Americans have become increasingly critical of public policy as a means of addressing social problems. Many believe that these policies don’t work; the reality is that public policies are often subverted in ways that make them ineffective or even counterproductive.

Take taxes and inequality. As Danny Vinik, writing in the New Republic explains:

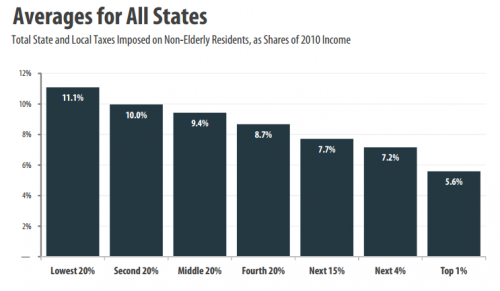

The vast majority of Americans—both liberals and conservatives—believe that state and local taxes should also be progressive. That’s the finding of a new report released by WalletHub Monday. The researchers surveyed 1,050 Americans on what they thought the combined rate of state and local taxes should be at various income levels. Not surprisingly, liberals want the rate structure to be a bit more progressive than conservatives do, but their responses [as the following chart shows] were relatively similar:

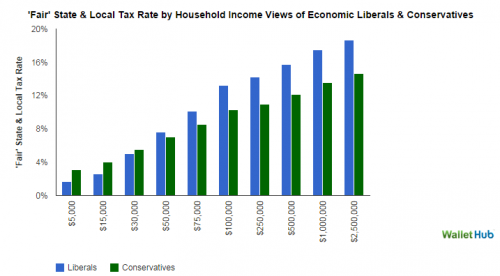

However the reality is quite different. State and local taxes are actually quite regressive. The Institute for Taxation and Economic Policy studied the “fairness of state and local tax systems by measuring the state and local taxes that will be paid in 2015 by different [non-elderly] income groups as a share of their incomes.” They did this state by state and, as presented below, on an overall basis. As we can see, the lower the income, the greater the state and local tax burden.

Here are some of the report’s key findings:

- Virtually every state tax system is fundamentally unfair, taking a much greater share of income from low- and middle-income families than from wealthy families. The absence of a graduated personal income tax and overreliance on consumption taxes exacerbate this problem.

- In the 10 states with the most regressive tax structures (the Terrible 10) the bottom 20 percent pay up to seven times as much of their income in taxes as their wealthy counterparts. Washington State is the most regressive, followed by Florida, Texas, South Dakota, Illinois, Pennsylvania, Tennessee, Arizona, Kansas, and Indiana.

- Heavy reliance on sales and excise taxes are characteristics of the most regressive state tax systems. Six of the 10 most regressive states derive roughly half to two-thirds of their tax revenue from sales and excise taxes, compared to a national average of roughly one-third . Five of these states do not levy a broad-based personal income tax (four do not have any taxes on personal income and one state only applies its personal income tax to interest and dividends) while four have a personal income tax rate structure that is flat or virtually flat.

- States commended as “low tax” are often high tax states for low-and middle-income families. The 10 states with the highest taxes on the poor are Arizona, Arkansas, Florida, Hawaii, Illinois, Indiana, Pennsylvania, Rhode Island, Texas, and Washington. Seven of these are also among the “terrible ten” because they are not only high tax for the poorest, but low tax for the wealthiest.

In short, we know how to construct tax policies that can lessen inequality, but we’re not using state and local taxes to do it.

Cross-posted at Reports from the Economic Front and Pacific Standard.

Martin Hart-Landsberg is a professor of economics at Lewis and Clark College. You can follow him at Reports from the Economic Front.

Comments 4

State and Local Taxes Penalize the Poor and Benefit the Rich - Treat Them Better — February 6, 2015

[…] State and Local Taxes Penalize the Poor and Benefit the Rich […]

Bill R — February 6, 2015

"Americans have become increasingly critical of public policy as a means of addressing social problems. "

Indeed. In fact, this may be the understatement of the past 60 years!

As much as we'd all like the state to address specific social problems, they have no idea what to do regardless of how much of our money they spend (foolishly) in the name of progress. The research conducted to inform them is tragic comedy; the waste they incur is criminal; programs that are GUARANTEED to fail if not properly funded are woefully underfunded in the name of compromise; "liberals" and "conservatives" routinely push their expensive/junk agendas hard to legislators who need to get reelected to earn a decent living; and only 40% of us even have the awareness to show up at a voting booth every other year.

So let's stop dreaming that raising the tax base a couple percent by taking our frustrations out of the "rich"* will turn this place into lala land and lets start spending the money we've got now on programs that snap heads in wonder at their success.

*How is this defined? By income? Net worth? Does age make a difference? Size of family? Good luck.

Mr. S — February 7, 2015

Terrific headline. Explain to me how a bunch of poor people paying excise taxes on cigarettes, soda, fast food and alcohol somehow benefit the rich.

It makes perfect mathematical sense that a low-income person who drives the same amount as a high-income person will pay a greater share of that income on gasoline (and thus, gas taxes). But such taxes aren't regressive; they're flat. Low income people pay a greater share of their income on EVERYTHING, so what exactly is the point here?

Mosque to be demolished and rebuilt 3 metres taller (From The Bolton News) - Trendingnewsz.com — February 13, 2015

[…] provides the opportunity to regenerate the application site as the existing building is in a poor state of […]