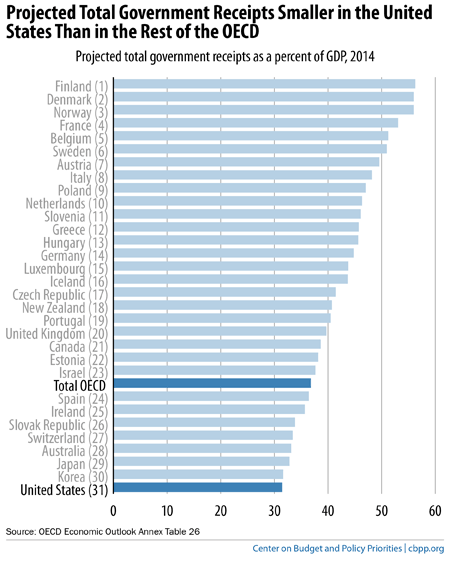

This chart comes from Chuck Marr at the Center on Budget and Policy Priorities. As Marr explains:

The United States is a relatively low-tax country, as the chart shows. When measured as a share of the economy, total government receipts (a broad measure of revenue) are lower in the United States than in any other member of the Organization for Economic Co-operation and Development (OECD), even after accounting for the modest revenue increases in the 2012 “fiscal cliff” deal and the taxes that fund health reform.

Martin Hart-Landsberg is a professor of economics at Lewis and Clark College. You can follow him at Reports from the Economic Front.

Comments 8

Bill R — April 19, 2014

Why is tax receipts as a percentage of GDP a good measure of the relative tax burden of its citizens and corporations?

Ruben Anderson — April 19, 2014

Does this explain why education, infant mortality and lifespan metrics are all getting worse--concurrent with the rest of the developed world looking at the U.S. like savages because of the bizarre conversations around healthcare?

lottopol — April 20, 2014

"..It is not just a coincidence that tax cuts for the rich have preceded both the 1929 and 2007 depressions. The Revenue acts of 1926 and 1928 worked exactly as the Republican Congresses that pushed them through promised.The dramatic reductions in taxes on the upper income brackets and estates of the wealthy did indeed result in increases in savings and investment. However, overinvestment (by 1929 there were over 600 automobile manufacturing companies in the USA) caused the depression that made the rich, and most everyone else, ultimately much poorer.

Since 1969 there has been a tremendous shift in the tax burdens away from the rich on onto the middle class. Corporate income tax receipts, whose incidence falls entirely on the owners of corporations, were 4% of GDP then and are now less than 1%. During that same period, payroll tax rates as percent of GDP have increased dramatically. The overinvestment problem

caused by the reduction in taxes on the wealthy is exacerbated by the increased tax burden on the middle class. While overinvestment creates more factories, housing and shopping centers; higher payroll taxes reduces the purchasing power of middle-class consumers. ..."

http://seekingalpha.com/article/1543642