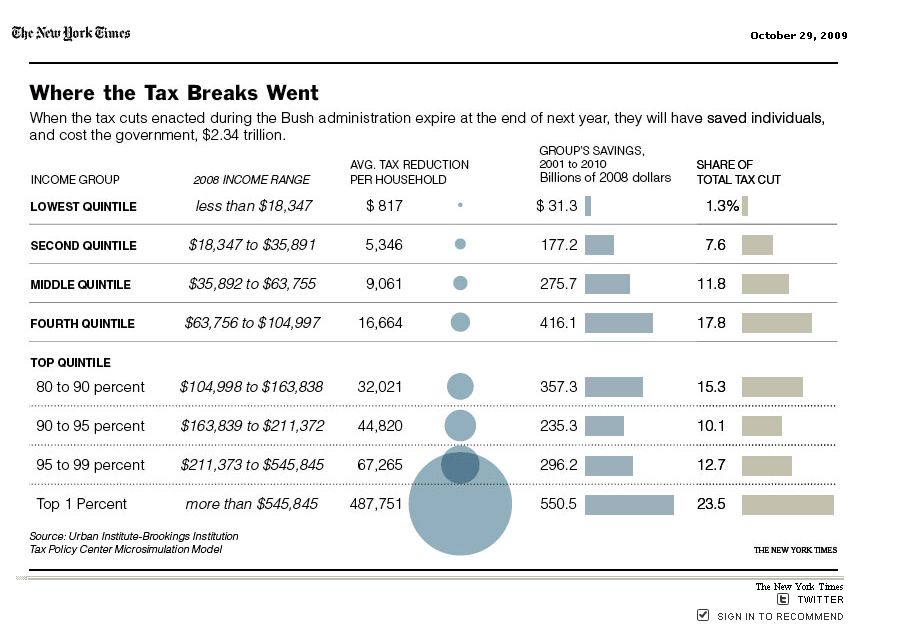

Last week the New York Times released this table illustrating who benefited the most from the Bush tax cuts. As you will see, people in the top 1% of income, making more than $545,845 a year benefited, by leaps and bounds, more than anyone else. And their share of the tax cut? Almost a quarter went to the top 1%.

Also see our post on social class and the tax burden.

Via MontClair SocioBlog.

—————————

Lisa Wade is a professor of sociology at Occidental College. You can follow her on Twitter and Facebook.

Comments 30

angie — November 2, 2009

Well, USA is a terrible country without even remote sense of social justice. But seriously, who cares of how the wealth is distributed among yanks? This nation kills and tortures foreign people. Some lowclass USAnians having hard time really financially is not important or noteworthy in comparison to that. Or is it? Perhaps it is now that this nation singlehandedly destroyed the world economy.

george — November 2, 2009

I think it's misleading, to say that nearly 25% of the tax cut went to the rich. While it's true that in terms of dollars they now get to keep more of their money, in percentage terms their tax cut was in fact less than that of lower income brackets.

This is the same kind of presentation where you point out that the top 1% pay 40% of all taxes and that the top 20% pay more than 80% of all taxes. look how awful it is for those rich people! The lower income brackets pay hardly anything!

I find both presentations polemical and not speaking to the underlying issues of fairness and inequity.

Daniel — November 2, 2009

I agree with George.. this is very misleading. For example, in the case of the lowest quintile group, it would be nearly impossible to increase the amount of that average tax cut shown ($817) because that is likely nearly all of the tax they were paying in the first place. If you want the tax cut to benefit everyone equally on a dollars basis, that means everyone pays $817 less in taxes.

And let's remember that it is a tax cut, meaning a decrease in the amount of taxes paid from income earned. A tax cut is not a gift from a benevolent government, it is a decrease in taking.

Jenn — November 2, 2009

The best thing is that our current majority-led Democratic government has decided that the tax cuts are a-okay. Just in case anyone every stupidly decided to forget which side Obama and other Democrat's bread is buttered on.

Tax cuts are a great illustration to non-Americans how really skewed and corrupt our politics are. There's very little difference between what the GOP and Democrats do when it comes to taxes. It's all about redistributing for the wealthy. As if their privilege in all other areas is inadequate. It's no wonder that upward mobility and the "American Dream" is more likely to be an unfamiliar buzz word on the news than happen to anyone you know.

But we all know that trickle-down economics, granted to us by those wonderfully benevolent souls of the Chicago School of Economics, has ushered in a new era of unheard prosperity and equality. Just keep truckin' dudes. It worked so well in the past.

CTD — November 2, 2009

So, I see SI has discovered we have a progressive income tax system. Congrats, guys. Most of the rest of us picked that up in high school government class...

Michael Connor — November 2, 2009

The graph could be improved by showing share of income. Of course the rich pay more in taxes, they have more income. What could be shown is that lower-income people pay almost as big a share of their income as the richest.

Here, for example: "The total federal, state and local effective tax rate for the richest one percent of Americans (30.9 percent) is only slightly higher than the average effective tax rate for the remaining 99 percent of Americans (29.4 percent). " http://www.ctj.org/pdf/taxday2009.pdf

Some may argue that the rich should pay less of a share of income than the poor, but they have a very hard argument, and that will not be popular. Apologists for the rich will try to confuse with the "we make more money, we pay more taxes" but this avoids questions of proportionality. Most people would support real progressive taxation, which is why the rich hate it so much, and seek to confuse.

Carla — November 2, 2009

Also, the "average tax reduction per household" statistic for the top 1% isn't particularly useful. Because it's an average, rather than a median, it is obviously being dramatically affected by outliers. Lumping someone who makes $550,000 a year in with someone making $55,000,000 a year doesn't give much clear or useful information.

shale — November 2, 2009

Actually Carla, lumping the two together may not be ideal, but either lumped or unlumped, the actual distribution of wealth and taxation are sufficient for Connor to make his point (not the one about the wealthy seeking to confuse, just the one about whether there is progressive taxation in America).

Carla said, "It’s tough to want to trust the analysis of a group whose agenda is raising taxes on the wealthy…"

I can't for the life of me figure out what people don't get about argument and evidence. Every group has an agenda--as long as they are living, breathing, thinking beings they must--but that doesn't mean that everything that they say will be BS. Apparently the ideology surrounding ideology is the most insipid ideology of all. Poor Habermas.

MNdemocrat — November 2, 2009

Its obvious to me, living in Minnesota, that those of us who do pay attention to politics and are democrats need to start getting behind progressive candidates that stand up for whats right. We need to put our money into candidates that refuse to take PAC, lobbyist or corporate contributions who want to work towards a fair tax as well as health care system.

I would say that as progressives who care in helping those who are less fortunate and truly would like to see the USA make a turn around need to be very vigilant of "democrats" that vote for tax cuts. We need taxes. I want kids to get education. I want those who need health care to get health care. I want the BRIDGES I drive over to stay safe. I don't want the rich to benefit from democrats not having the cojones or ovaries to stand up FOR progressive TAXES.

If you're in MN, check out John Marty whose running for Governor. Seriously progressive and a fair politician.

angie — November 3, 2009

Look at the yanks here argue about their government and policies. Such vain thing, really. We all know that such nation as USA is founded on this delusional mindset of the age of enlightenment. A collection of outdated ideals of liberty that are meant to be the anti-thesis of monarchy. Or at least were some odd 200 years ago in Europe. Now this misplaced nation founded on whole lot of nothing is just caught in a timewarp and totally unable to pull through into the value climate of modern era because this would mean the annihilation of the core values USA is solely founded on and which their feeble constitution celebrates. There is no way around that. Currently USA is trying to justify its existence by brutish violence and nothing more. This nation of absurdity that should collapse and that should not came to existence in the first place.

NY Times: Where the Tax Breaks Went « Social Inequalities — November 3, 2009

[...] http://thesocietypages.org/socimages/2009/11/02/the-rich-get-all-the-breaks/ [...]

amgriffin — November 4, 2009

They needed those tax breaks for their triathlon participation.

opminded — November 4, 2009

What's most shocking is how many Americans pay no income tax at all.

Joe Sparks — November 11, 2009

The creator of the table is either ignorant or deliberately misleading.

Look how much money the tax cuts saved the little guys making 40-60-80k a year (not even able to support a family with that in San Francisco), that a= HUGE percentage of their income not taken away from them, and a HUGE personal relief and improvement of "the little guy's" life.