lawyers to push ch 13 over 7.

Racial Disparities in Bankruptcy Filings » Sociological Images – Information On Bankruptcy — February 6, 2012

[...] to file for and, obviously, provides less financial … … See the article here: Racial Disparities in Bankruptcy Filings » Sociological Images ← Is Filing for Bankruptcy the Only Hope to Becomeing Free of Debt? The Importance of [...]

Johnfnewman — February 6, 2012

As a bankruptcy attorney, I don't understand this study or its result. Chapter 13 is a longer process for both attorney and client - as noted 3-5 years and the debtor must have monthly disposable income (i.e., your monthly income must exceed your monthly household expenses - these expenses exclude credit cards and other non-recurring services - think doctor or lawyer bills).

Many attorneys in my state don't like chapter 13s and would rather have any client file a 7 - it is quicker and cheaper for the client (you must however pay up front in a 7, whereas in a chapter 13 you can put the attorney fees into the 3-5 year repayment plan). But even though you can pay your chapter 13 fees inside the payment plan, many attorneys want most if not all of the chapter 13 fees to be paid up-front (I ask for 50%, which is close to the fee it would cost for a chapter 7 in my office).

Also, many chapter 13s fail. the debtors misses payments or something happens in their life to make it no longer feasible (5 years is a long time for someone already struggling with bills). When the 13 fails, it is either dismissed or converted to a chapter 7. In either case, the attorney may be out of luck for his remaining fees (that depends on the priority of debts being paid inside the chapter 13 plan and how long the person was in bankruptcy before the 13 failed). So while the benefit of a 13 is higher fees, the downside is a longer process and more work for the attorney.Chapter 13s are most often for people who make more than the average income for people in their state, or for people who are looking to save an asset like a car or house. Maybe they fell behind in payments, and the chapter 13 lets them pay the arrearages over a 3-5 year period.

LarryW — February 6, 2012

Perhaps it is that African Americans have a greater sense of responsibility than do whites in similar situations?

An additional point: The reason that there were debtor prisons was that failing to pay a debt was seen as theft.

TA — February 6, 2012

Two different things they're studying, though:

One part is the survey of attorneys who recommend Chapter 13 more for similarly-situated hypothetical black clients than white clients. That may be related to the attorneys' opinion that the hypothetical black clients showed better competence and values when they preferred Chapter 13 (repayment), whereas the white clients showed better competence and values preferring Chapter 7 (liquidation).

I don't see how to get around the racial prejudice shown by the lawyers here.

Chapter 13 does cost more (in lawyer fees) than Chapter 7. But if lawyers are operating on pure profit motive, as the authors indicate, we would see a push toward Chapter 13 across the board...

Racial Disparities in Bankruptcy Filings » Sociological Images – To File Bankruptcy — February 6, 2012

[...] to file for and, obviously, provides less financial … … Read this article: Racial Disparities in Bankruptcy Filings » Sociological Images ← Chapter 7 Bankruptcy [...]

Bankruptcy Brisbane — November 6, 2013

Bankruptcy is not something to take lightly. Very few people who have been through bankruptcy would tell you that it is a painless action, wiping the slate clean, after which you just go off into your new future to start fresh, without a care.

katerichards — August 29, 2014

Yeah, It is important to have a joint idea with the couple once planning into bankruptcy especially if it really involve the partner. Better to ask from the experts for the best solutions.

katerichards — August 29, 2014

An interesting article and it can really help the people who experience bankruptcy.

katerichards — August 29, 2014

An interesting article and it can really help the people who experience bankruptcy.

Racial Disparities in Bankruptcy | Workers World Today — April 17, 2019

[…] Read More: Racial Disparities in Bankruptcy Filings […]

Racial Disparities in Bankruptcy Filings | Caribbean American Weekly Newspaper — April 19, 2019

[…] By Gwen Sharp (Sociological Images) […]